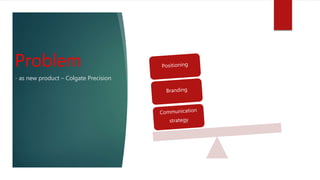

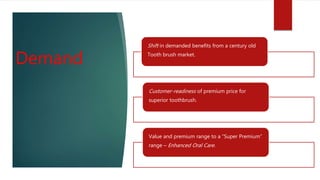

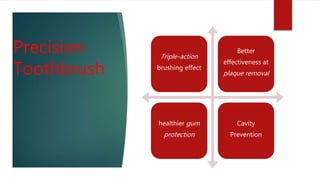

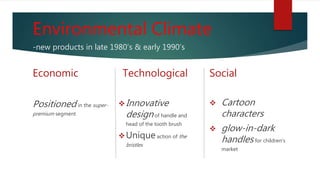

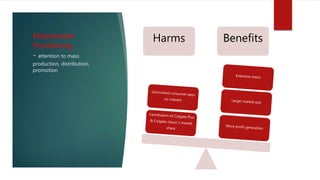

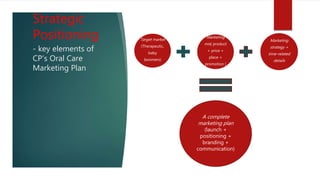

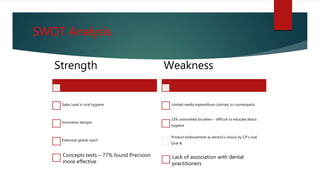

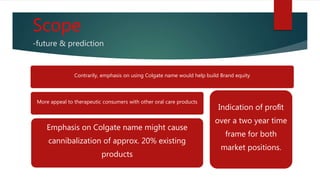

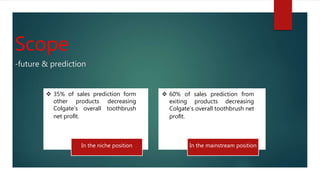

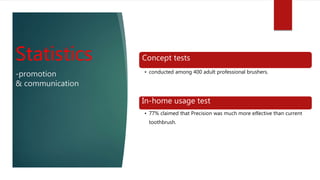

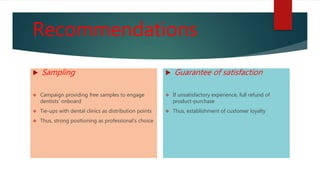

Colgate Palmolive is analyzing the launch of its new Precision toothbrush. The Precision toothbrush provides triple brushing action and is more effective at plaque removal than rivals. It is positioned in the super-premium market segment at a higher price point. While the toothbrush market has grown steadily, Colgate aims to target the niche segment of therapeutic brushers with the Precision. Colgate's recommendations include providing free samples to dentists to promote the Precision as the professional's choice and offering refund guarantees to build customer loyalty for the new product.