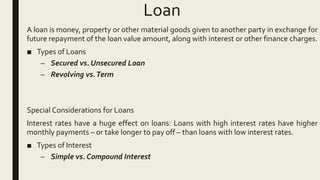

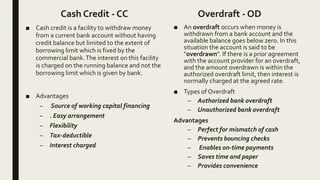

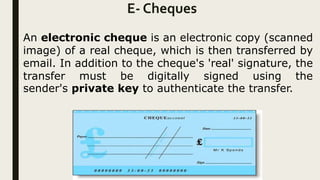

This presentation provides an overview of various banking products and services. It discusses the different types of banks and their core functions. It then examines several common banking products in India including deposits (current, savings, fixed, recurring), loans, cash credit, overdraft, credit cards, debit cards, ATMs, mobile/internet banking, demat accounts, and e-cheques. For each product, it provides details on what they are, the types that exist, their key features and benefits. The presentation is intended to educate audiences on the range of offerings provided by banks in India.