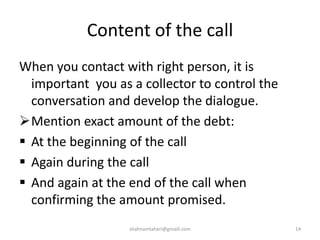

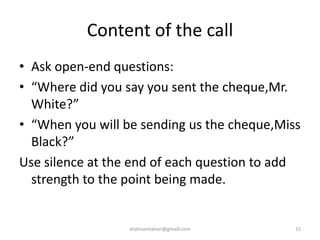

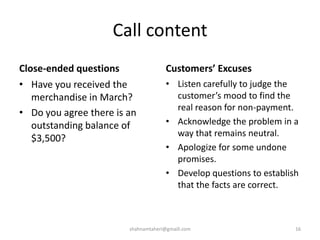

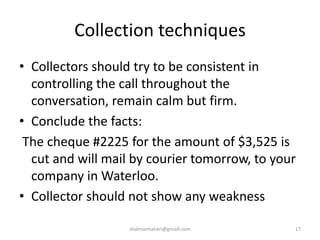

The document outlines techniques for effective debt collection, including setting objectives, training collectors, and following a multi-step collection process involving reminders, letters, phone calls, and if needed, use of collection agencies or legal action. It emphasizes being prepared, persistent, prompt, urgent, courteous, tactful, businesslike, cooperative, and repetitive in collection efforts. The goal is to collect past due invoices, maintain cash flow, make decisions about future credit, and educate customers to pay on time.