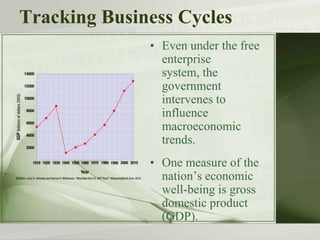

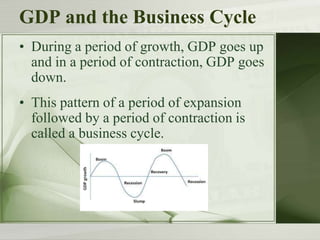

The document summarizes the role of government in a free enterprise system. It discusses how the government provides public goods and services to address market failures, promotes economic growth and stability, funds technological progress, and provides a safety net for those in need. The government aims to achieve high employment, economic growth, and price stability. It also regulates to reduce negative externalities like pollution.