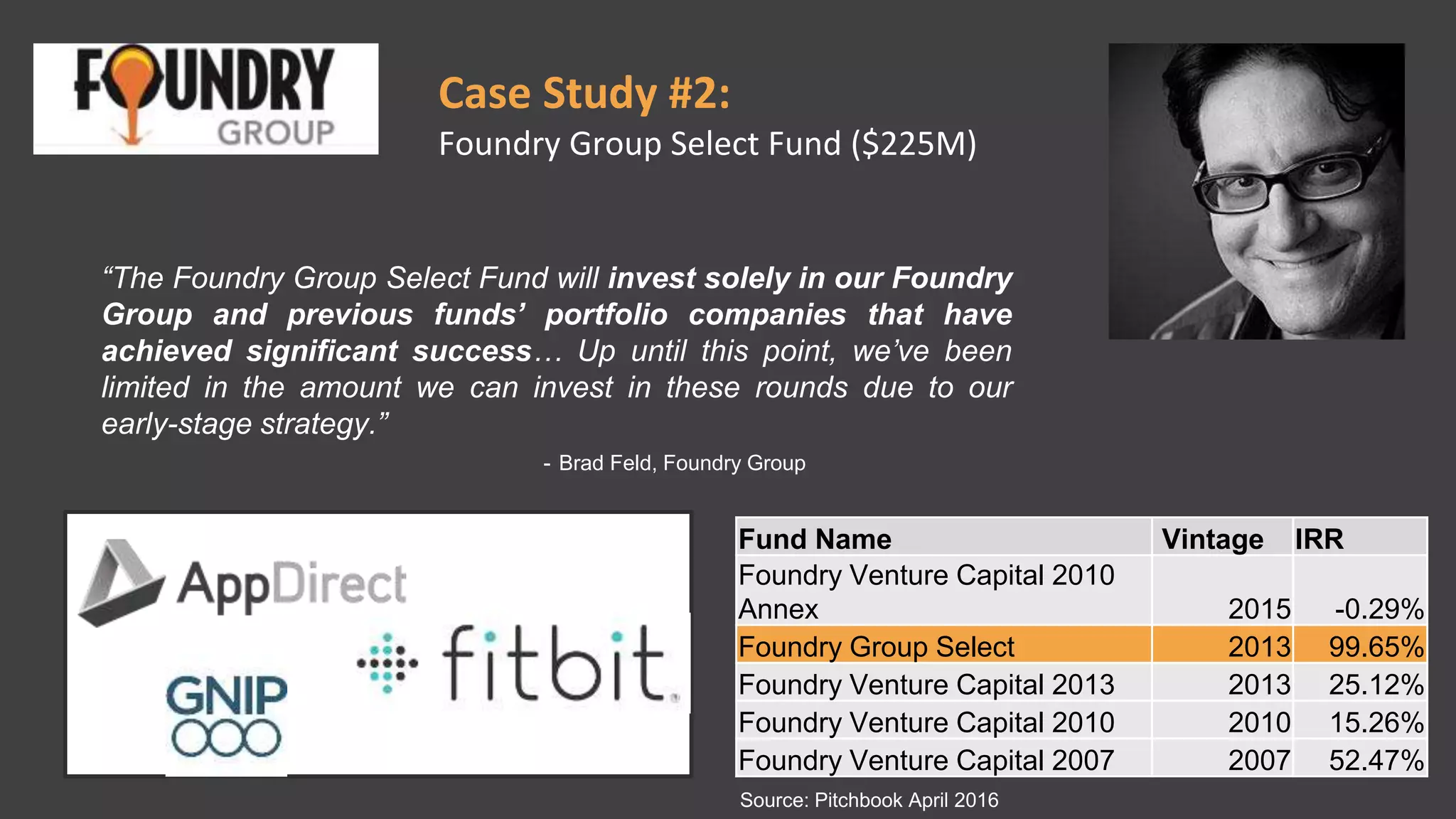

This document discusses preemptive rights in venture capital, emphasizing their importance for investors to maintain ownership stakes during new stock issues and maximize potential returns. It highlights a series of case studies and the success of opportunity funds that allow existing investors to reinvest in promising startups, showcasing the significance of exercising pro rata rights. Additionally, it mentions the risks involved in early-stage investments and offers educational resources for better understanding the investment landscape.

![The exponential arc of success

“Successful businesses tend to have an exponential arc to them. Maybe they

grow at 50% a year and it compounds for a number of years. It could be more

or less dramatic than that. But that model — some substantial period of

exponential growth — is the core of any successful tech company. And during

that exponential period, valuations tend to go up exponentially.”

– Peter Thiel (PayPal and Palantir founder, angel investor in Facebook)

“Exceptional performance … attracts new resources as well as rewards that

facilitate continued high performance [repeat].”

– Robert Merton (sociologist)](https://image.slidesharecdn.com/preemptivewebinar-final-160407075413/75/Everything-You-Need-to-Know-about-Preemptive-Rights-5-2048.jpg)