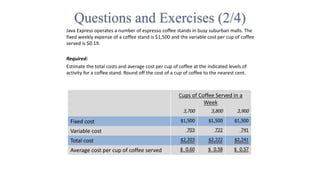

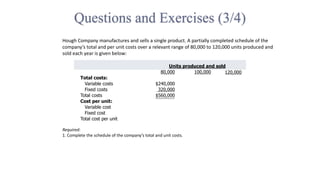

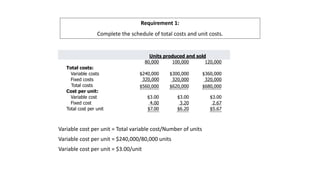

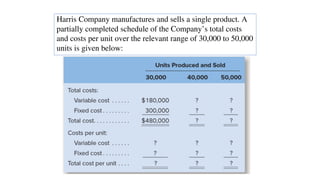

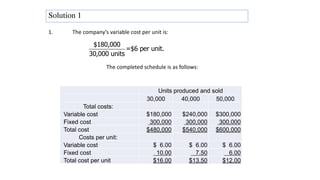

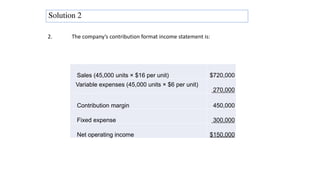

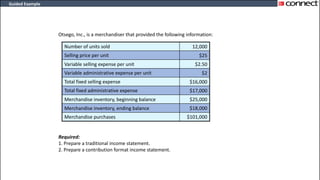

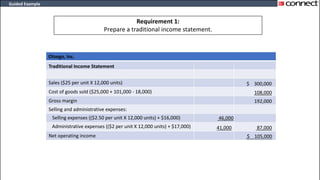

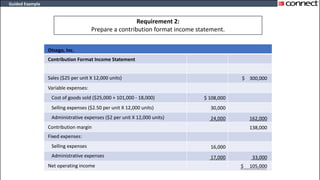

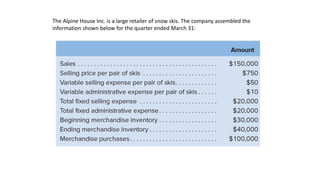

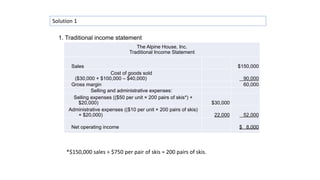

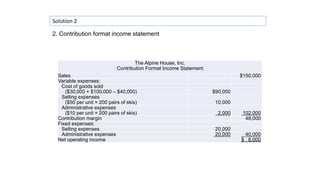

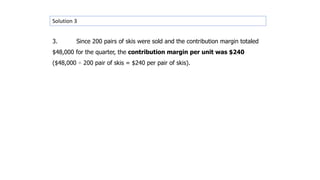

The document contains exercises related to product costs in manufacturing, including definitions and distinctions between direct and indirect costs, as well as product and period costs. It includes multiple examples and problems involving cost calculations for various companies and products, such as coffee stands and ski retailers, detailing fixed and variable costs, total costs, and unit costs. Additionally, it provides guidance on preparing traditional and contribution format income statements based on given data.