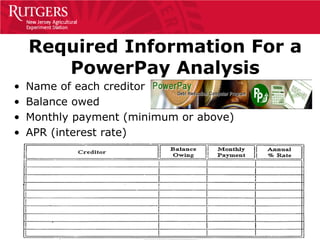

The document discusses various strategies for dealing with debt, including increasing income, decreasing expenses, contacting creditors, credit counseling, debt consolidation, bankruptcy, and credit card fees and traps. It provides tips on using the PowerPay method to accelerate debt repayment by reallocating payments as debts are paid off. It warns that credit card minimum payments can result in high interest costs over time and paying more than the minimum each month reduces costs.