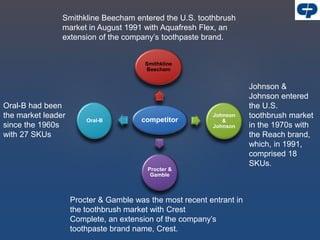

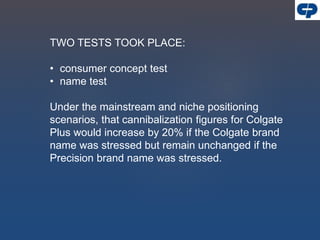

- Colgate-Palmolive developed a new toothbrush called the Precision toothbrush to capture market share.

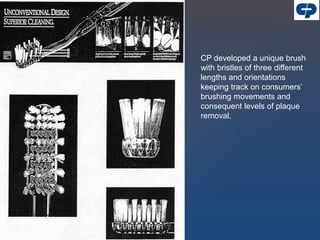

- The Precision was designed with three different length bristles to better remove plaque from different areas of the teeth compared to competitors' toothbrushes.

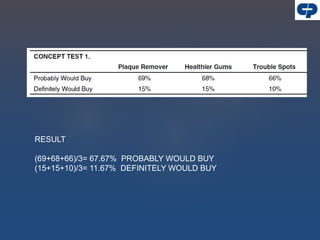

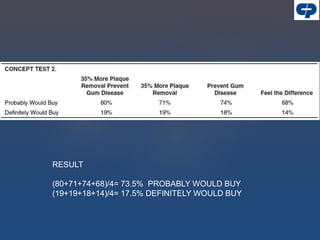

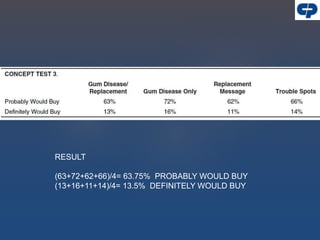

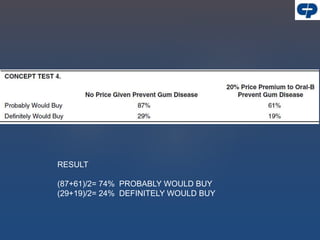

- Test marketing showed the Precision was effective at removing plaque and many consumers said it was more effective than their current brush and they would purchase it.

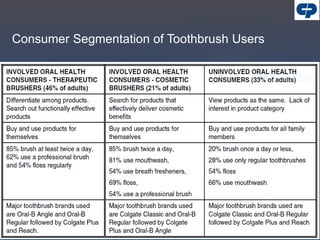

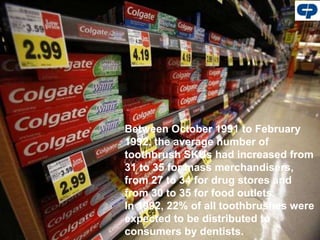

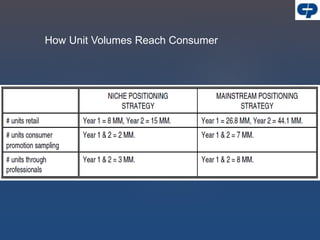

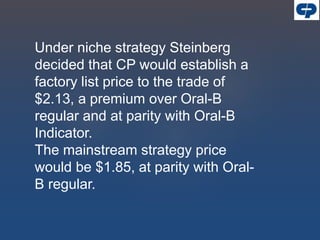

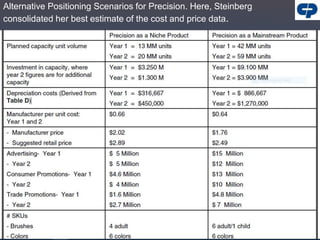

- Colgate debated whether to position the Precision as a niche product to target a subset of consumers or a mainstream product for broader appeal.