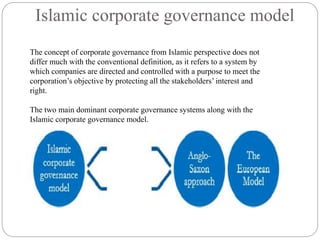

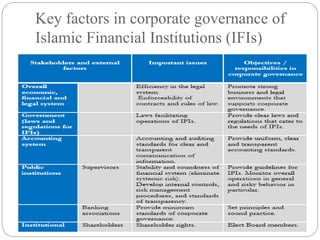

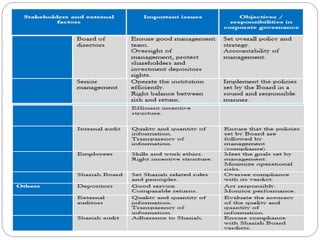

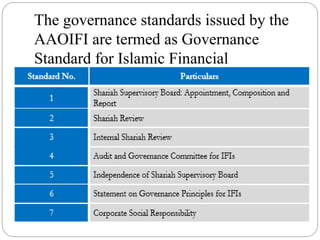

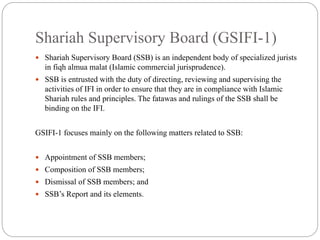

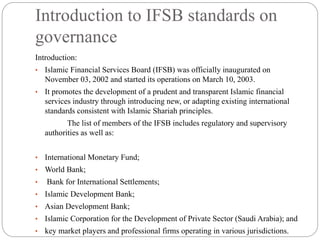

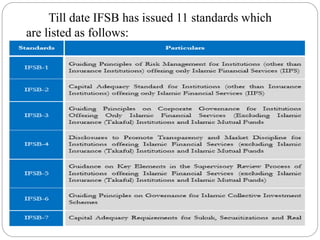

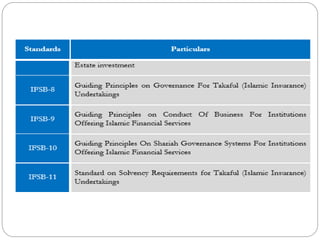

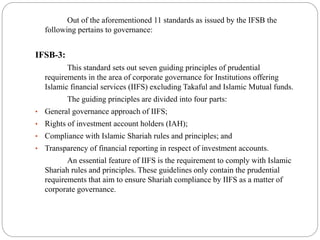

This document discusses corporate governance and provides details on key concepts and frameworks. It begins by defining corporate governance and outlining its objectives. It then discusses fundamental pillars like accountability, transparency, responsibility, fairness and independence. Next, it covers impacts of good governance and introduces various corporate governance codes from the UK, US and OECD. It also provides an overview of the Islamic corporate governance model and compares it to the Anglo-Saxon and European models. Finally, it introduces the AAOIFI governance standards for Islamic financial institutions focusing on the Shariah Supervisory Board, Shariah review and internal Shariah review.