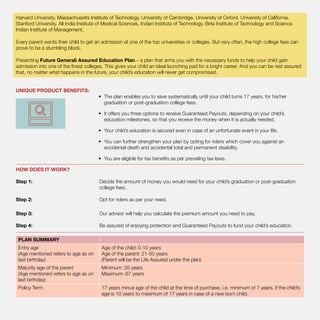

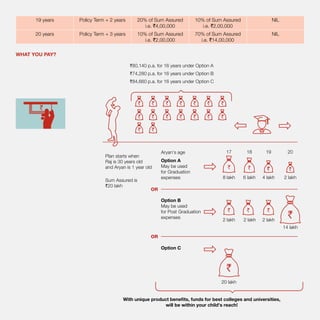

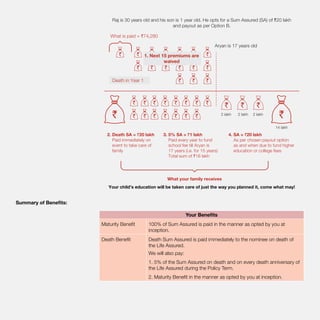

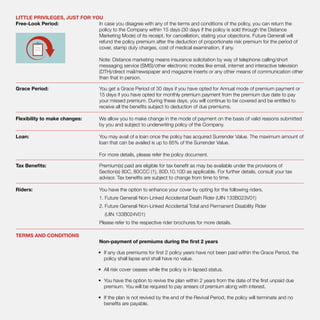

This document summarizes the key details of the Future Generali Assured Education Plan, which aims to provide funds for a child's college education. The plan allows parents to save systematically and receive guaranteed payouts at education milestones to cover college fees. It offers death and maturity benefits to fund the child's education even if the parent is not alive. The plan has a minimum annual premium of Rs. 20,000 and provides tax benefits. It allows policyholders to choose payout options to receive the sum assured in installments matching education milestones between ages 17-20.