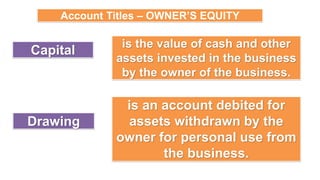

The document discusses key financial statements used in accounting: the balance sheet, income statement, statement of owner's equity, and statement of cash flows. It also defines typical accounts that appear on these statements, such as assets, liabilities, owner's equity, revenues and expenses. Specific asset, liability and equity accounts are defined, such as cash, accounts receivable, accounts payable, capital, etc. The fundamental accounting equation of assets equal liabilities plus owner's equity is also explained.