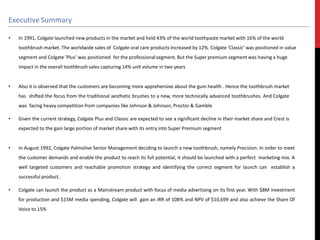

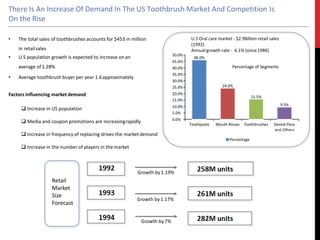

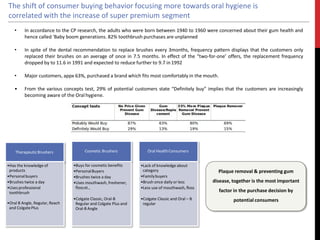

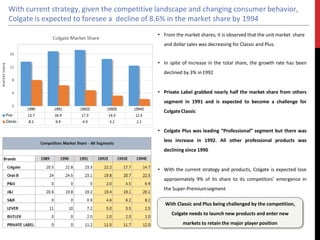

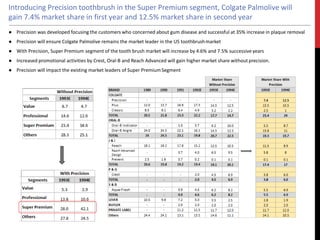

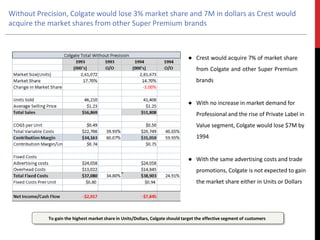

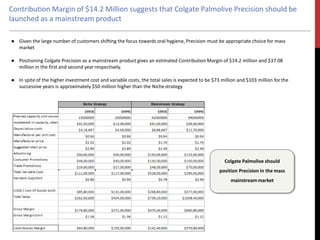

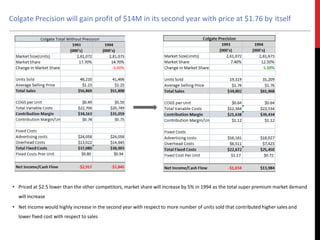

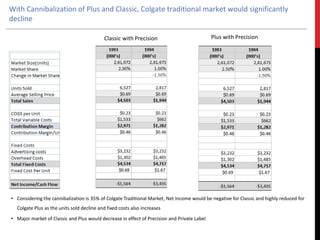

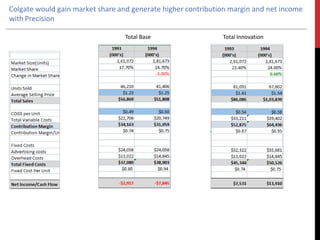

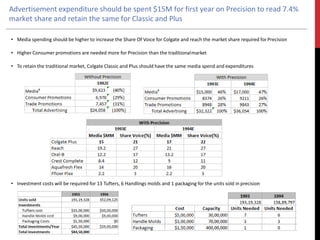

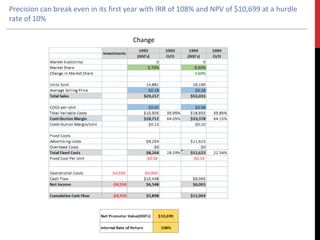

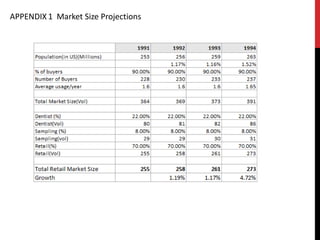

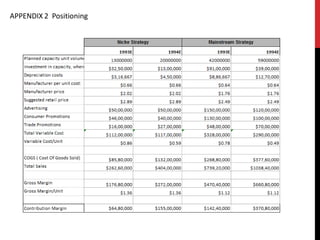

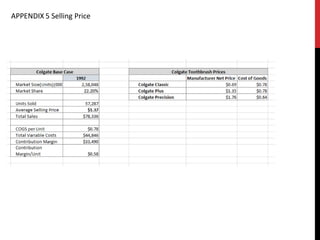

Colgate is facing increased competition in the toothbrush market and a decline in market share for its Classic and Plus lines. The introduction of the super premium segment has been successful, accounting for 35% of the market. Colgate is considering launching a new toothbrush, Precision, targeted at the super premium segment to focus on gum health. Precision has the potential to increase Colgate's market share to 7.4% in the first year and generate a profit of $14 million in the second year with $15 million spent on advertising. Positioning Precision as a mainstream product could gain an even higher market share and contribution margin for Colgate compared to a niche strategy.