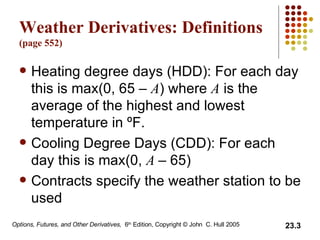

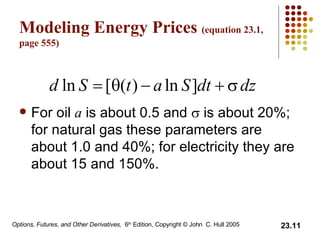

The document discusses weather, energy, and insurance derivatives. It defines heating and cooling degree days which are used in weather derivatives contracts. Typical weather derivatives are options or forwards on cumulative degree days in a month. Energy derivatives include oil, natural gas, and electricity contracts traded over-the-counter or on exchanges. Insurance derivatives known as CAT bonds pay higher interest but principal can be lost if claims exceed a set level, providing alternative reinsurance. The document provides formulas for modeling how energy prices relate to factors like temperature and for estimating parameters in those models.