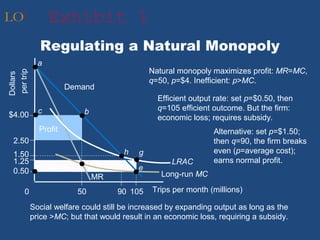

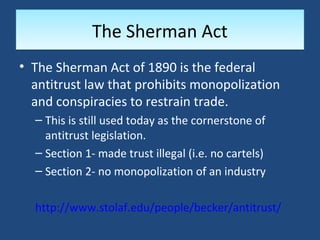

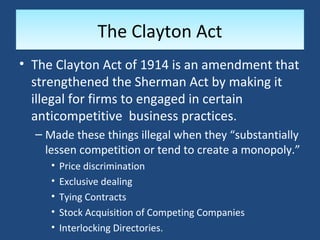

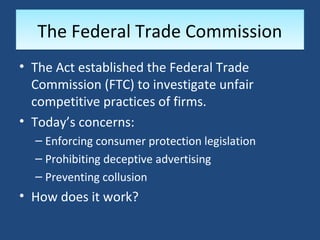

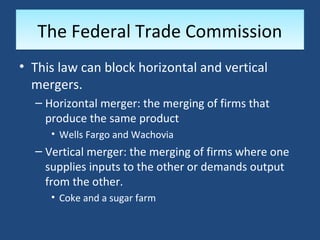

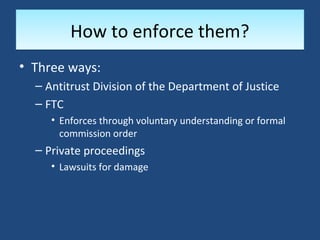

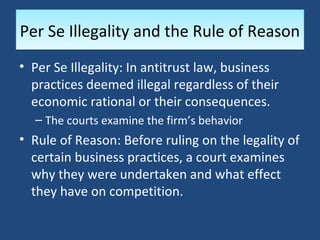

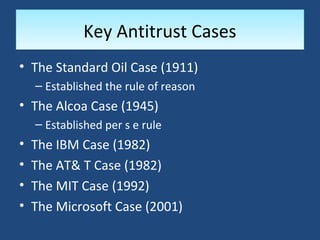

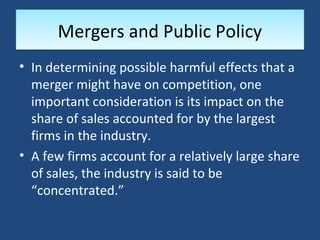

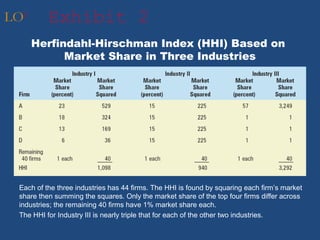

The document discusses different types of government regulations including social regulation, economic regulation, and antitrust regulations. It then provides examples of how governments regulate natural monopolies and industries through setting prices, limiting entry of new firms, and establishing regulatory agencies like the Federal Trade Commission. The document also covers the origins and key components of antitrust policy in the United States including the Sherman Act, Clayton Act, and landmark antitrust cases.