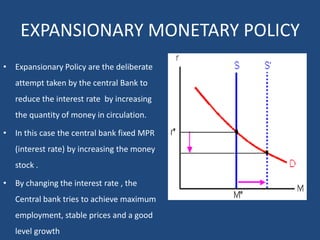

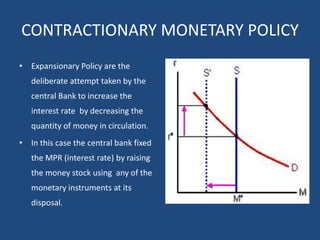

The document discusses the relationship between a country's Monetary Policy Rate (MPR) and corporate performance. It explains that the MPR is the official interest rate set by a country's central bank to influence economic growth and price stability. Lowering the MPR makes borrowing cheaper for businesses, which can spur investment and economic activity. However, raising rates makes borrowing more expensive and can discourage business investment and cause stock prices to fall. The document analyzes how changes to the MPR impact factors like business borrowing, strategic planning, and stock market performance.