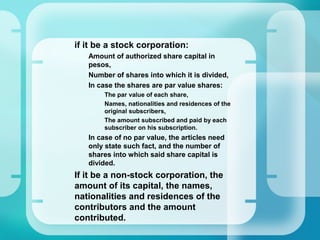

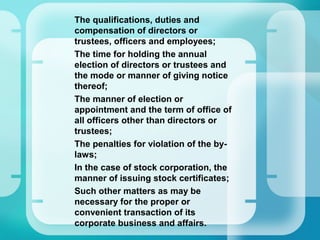

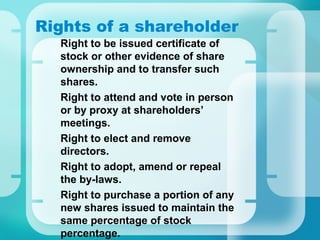

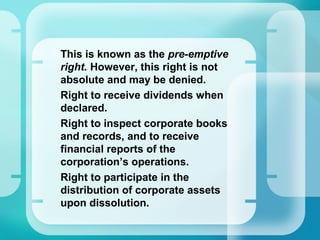

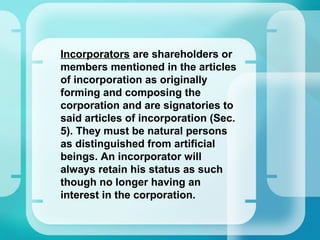

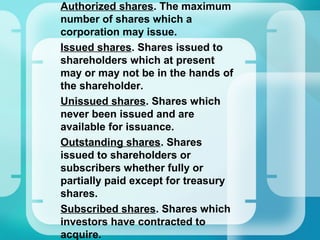

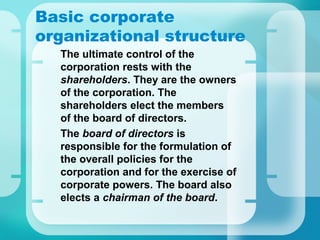

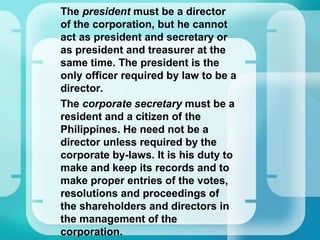

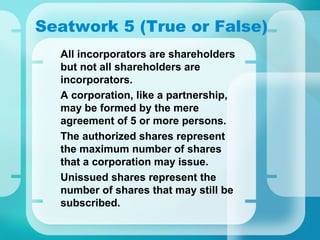

Corporations raise capital by issuing stock. Equity financing through stock issuance is less risky than debt financing through bonds. When profits are not paid out as dividends, the cash can be reinvested in expanding operations. A corporation is a legal entity separate from its shareholders, with unlimited life, transferable shares, and limited liability for shareholders. Key components include incorporators, shareholders, directors, and officers.