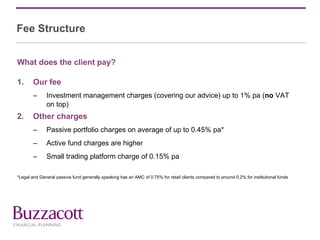

Buzzacott Financial Planning offers an in-house portfolio management service that was launched in 2008. They currently advise around 25 clients with average portfolio sizes of £450k. Their service provides consolidated investments on one trading platform for simplicity, holds funds with a large custodian, and provides consolidated tax documents. Their portfolios focus on capital preservation and long-term performance using research-backed funds, both passive and actively managed, tailored to each client's goals, risk tolerance, and tax situation. Fees are up to 1% of assets per year for their advice and portfolio management services.