The document discusses several topics related to free enterprise in the United States, including:

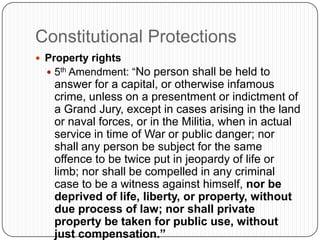

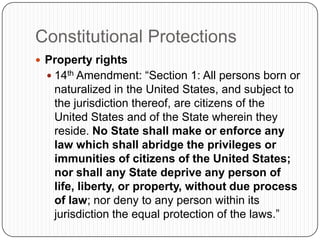

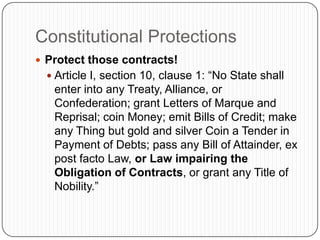

1) Constitutional protections for private property rights and contracts help enable free enterprise by protecting individuals' ability to profit from their work and property without excessive government interference.

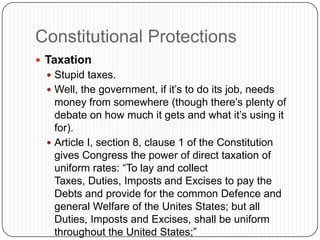

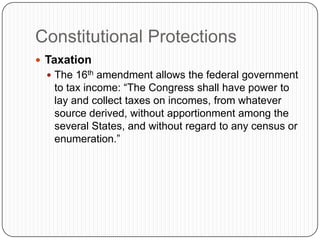

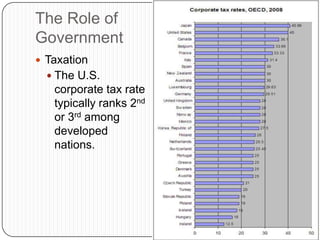

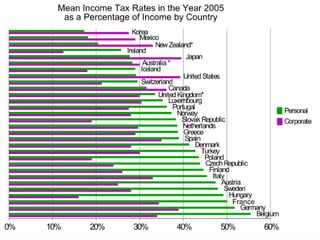

2) The government plays an important role in maintaining stability through consistent rules and taxation, though taxes above a certain level could hinder free enterprise and corporate taxes may ultimately be paid by consumers.

3) Key principles of free enterprise like the profit motive, voluntary exchange, and competition are generally well supported in the U.S. system, though the government's role is debated in areas like stimulus spending and regulating certain industries.