Chasing unicorns feb 2020

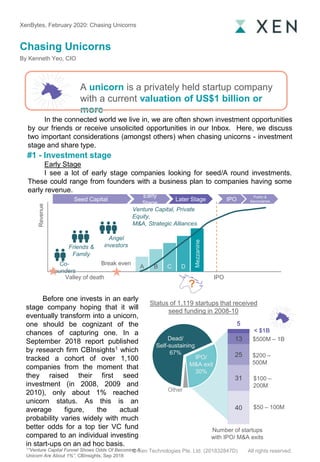

- 1. Chasing Unicorns XenBytes, February 2020: Chasing Unicorns By Kenneth Yeo, CIO A unicorn is a privately held startup company with a current valuation of US$1 billion or more In the connected world we live in, we are often shown investment opportunities by our friends or receive unsolicited opportunities in our Inbox. Here, we discuss two important considerations (amongst others) when chasing unicorns - investment stage and share type. Early Stage I see a lot of early stage companies looking for seed/A round investments. These could range from founders with a business plan to companies having some early revenue. Before one invests in an early stage company hoping that it will eventually transform into a unicorn, one should be cognizant of the chances of capturing one. In a September 2018 report published by research firm CBInsights1 which tracked a cohort of over 1,100 companies from the moment that they raised their first seed investment (in 2008, 2009 and 2010), only about 1% reached unicorn status. As this is an average figure, the actual probability varies widely with much better odds for a top tier VC fund compared to an individual investing in start-ups on an ad hoc basis. #1 - Investment stage 1“Venture Capital Funnel Shows Odds Of Becoming A Unicorn Are About 1%”, CBInsights, Sep 2018 40 31 25 13 5 < $1B $500M – 1B $200 – 500M $100 – 200M $50 – 100M Number of startups with IPO/ M&A exits Dead/ Self-sustaining 67% IPO/ M&A exit 30% Other Status of 1,119 startups that received seed funding in 2008-10 Co- founders Revenue Seed Capital Early Stage Later Stage IPO Public & Secondaries Valley of death Break even A B C D Mezzanine Friends & Family Venture Capital, Private Equity, M&A, Strategic Alliances Angel investors IPO ? © Xen Technologies Pte. Ltd. (201832847D) All rights reserved.

- 2. Late Stage Investing in unicorns after they have become unicorns have been popular in recent years. While the risk of the company not reaching the finishing line of a successful IPO is lower than an early stage investment, it may not result in a profitable investment. Below is a simulation of the funding rounds a start-up goes through before reaching a successful IPO. Pre-Money, $M Dilution Post-money, $M 20 20% 24 50 20% 60 100 20% 120 300 20% 360 1,000 20% 1,200 2,000 20% 2,400 3,000 20% 3,600 1.00 2.10 3.50 8.70 24.10 40.20 50.20 0 10 20 30 40 50 60 A B C D E Pre-IPO IPO Price/share,$ Stage of financing Series A InvestorCost/share = $1 50x IPO price Pre-IPO Investor Cost/share = $40.20 1.25x IPO price The investor in the A round of this simulation makes 50x his investment (his cost/share is $1 while the IPO price per share is $50). The pre-IPO investor makes 1.25x. For the pre-IPO investor, most of the upside or downside will take place post-IPO. The risk of making a loss is high if the stock price declines after IPO. Pre-Money valuation is the company valuation prior to the investment round Dilution is the decrease in ownership for existing shareholders that occurs when a company issues new shares Post-Money valuation is the value after the investment has been made Definitions © Xen Technologies Pte. Ltd. (201832847D) All rights reserved. XenBytes, February 2020: Chasing Unicorns

- 3. Case study: Uber According to Crunchbase, Uber raised a total of US$16.6b in 22 funding rounds prior to its IPO in May 2019 at a pre-money valuation of US$74b (US$45 per share), which is just above the pre-IPO round led by Toyota raised about 6 months before its IPO. After IPO, the share price fell to a low of just below US$30/share, which is below the valuation of the early 2018 funding round led by Softbank at US$33/share. The share price has since recovered some ground and is trading at US$36/share (as of end Jan 2020). Thus, pre-investors who bought shares at pre-IPO valuation and have held on to these shares are still making losses. This is not unique to Uber. Of the top 50 VC backed IPOs in 2019, 14 were trading below their respective IPO valuations on Jan 31, 2020. The top 4 companies have valuations of above US$10b each at IPO, namely, Uber (US$82b), Lyft (US$24b), Slack Technologies (US$23b) and Pinterest (US$13b). With the exception of Pinterest, all the other 3 companies were trading below their IPO price as of end Jan 2020 with discounts of between 16% to 56%. The largest unicorns are usually the ones that are most well-known and commonly available to investors pre- IPO and are also the most likely to underperform after the IPO. 0 10 20 30 40 50 60 70 80 90 0 1 2 3 4 5 6 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Equity Debt Funds raised (US$B) Implied valuation (US$B) IPO Valuation: $82.4B Current market cap: $62.5B 2013 TPG & Google lead $258m investment 2015 Goldman raises $1.6b in convertible debt from private wealth clients 2016 Saudi wealth fund makes $3.5b backing 2017 SoftBank-led consortium invests $1.3b 2018 Toyota invests $500m © Xen Technologies Pte. Ltd. (201832847D) All rights reserved. XenBytes, February 2020: Chasing Unicorns

- 4. #2 - Share type The other important consideration is the share type which can be broadly classified into primary and secondary shares. Primary shares Shares you buy directly from the company when the company raises a new round Secondary shares Shares bought from existing shareholders or management Who are the investors investing in the round? Having a top tier VC fund leading the round will give more assurance than a round led by a strategic investor who might have other considerations beyond financial gains. What to consider Who is the seller and why is he selling? As an “outsider” we must avoid being “dumped” shares by “insiders” who have better visibility of the company’s performance. What to consider Share class and valuation Shares sold by founders or early investors are usually of a lower preference than later round shares sold by the company. In the event of a liquidation, the holders of lower class of shares will only be paid back after the holders of higher classes of shares have been paid back. Direct vs. indirect shares Earlier investors typically hold their shares in an SPV. When selling their shares to you they are transferring shares in the SPV instead of shares of the underlying company. This means you have no direct access to the company and are dependent on the seller to provide you with ongoing updates on the company. When purchasing indirect shares, you should also look at the terms of sale to see if the seller charges you any fees and carry for managing the SPV. © Xen Technologies Pte. Ltd. (201832847D) All rights reserved. XenBytes, February 2020: Chasing Unicorns

- 5. Chasing unicorns is a potentially rewarding but highly risky hobby that is best left to the professionals (top tier VC funds) who have the experience of spotting the next unicorn and also the expertise to give assistance and guidance to groom the start-ups into unicorns. At Xen, we seek out the best VC managers and present opportunities for investors to invest in them via our a fintech solution, which allows fractionalized access and tradability in alternative investments, through a user-friendly, compliant onboarding platform. We also bring curated quality unicorn opportunities backed by top tier VC funds to our investors.The author About Xen Kenneth has over 20 years of experience in the private equity industry. He started his investment career with the Government of Singapore Investment Corp (GIC) where he spent 12 years, half of which was based in GIC's overseas offices in Bangkok, London and the Silicon Valley. Kenneth joined Allianz Capital Partners in 2007 as an Investment Director, responsible for its private equity fund investments in Asia. Most recently, he was a Senior Director at Azalea, a wholly owned subsidiary of Temasek Holdings. Transforming Alternative Asset Management. We live in an age where access to the right investments can be a door to wealth and financial security. In Asia, where there has been an unprecedented growth in wealth, the current force of economic influence and power is among the young and affluent, the millennials and XENnials. Most accredited investors in Asia are locked out of alternative opportunities due to high barriers to entry – high minimum investment levels, zero liquidity and lack of transparency. Only a small fraction of investors has access to the above market returns and performance of alternative investments, including private equity, venture capital, real estate, infrastructure, private debt and hedge funds. Xen creates a fintech solution which allows fractionalized access and tradability in alternative investments, through a user-friendly, compliant onboarding platform. Xen is opening up an industry, traditionally dominated by and designed for UHNWIs and institutional investors, to accredited investors seeking access and liquidity in alternatives. Founded in 2018 by a strong management team of former investment bankers, traders and fintech veterans, Xen envisions a future of alternative asset management powered by technology for the utmost transparency, liquidity and cost efficiency. © Xen Technologies Pte. Ltd. (201832847D) All rights reserved. This Publication and any information contained herein is made available by Xen Technologies Pte. Ltd. (hereafter “Xen”) for general information only and not for any other purpose. The Viewer agrees that this website shall be used solely as reference, or for informational use and not for any other purposes, commercial or otherwise. The information contained in this publication is not intended and should not be used or construed as an offer to sell, or a solicitation of any offer to buy, securities of any fund or other investment product in any jurisdiction. Neither Xen nor any of its officers, directors, agents and employees makes any warranty, express or implied, of any kind related to the adequacy, accuracy or completeness of any information on this site or the use of information in this publication. The information in this publication is not intended and should not be construed as investment, tax, legal, financial or other advice. Xen holds exclusive and rightful ownership of the intellectual and proprietary rights to all opinions, concepts, ideas, work products, and the like, related to or as a result of the General Information and contents in this publication. Contact us info@xen.net Oxley Tower #23-02, 138 Robinson Road Singapore 068906 Conclusion XenBytes, February 2020: Chasing Unicorns