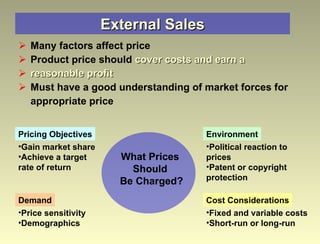

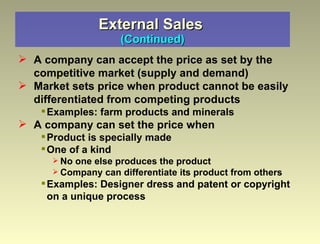

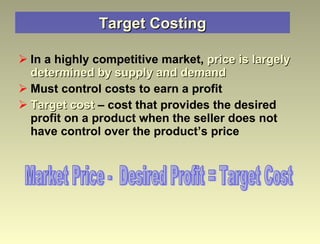

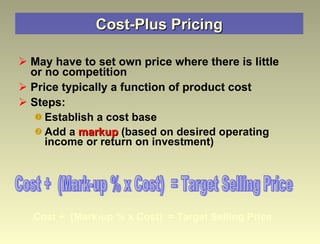

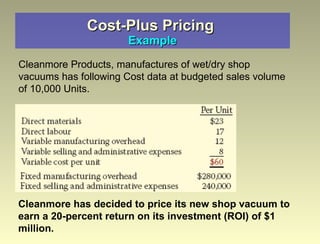

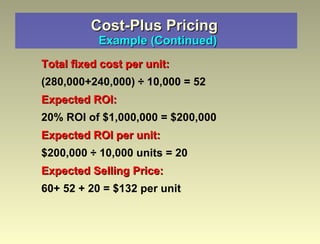

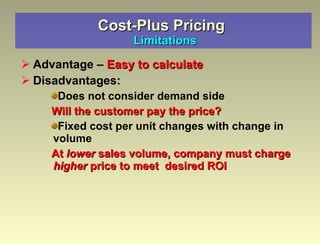

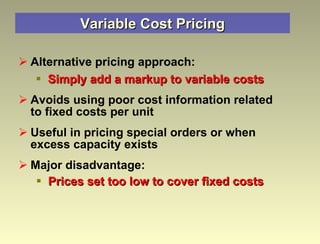

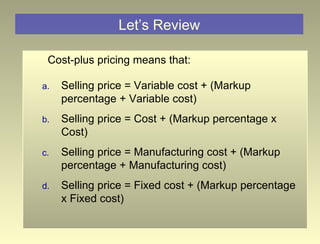

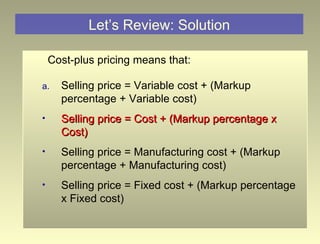

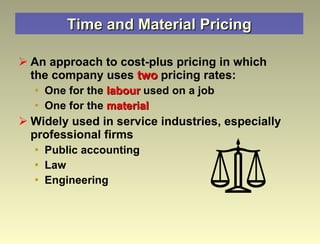

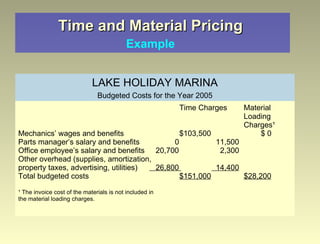

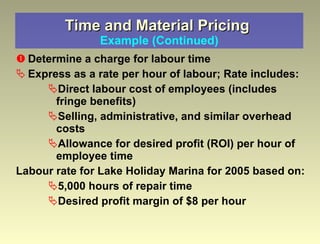

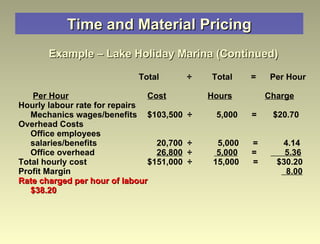

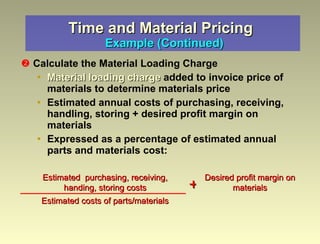

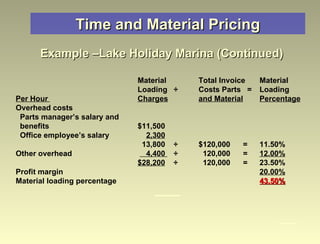

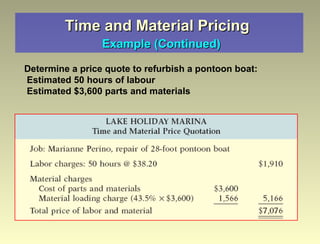

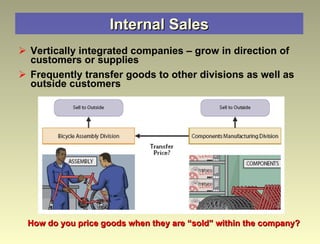

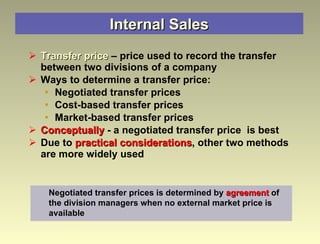

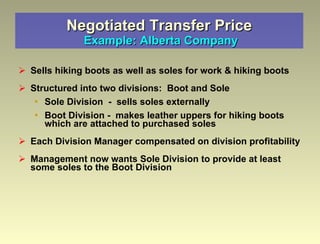

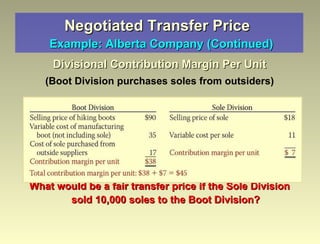

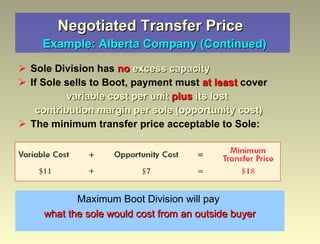

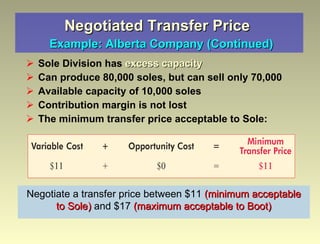

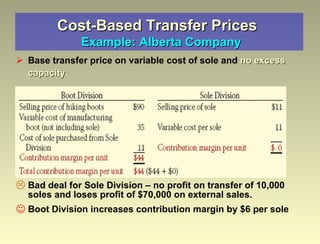

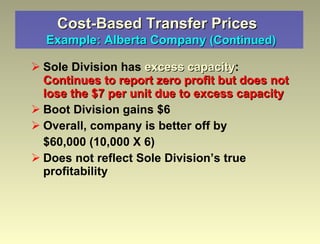

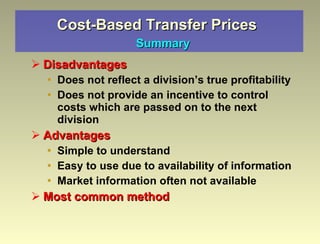

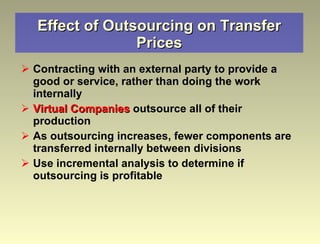

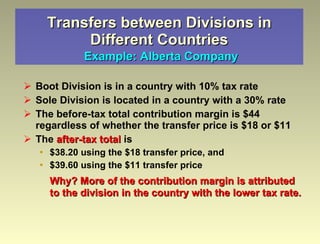

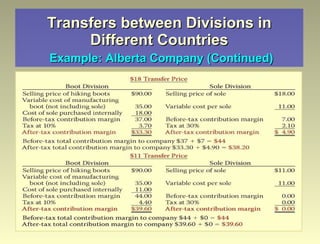

The document discusses various pricing strategies and concepts in managerial accounting, including target costing, cost-plus pricing, time and material pricing, transfer pricing, and considerations for pricing transfers between divisions in different countries. It provides examples to illustrate how to calculate target costs, determine selling prices using cost-plus methods, set hourly labor rates, and establish transfer prices within and between organizations.