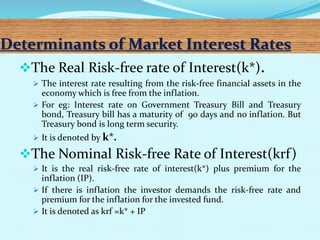

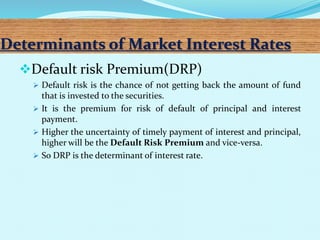

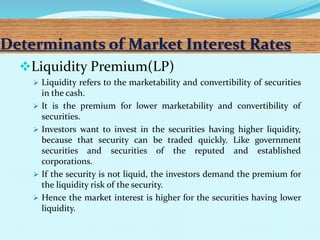

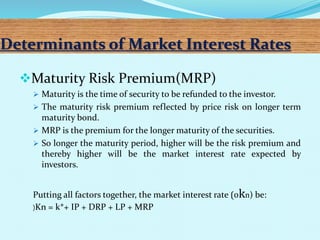

The document discusses the cost of money and factors that affect it. The cost of money refers to the price paid for using money, whether borrowed or owned, through interest on debt or dividends on equity. Key factors that influence the cost of money include production opportunities, time preference for consumption, risk, and inflation. Higher production opportunities and inflation increase the cost of money while higher risk demands a higher return and therefore higher cost of money. Determinants of market interest rates are the real risk-free rate, nominal risk-free rate, default risk premium, liquidity premium, and maturity risk premium.