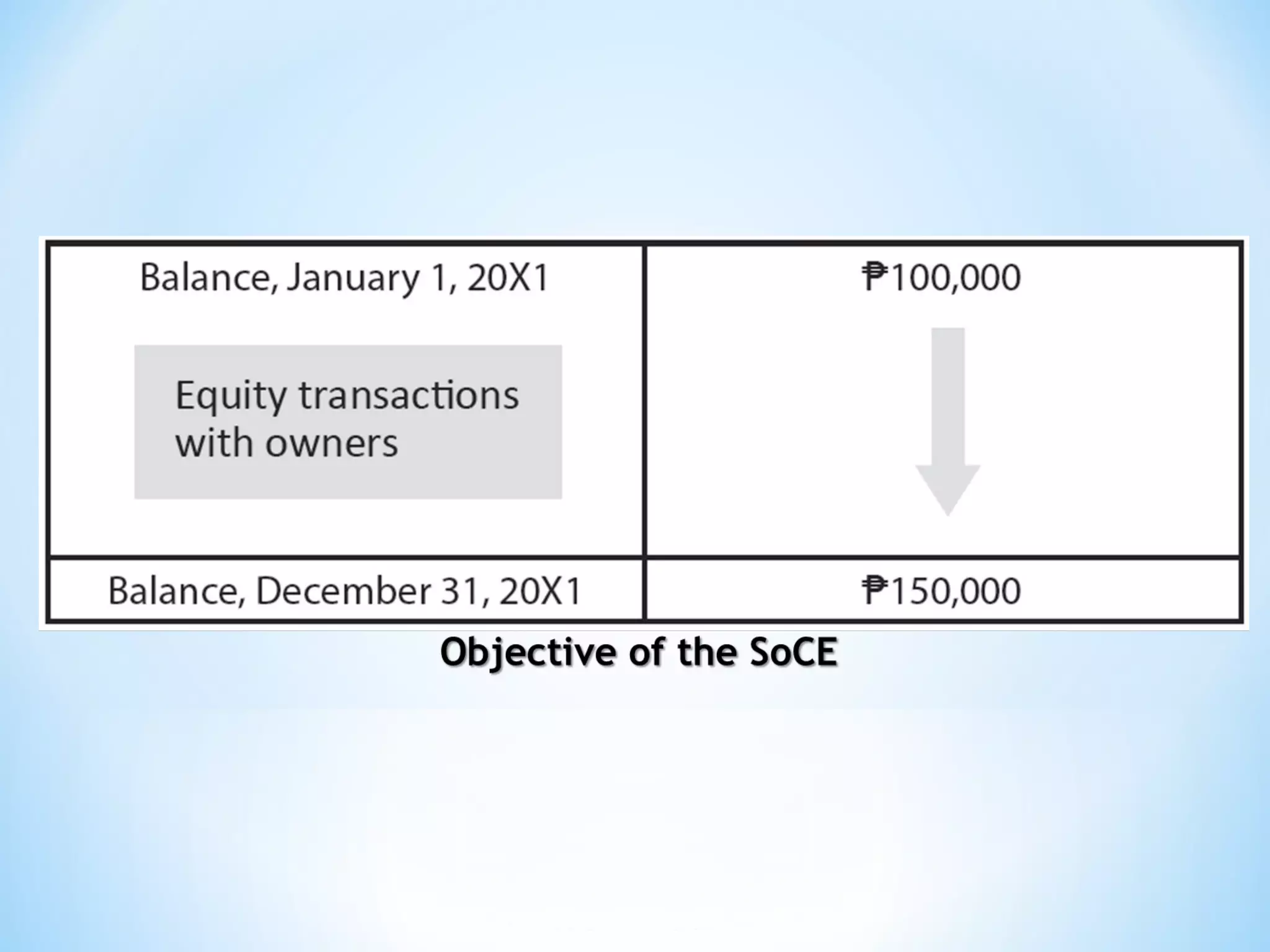

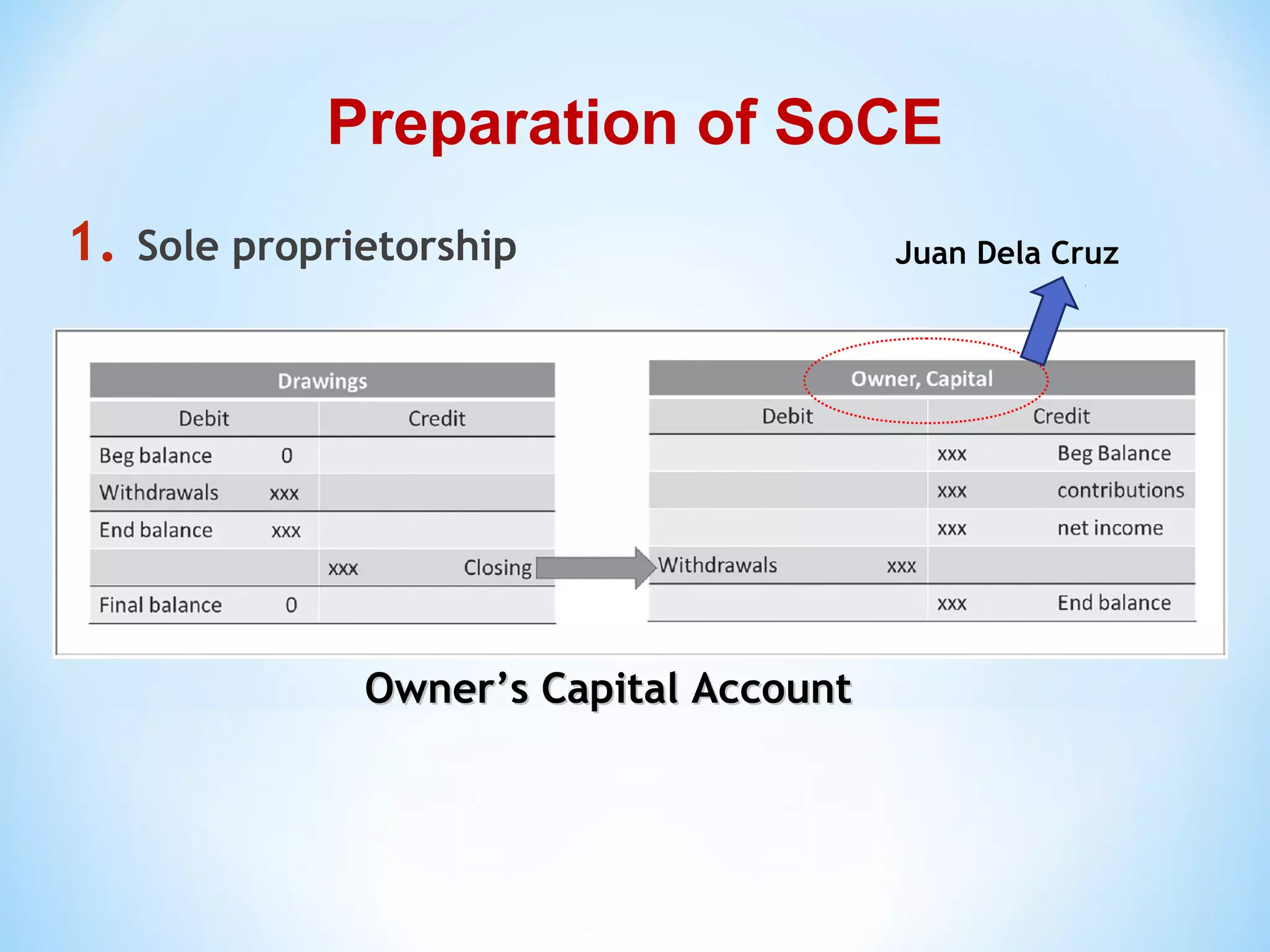

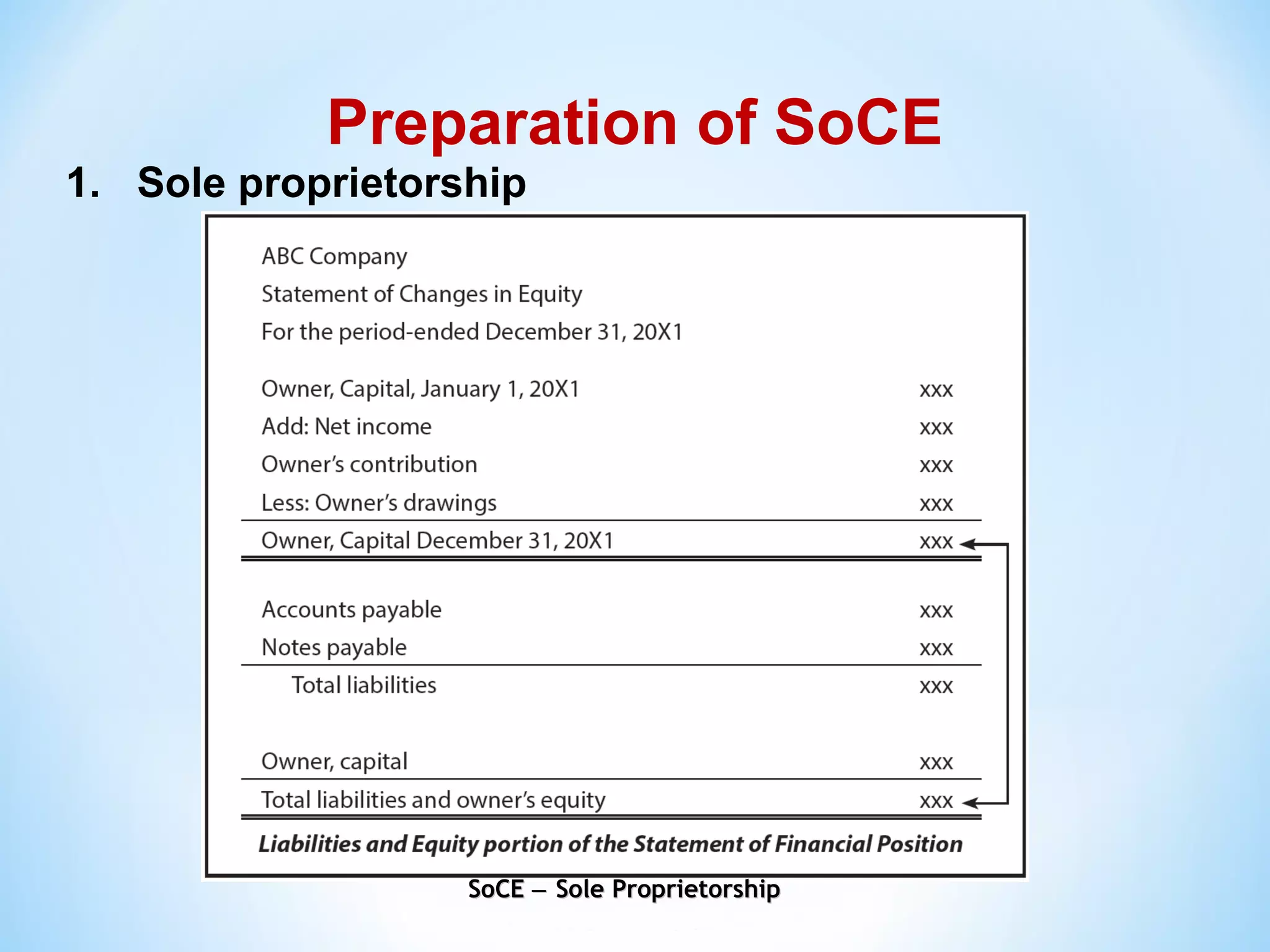

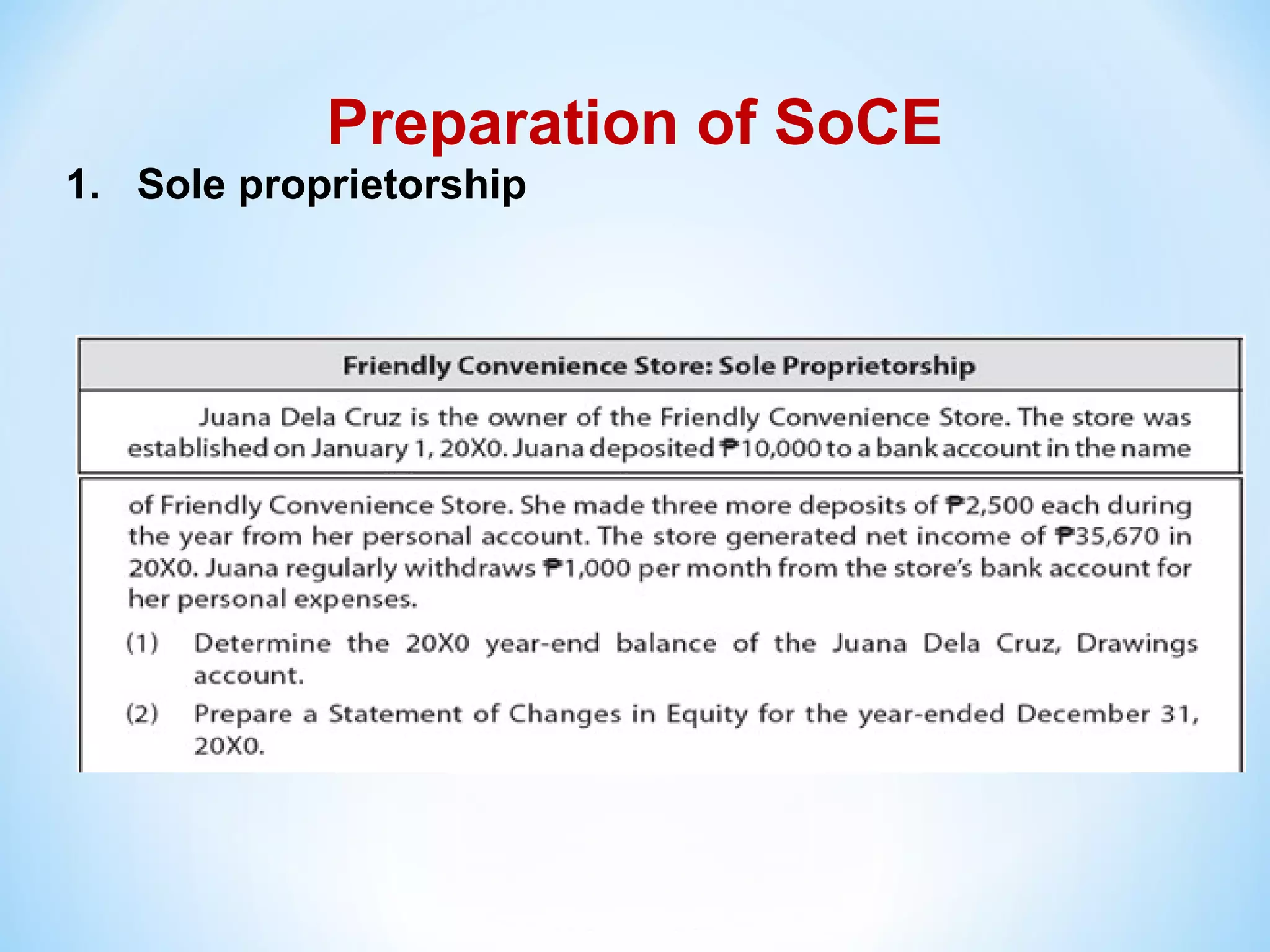

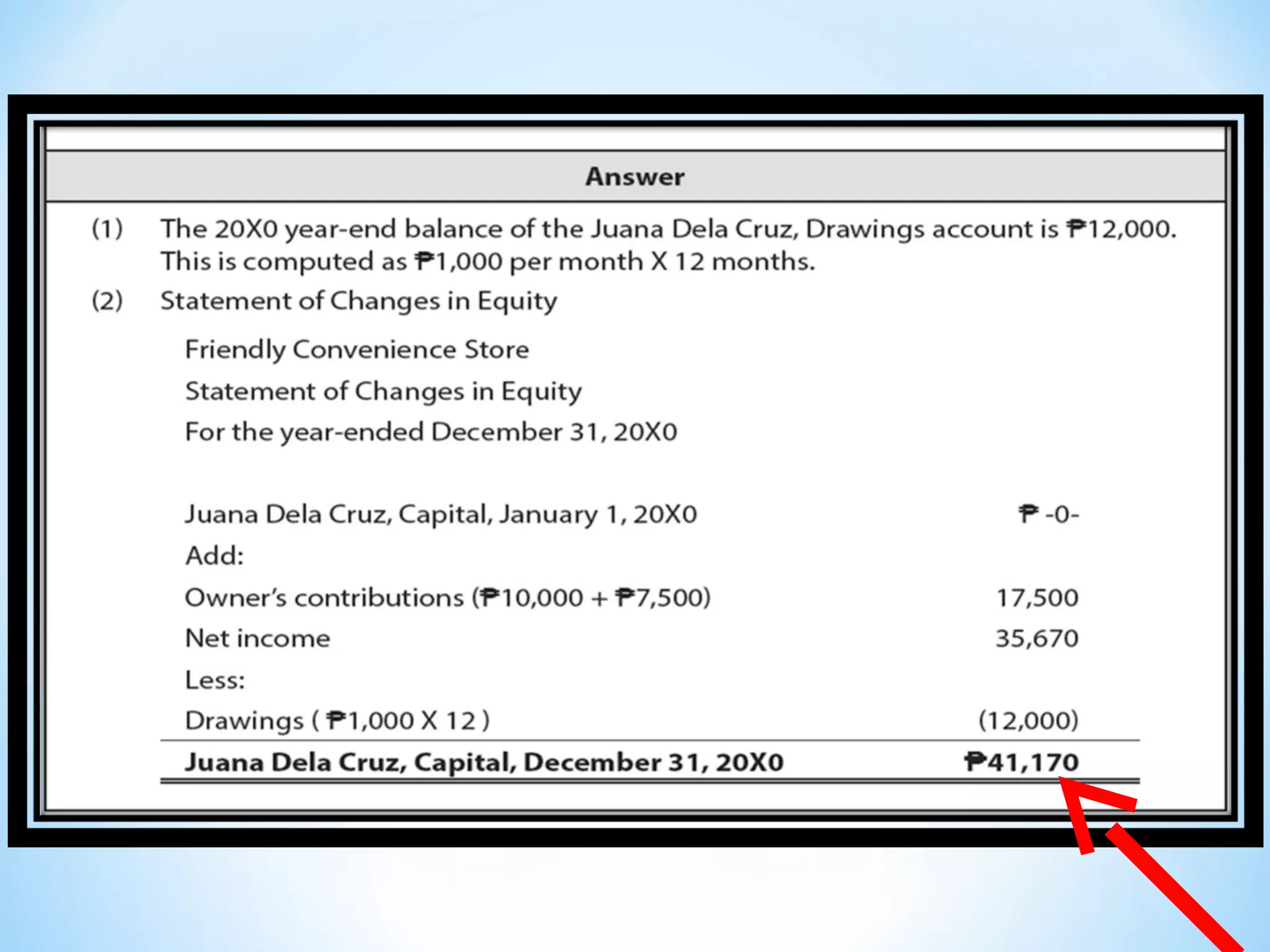

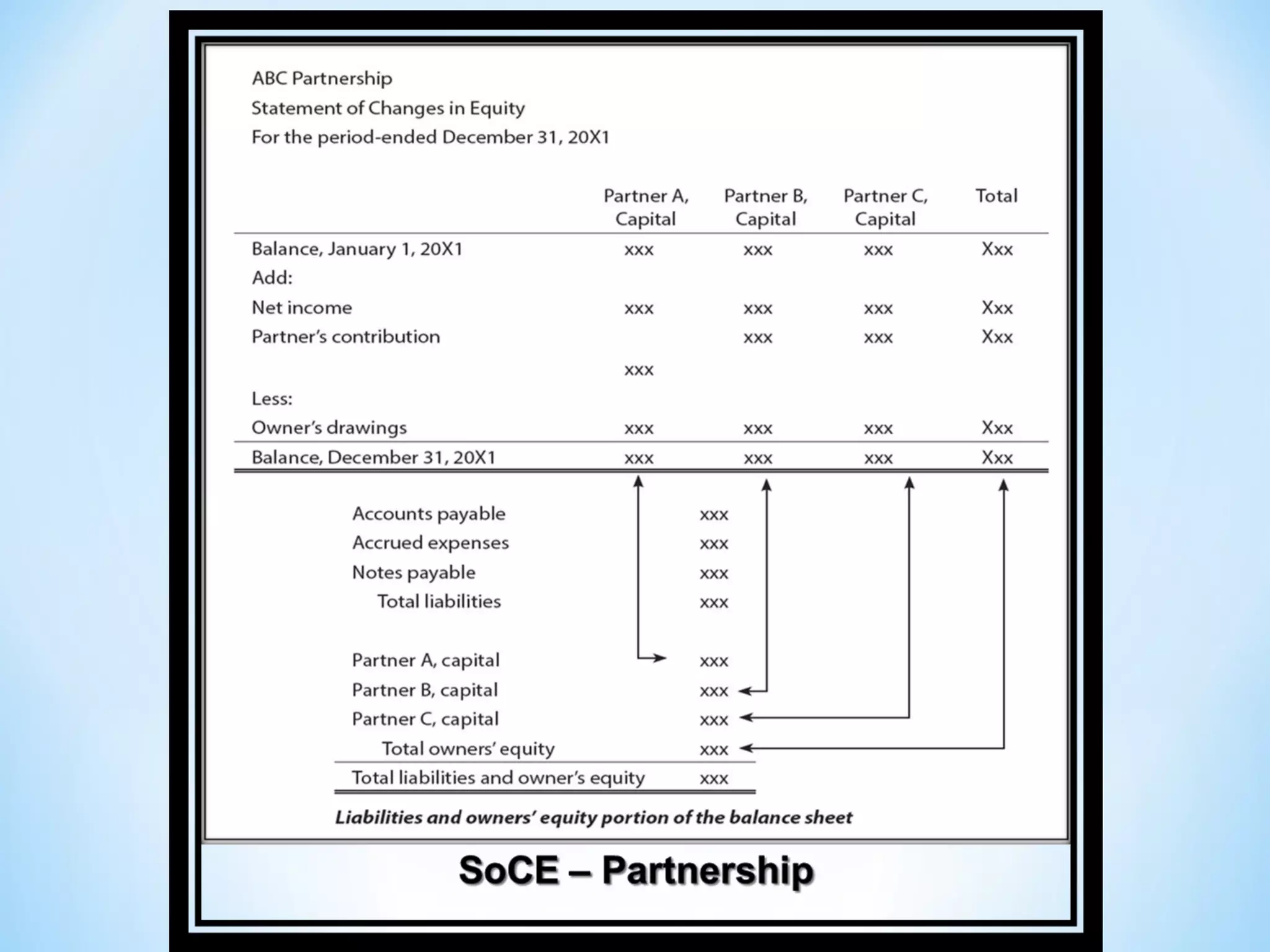

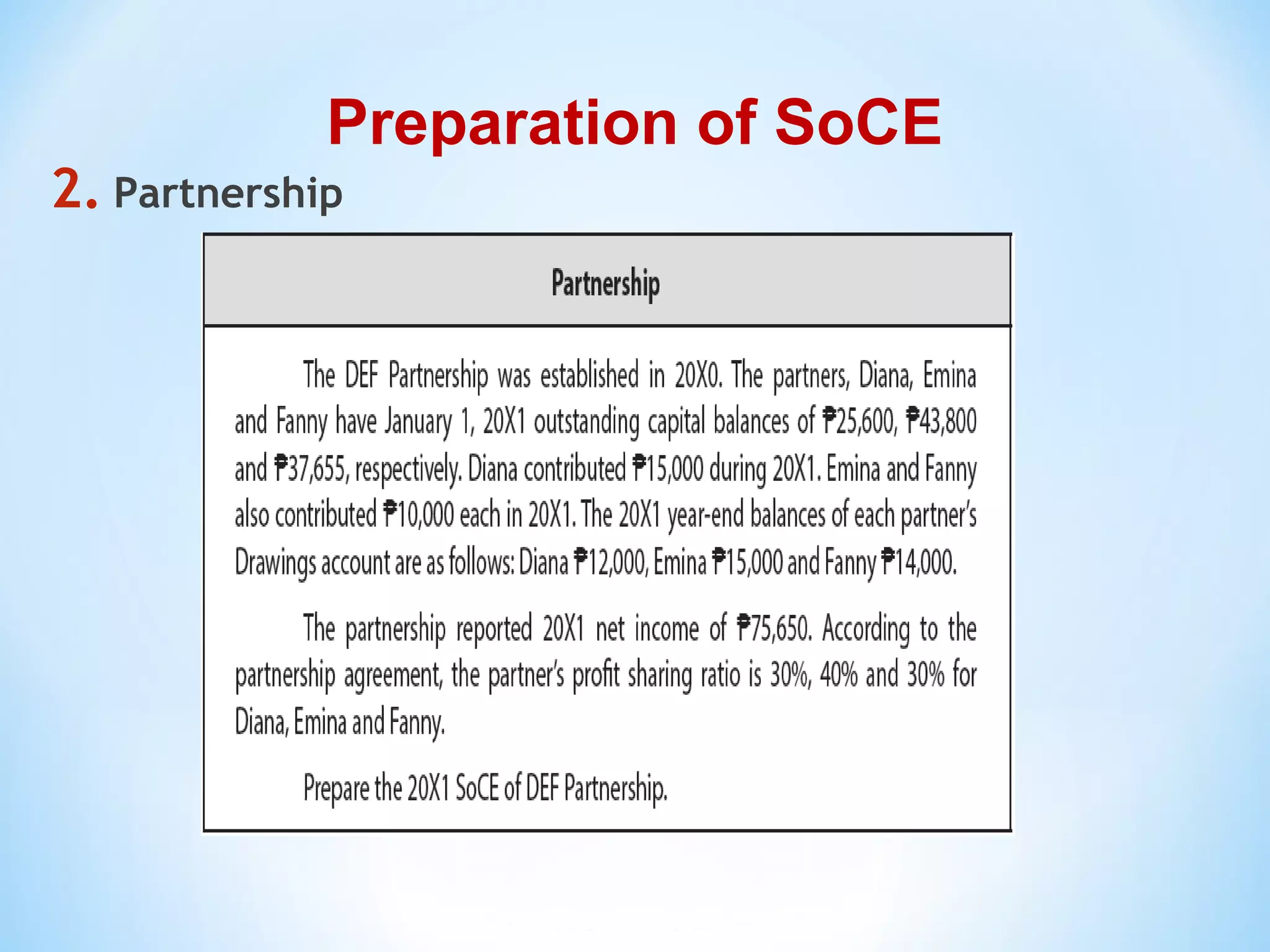

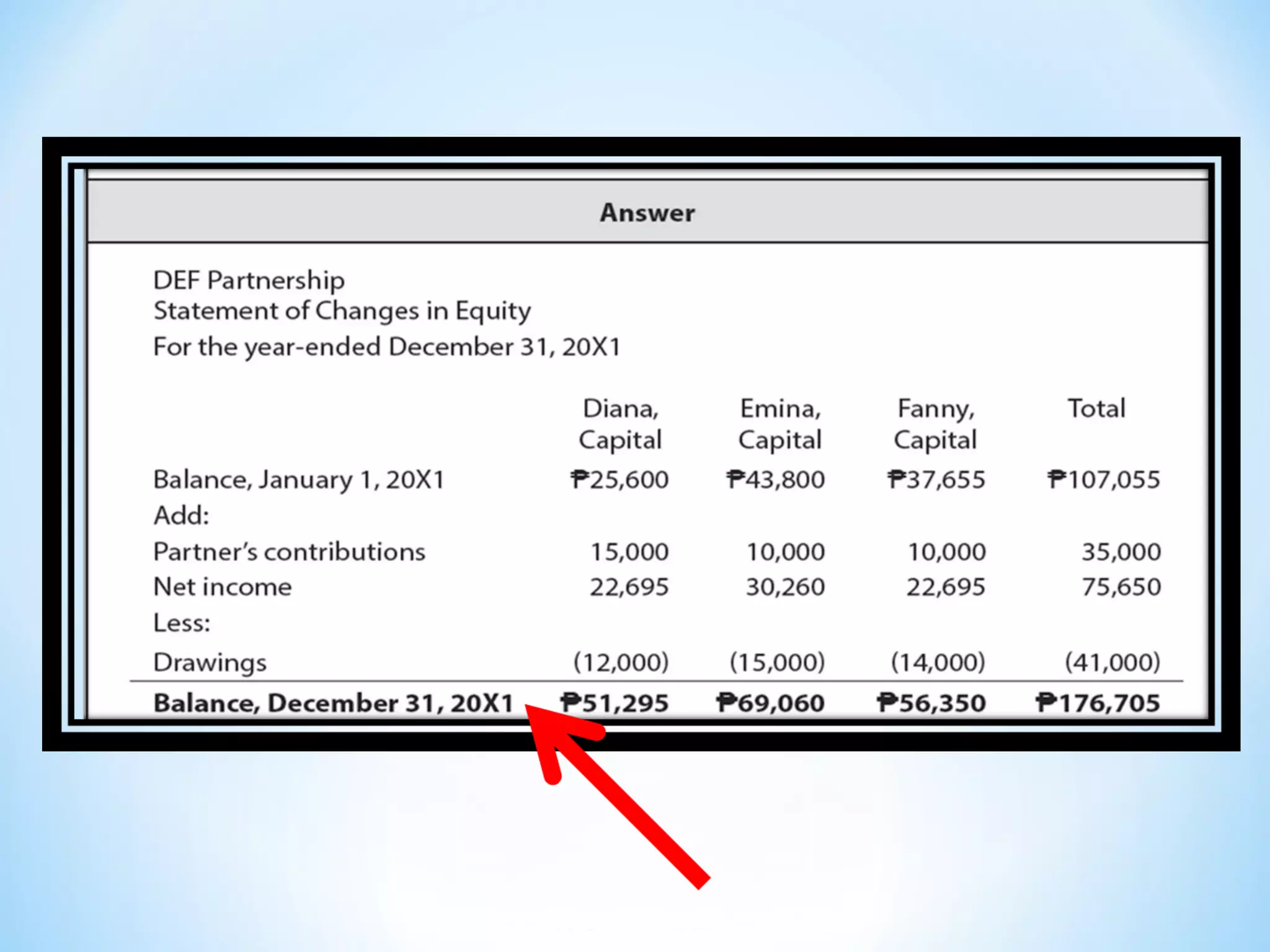

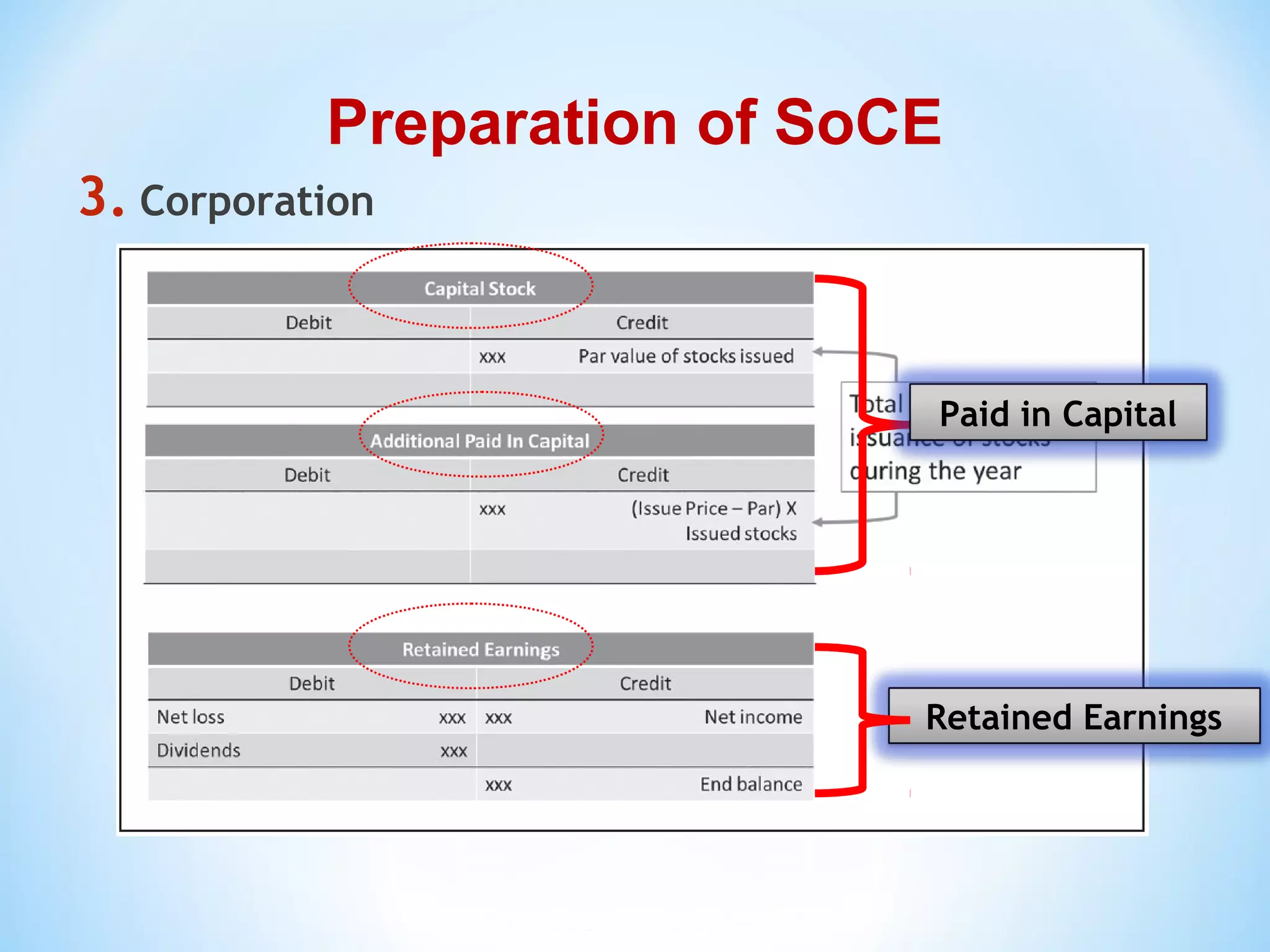

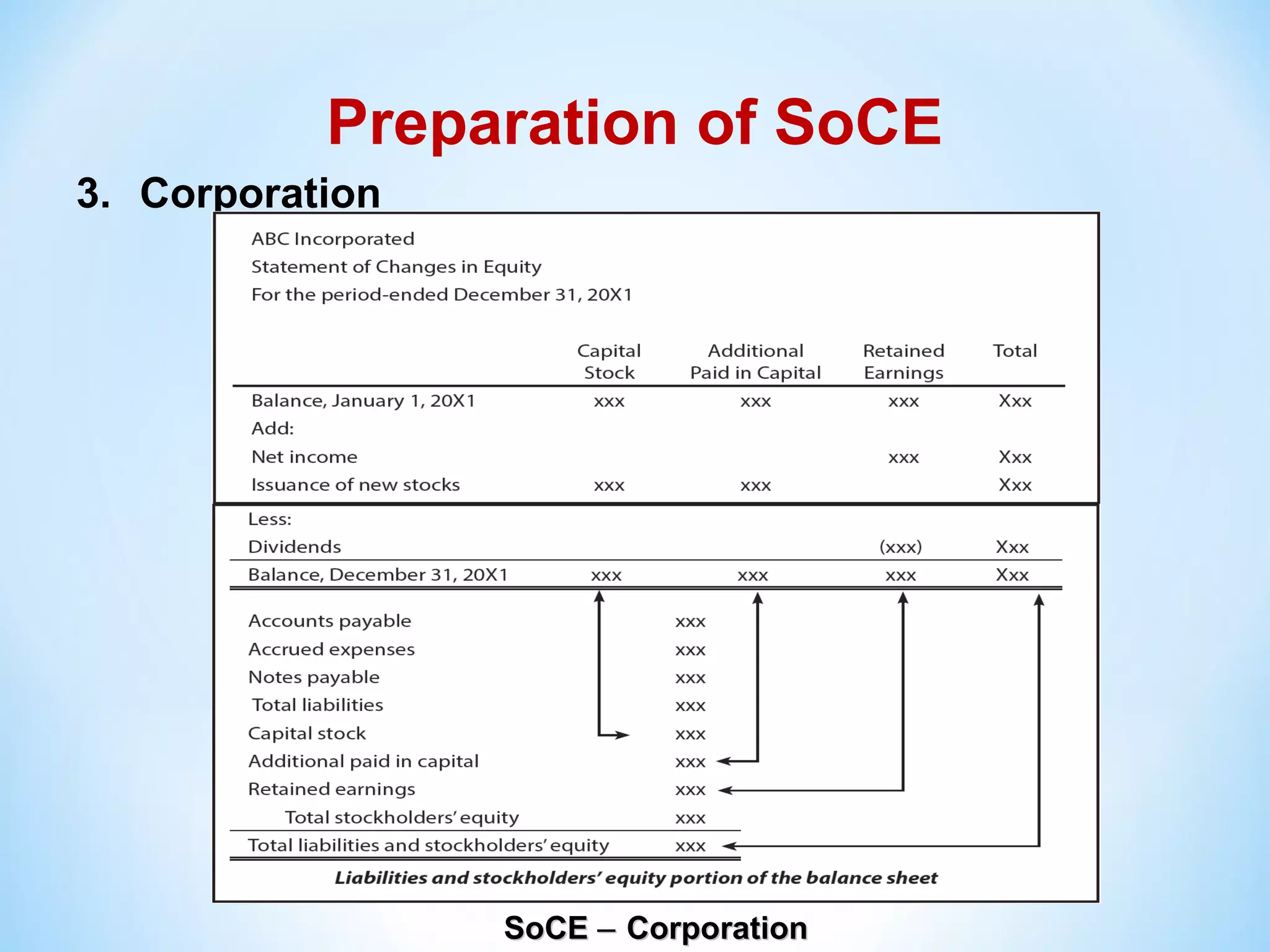

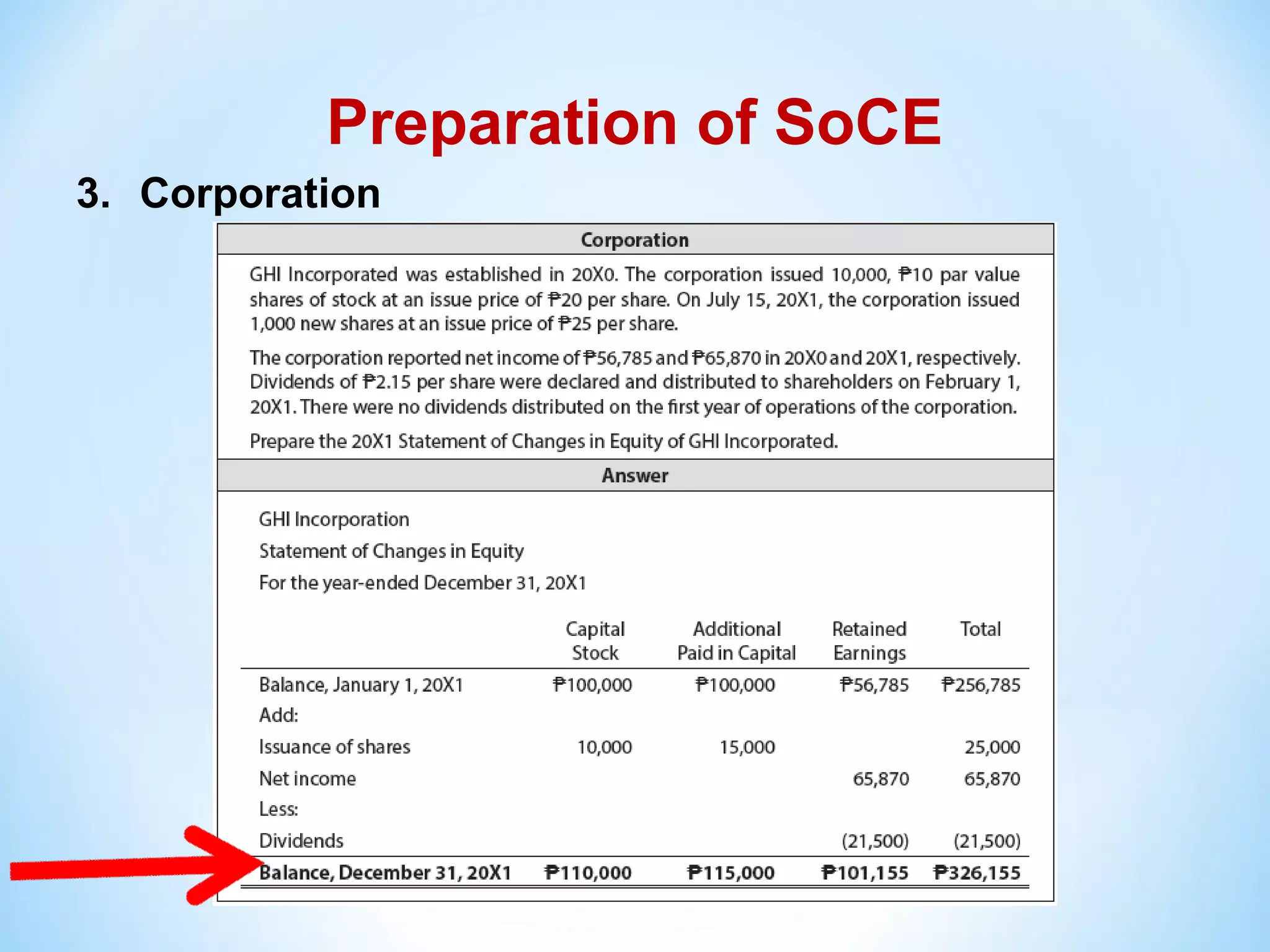

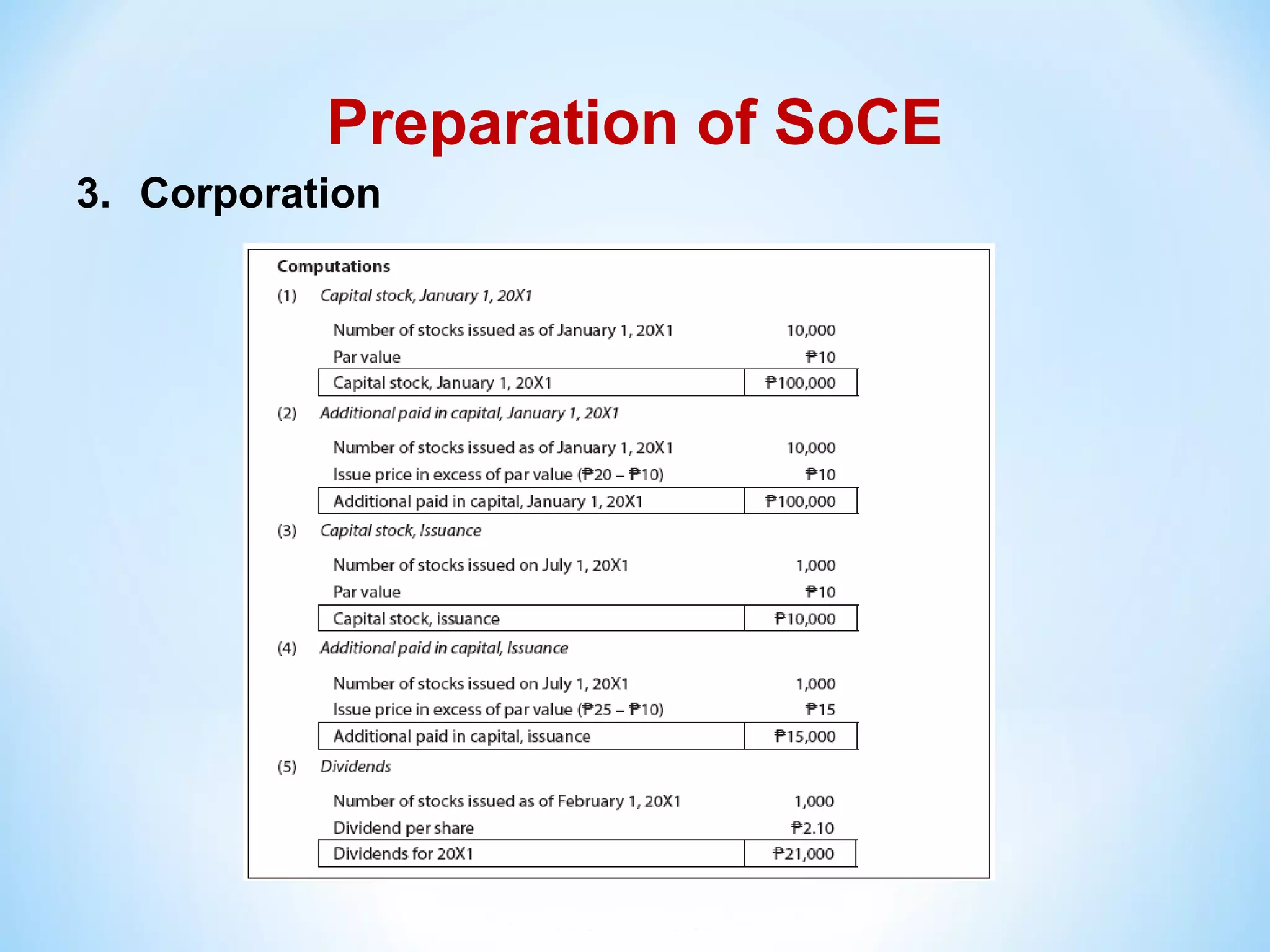

The Statement of Changes in Equity (SoCE) summarizes equity transactions with business owners that occurred during the year. It shows a reconciliation of beginning and ending balances of equity accounts, including owners' capital, partners' capital accounts, and paid-in capital and retained earnings for corporations. The SoCE is prepared to inform readers about movements in equity and meet reporting requirements.