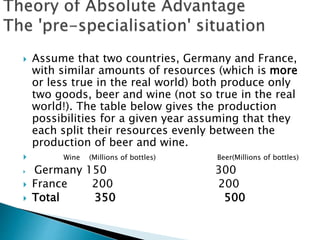

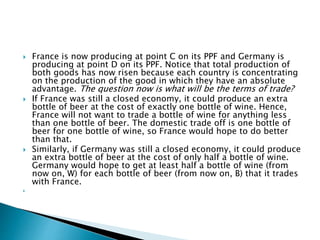

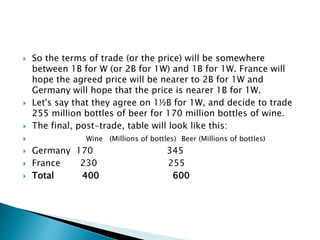

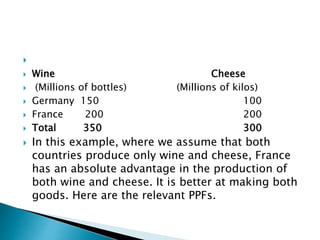

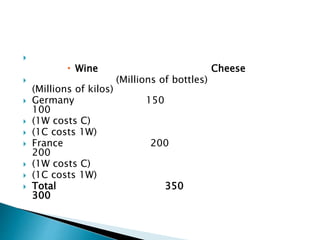

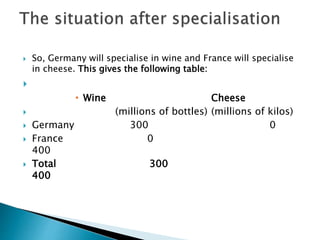

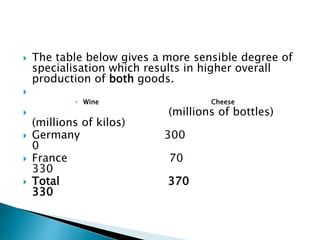

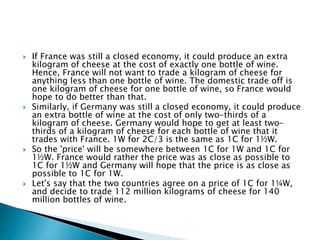

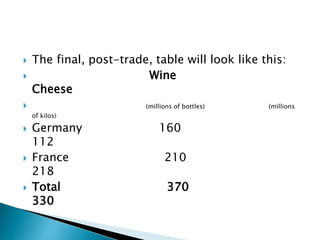

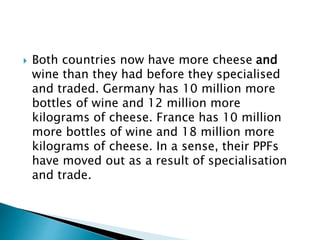

This document summarizes the theory of comparative advantage in international trade. It provides an example where Germany and France each produce wine and cheese. While France has an absolute advantage in both goods, Germany has a comparative advantage in wine due to lower opportunity costs of production. Specialization and trade allows both countries to increase total production. They agree on terms of trade and both benefit with increased consumption of both goods.

![ An import quota is a limit on the quantity of a

good that can be produced abroad and sold

domestically.[1] It is a type of protectionist trade

restriction that sets a physical limit on the

quantity of a good that can be imported into a

country in a given period of time. If a quota is

put on a good, less of it is imported. [2] Quotas,

like other trade restrictions, are used to benefit

the producers of a good in a domestic economy

at the expense of all consumers of the good in

that economy.](https://image.slidesharecdn.com/compaadva1-151115101617-lva1-app6891/85/Compa-adva1-52-320.jpg)