2015 day 9

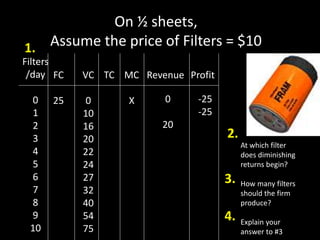

- 1. On ½ sheets, Assume the price of Filters = $10 Filters /day 0 1 2 3 4 5 6 7 8 9 10 FC 25 VC 0 10 16 20 22 24 27 32 40 54 75 TC MC X Revenue Profit At which filter does diminishing returns begin? How many filters should the firm produce? Explain your answer to #3 0 20 -25 -25 1. 2. 3. 4.

- 2. Practice one, Assume the price of Filters = $10 Filters /day 0 1 2 3 4 5 6 7 8 9 10 FC 25 25 25 25 25 25 25 25 25 25 25 VC 0 10 16 20 22 24 27 32 40 54 75 TC 25 35 41 45 47 49 52 57 65 79 100 MC X 10 6 4 2 2 3 5 8 14 21 Revenue 0 10 20 30 40 50 60 70 80 90 100 Profit How many filters should the firm produce? -25 -25 -21 -15 -7 1 8 13 15 11 0 8, because the profit is 15, the highest. Profit Maximization point

- 4. Get into 4 groups Using two slates, draw a large X and large O X O

- 5. Let’s play a game for points If all X’s are played everyone loses 1 point 3 Xs and 1 O played each x gets 1 point, O loses 1 point 2 X and 2 O’s played each X gets 2 points, O loses 1 point 1 X and 3 Os played each x wins 3 points each O loses 1 point All O’s played everyone wins 1 point X O

- 6. Lack of Competition • Oligopolies sometimes figure out competition hurts their profits, so……….

- 8. If firms discuss and agreed on new prices… This is called collusion. And you formed a cartel. Collusion = setting of prices by rival firms Cartel = groups of rival firms that try to fix prices to increase profits **Drug cartels – don’t compete on price In the United States, it is illegal

- 9. Meanwhile…. • OPEC – Organization of Petroleum Exporting Countries (1960-present)

- 10. How does OPEC indirectly set prices? $/Barrel Q/barrels S D 50 10 billion Every 6 months, OPEC representatives and economists meet inVienna to decide production. S after meeting 100 75 8 bi Most Economists think cartels don’t work in the long term, why?

- 11. Problems with larger group assignments? • Strategy? • Incentives?

- 12. On slates • 3 + goods that if you consume it, your friends can’t consume it at the same time • 1.5 + goods that if you consume it, your friends are unaffected by your consumption

- 13. Private Goods • Rivaled consumption • A person’s consumption affects others’ consumption • Excludable • Firms can exclude people who don’t pay

- 14. Public Goods • Goods that are both non-excludable and non-rivaled in consumption

- 15. Free Rider Problem • Free Rider – a person who does not pay for, but benefits from a public good • Incentives? How does society pay for public goods? Taxes User fees

- 16. Private Goods For example: food Common Goods EX: Open ocean fishing Club goods EX: Golf Course, movie theatre Public goods EX: National Defense Street lights

- 17. Excludable? Rivaled Consp.? Market structure?

- 18. Excludable? Rivaled Consp.? Market structure?

- 19. Excludable? Rivaled Consp.? Market structure?

- 20. Excludable? Rivaled Consp.? Market structure?

- 21. Excludable? Rivaled Consp.? Market structure?

- 22. Excludable? Rivaled Consp.? Market structure?

- 23. On Slates 1. Write a building in your neighborhood you wish didn’t exist. 2. Why does that building bother you?

- 24. Externalities • Economic question: would you want to live next to the airport? Why or Why not? • Different question: Would you want to own a business next to the airport? Externality: any external effect due to economic activity

- 25. Positive Externalities Brings customers to other businesses in Anaheim

- 26. Positive Externalities Prevents the spread of future diseases

- 27. Positive Externalities Brings customers to Food City, Walgreens and El Potisino Also educates future workers Also a negative?

- 35. Negative Externalities Brings traffic to Anaheim

- 37. Remember Public Goods? • Any good which is non-rivaled consumption AND non-excludable • EXAMPLES?

- 39. 2-3 paragraph letter re: Rosemont Mine • Write a letter to the Star either in support or opposition to the Rosemont Copper mine in the Santa Rita Mountains south of Tucson • Use at least 2 economic externalities to support your letter Dear editor, last Sunday’s Star discussed the Rosemont Copper mine, I would like to express my support/opposition to the mine.

- 41. US government spending on mostly non-public goods Show US debt clock

- 43. 1. How much money you want to be earning (per year) when you are 30. 2. What percentage do you think that income has to pay to the government in taxes (in the US) Bellringer on your ½ sheet

- 44. Taxation “In this world nothing can be said to be certain, except death and taxes.” Benjamin Franklin

- 45. In reality… • US Federal Tax Rates: (only 3 % of Americans make over $250,000) • Add 3 -15 % more depending on which state you work in 3. On your ½ sheet how much in tax dollars would you would pay?

- 46. Net Income • Gross income: How much you earn • Net income: how much you keep • Net income = gross income - gross income*tax rate • For example: Mr. Klein made $37,500 last year. • Net income = $37,500 - $37,500(.25) • Net income = $37,500 - $9,375 = $28,125 4. How much is your “net income”?

- 47. World Tax Rates United Kingdom 21-28% 0-40 % 17.5% Ireland 12.5 % 20- 41% 21 % Mexico 29% 3-29 % 15 % Sweden 28 % 0-59 % 25 % Slovakia 19 % 19 % 19 % Hong Kong 15 % 0-15 % 0 % United Arab Emirates 0 % 0 % 0 % Country Corporate Tax rate Income Tax Sales Tax

- 48. What are “Good Taxes”? • According to Adam Smith: • Simple to understand • Don’t mess up incentives • Avoid loopholes • IRS manual – 70,000 pages – (4 X size of the Bible)

- 49. Loopholes • Reading, other problem in USA? Why difficult to solve? • Tax incentives • Really, ways to not pay tax • “write offs” • Thousands of examples, hybrid cars, college loan debt, 2nd home mortgage

- 50. Income Tax in USA • IRS – tax collection agency in USA • Taxes are deducted throughout year • Every citizen must file every year by: • If you paid more during the year then you need to: you get a refund • If you paid less during the year then you need to: pay the difference

- 51. Taxes: For Example • For example: Mr. Klein made $37,500 last year. • Net income = $37,500 - $37,500(.25) • Net income = $37,500 - $9,375 = $28,125 5. If Mr. Klein paid $10,375 in 2010, what happens after he files? 6. Why is a BIG refund not such a great idea?

- 52. 7. Does the US have a good tax system? Explain your answer & remember Adam Smith’s definition

- 53. With your partner • Imagine the state of Arizona was going to simplify its tax structure and adopt only 1 tax method. How it works, why it’s the best, why the other two are not as good 1. Sales tax 2. airport tax 3. Corporate tax 4. Alcohol tax 5. rental car tax 6. Income tax 7. property tax 8. Gasoline tax 9. Hotel room tax What would be good about each tax, one change in behavior tax payers/consumers/businesses would make.

- 54. Tax on a household income % increases b/c income “tax the rich more!” The more you make, the higher your tax % For example: Tax $12/hour labor or accountant $55,000/year Why common in USA & EU Incentive? Progressive Income Tax Income Tax Rate $0-$15,000 0% $15,001- $20,000 10% $20,000- $30,000 15% $30,000- $50,000 25% $50,000- $100,000 33% $100,001 + 38%

- 55. Proportional Income Tax • Tax on a household income • % of stays the same • “flat tax” • For example: 5% tax, $25,000/year or $100,000/year • Why rare in USA? • Incentive?

- 56. But wait, the government isn’t done yet! • Other taxes

- 57. Property tax • Tax on something you own • Usually expensive like your house or boat • For example: $100,000 home – 5% property tax rate • 100,000 X .05 = $5,000 property tax • Incentive? 8.01 % ave Pima Co rate

- 58. Regressive Tax • Smaller % taken the higher your income • Sales tax • Sin tax • For example: 5% tax, $25,000/year w/$10,000 consumption pays: 10,000 X .05 = $500, or 2% of total income • $50,000/year w/$15,000 consumption pays: 15,000 X .05 = $750, or 1.5% of total income • Incentive? • Why don’t poor people get upset?

- 60. Regressive taxes

- 61. Regressive taxes

- 62. Capital Gains Tax • Tax on real estate, stock sales or dividends, or collectables. • Why not only for the rich?

- 63. Gift tax • Tax on gifts or rewards • Games shows, gambling, lottery • Rate depends on gift • 35-60 % • Is this a bad incentive?

- 64. Tucson painter Ted DeGrazia

- 65. Estate tax • Tax on inheritance • Sometimes called “death tax” • In US today, $5,000,000 and up • 40% rate • Is this a bad incentive?

- 66. If you are curious… • US estate taxes over the years • GW Bush worked to repeal in 2001 • Came back in 2011 when law expires • Barack Obama supports estate tax • Next president?

- 68. Tax Game • Each of you has a job • Present a tax proposal before the end of class • You can use: proportional, progressive or regressive taxes, or a combination of both • You can cut $100,000 in services The group with the most votes wins 5 points of extra credit.

- 69. In reality… • US Federal Tax Rates: (only 3 % of Americans make over $250,000)

- 70. Let’s do your taxes • 1040 Form for IRS • 1040EZ • W2 from employer (s) – shows wages • 1099 (other forms for interest, stock income, etc) • Plus you must file in every state except: TX, NV, NH, FL, WA.

- 71. On Slates 1. How old will you be in 2070? 2. Do you think $13/hour is a lot of money?

- 72. 10 richest people in the World Forbes (2014) 1. Bill Gates $79 B 2. Carlos Slim Helú $69 B 3. Warren Buffett 4. Amancio Ortega 5. Larry Ellison 6. Charles Koch 7. David Koch 8. Christy Walton 9. Jim Walton 10. Liliane Bettencourt 1, 3, 5, 6, 7, 8, 9 2 10 4

- 76. 10 richest people in the USA Forbes (2014) 1. Bill Gates $79 B Operating Systems 2. Warren Buffett $68 B Investments 3. Larry Ellison $54 B Cisco systems 4. Charles Koch $41 B oil production 5. David Koch $41 B oil production 6. Jeff Bezos $ 39 B Amazon.com 7. Michael Bloomberg $37 B computerized investments 8. Christy Walton $36 B Walmart family 9. Mark Zuckerberg $35 B Facebook 10. Jim Walton $35 B Walmart family BusinessName

- 82. Credit Cards • Loan from the bank • High interest rates • Keep control • Bankruptcy • Video clip • http://www.nbc.com/saturday-night- live/video/dont-buy-stuff/n12020 https://vimeo.com/50044167

- 84. Chances are…. Only 3% of the US earns over $250,000/year You will work You will have a limited supply of wealth You will need to think about your income and make good choices You need a budget You need to think about investing

- 85. Do you want to be? • Rich & Retired Social Security

- 86. Specifics about investing • Opportunity cost of investing? • Things to consider: – Liquidity – Risk – Diversify

- 87. Liquidity • “How easy is it to turn this investment into cash”?

- 89. Cash under mattress • Bad idea, why? • No return, risky • 100% liquid • Inflation, you will lose the inflation rate

- 90. Savings Account • Low interest rate • No risk in USA • Today: 1%, yuck! Money Market Acct 3-3.5 %

- 91. Pension Plan • Employee plan • Usually union or large firm • For example: 10% from State employees, 80% of salary when you retire, after 30+ years • Not liquid at all • Low risk, long term

- 92. Bonds • Issued by government or large corporation • Low risk, low return • Must wait for maturity • Can be traded (liquidity!!) • WW1 & WW2 War Bonds

- 93. Mutual Funds • Managed stocks • Lower risk, lower control • Some sort of theme • Saves you time

- 94. Traditional IRA • Individual Retirement Account • You have to set it up • You can deposit up to $5000 per year • (into mutual funds, stocks or bonds) • Tax loopholes (breaks) • Can’t touch until 60 • Not liquid At 10% interest, a $5000 IRA becomes $226,000 over 40 years! $10,000 is over $400,000!

- 95. Roth IRA • Individual Retirement Account • You have to set it up • You can deposit up to $5000 per year • (into mutual funds, stocks or bonds) • No tax break, but tax free when you retire • Can’t touch until 60 • Not liquid At 10% interest, a $5000 IRA becomes $226,000 over 40 years! $10,000 is over $400,000!

- 96. 401 K Plan • Set up by employer • Payroll deduction • Invested into stock market • Lowers tax incidence • Tax break for employee • Employee match • Not liquid

- 97. Investment calculator • http://www.moneychimp.com/calculator/com pound_interest_calculator.htm • .

- 98. Real Estate • Risky, high capital • Relatively liquid • Speculation • Average real estate in Tucson in 1970 $23,000 • Average real estate in Tucson in 2013 $164,900!!!

- 99. Rank in order by liquidity • Traditional IRA • Roth IRA • 401 K • Real Estate • Stocks • Mutual Funds • Pension plan • bonds

- 100. Rank in order by liquidity • Traditional IRA • Roth IRA • 401 K • Real Estate • Stocks • Mutual Funds • Pension plan • bonds

- 101. Cable company article for portfolio