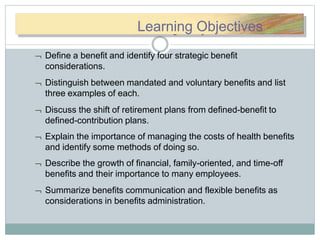

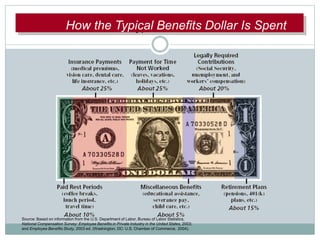

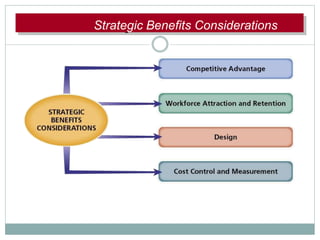

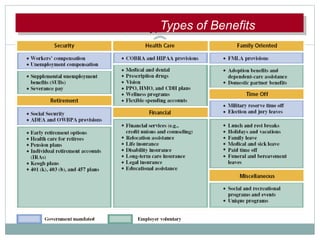

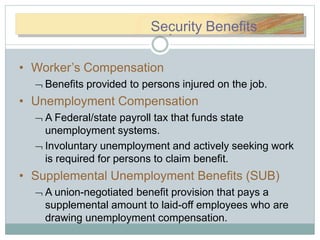

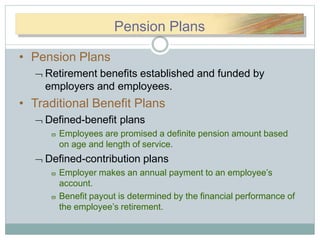

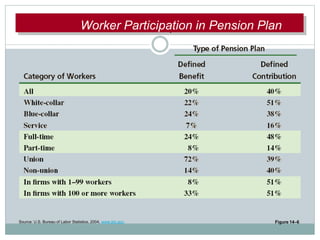

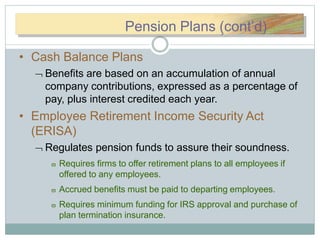

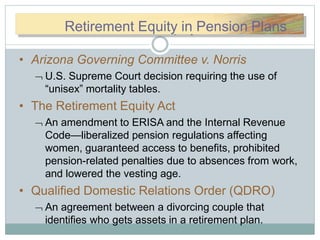

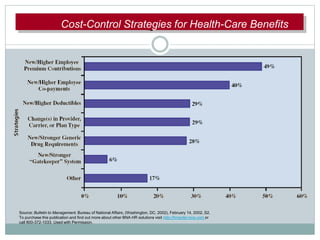

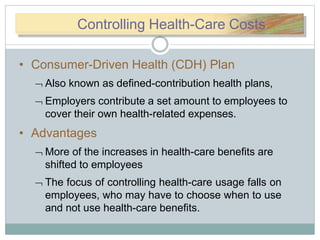

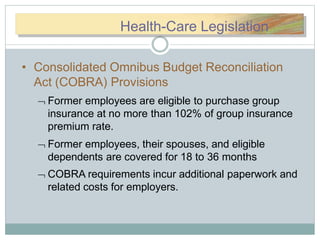

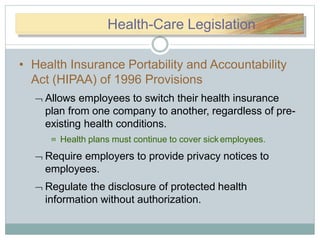

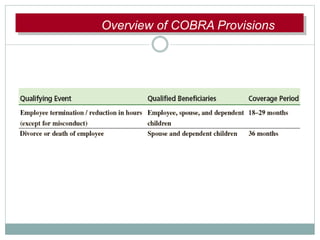

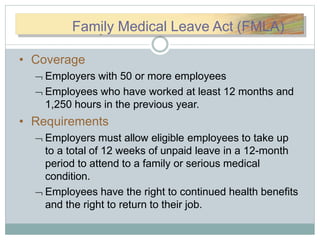

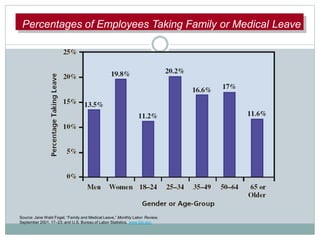

This document provides an overview of employee benefits. It defines a benefit and lists four strategic considerations for benefits. It distinguishes between mandated and voluntary benefits, providing examples of each. It discusses the shift from defined-benefit to defined-contribution retirement plans and methods for controlling health care costs, such as changing co-payments and utilization review. Finally, it describes the growth of benefits like family leave and their importance to employees.