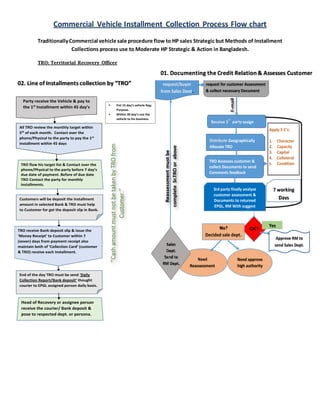

1. The document outlines the commercial vehicle installment collection process used by HP Strategic & Action in Bangladesh.

2. It involves assigning Territorial Recovery Officers (TROs) to specific geographical areas to assess customers, collect documents, and receive the first installment payment within 45 days of the customer receiving the vehicle.

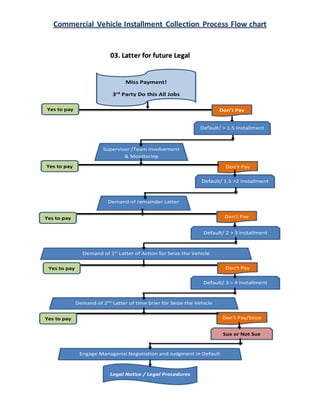

3. The process then has the TRO contact customers monthly by phone or in-person before the due date to receive installment payments, issue receipts, and report daily collections, with escalating legal notices and potential vehicle seizure if payments are missed.