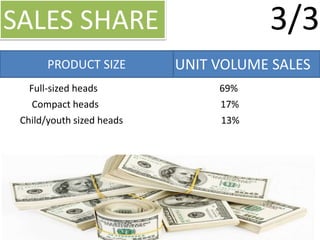

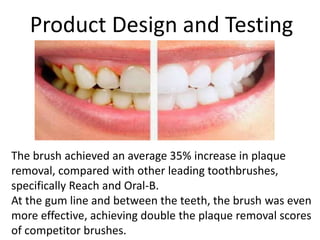

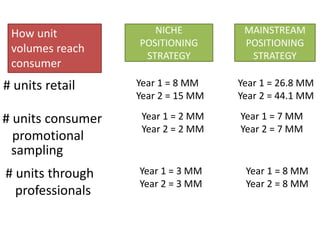

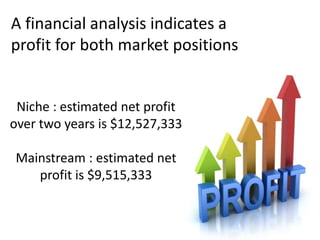

Colgate-Palmolive Company aimed to enhance its market position in the toothbrush segment in 1991, focusing on product innovation, advertising expenditure, and updating manufacturing processes. The Precision Toothbrush, scheduled for launch in 1993, was designed for effective plaque removal with distinct bristle configurations, but faced challenges in brand positioning and consumer perception. In-depth consumer research revealed that professional endorsements and 'sampling' strategies would be vital for establishing credibility and motivating further purchases.