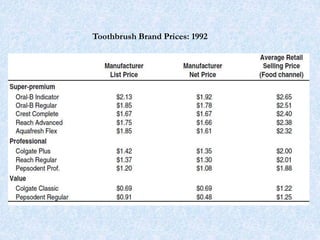

The document discusses Colgate-Palmolive's launch of the Precision toothbrush in 1992, highlighting the company's market position and competitive landscape in the U.S. oral care market. It examines consumer behavior, product segmentation, and promotional strategies while providing insights on consumer preferences and expected performance of the new toothbrush. Key conclusions suggest positioning the product as a niche offering, and emphasizing effective communication and pricing strategies to ensure market success.