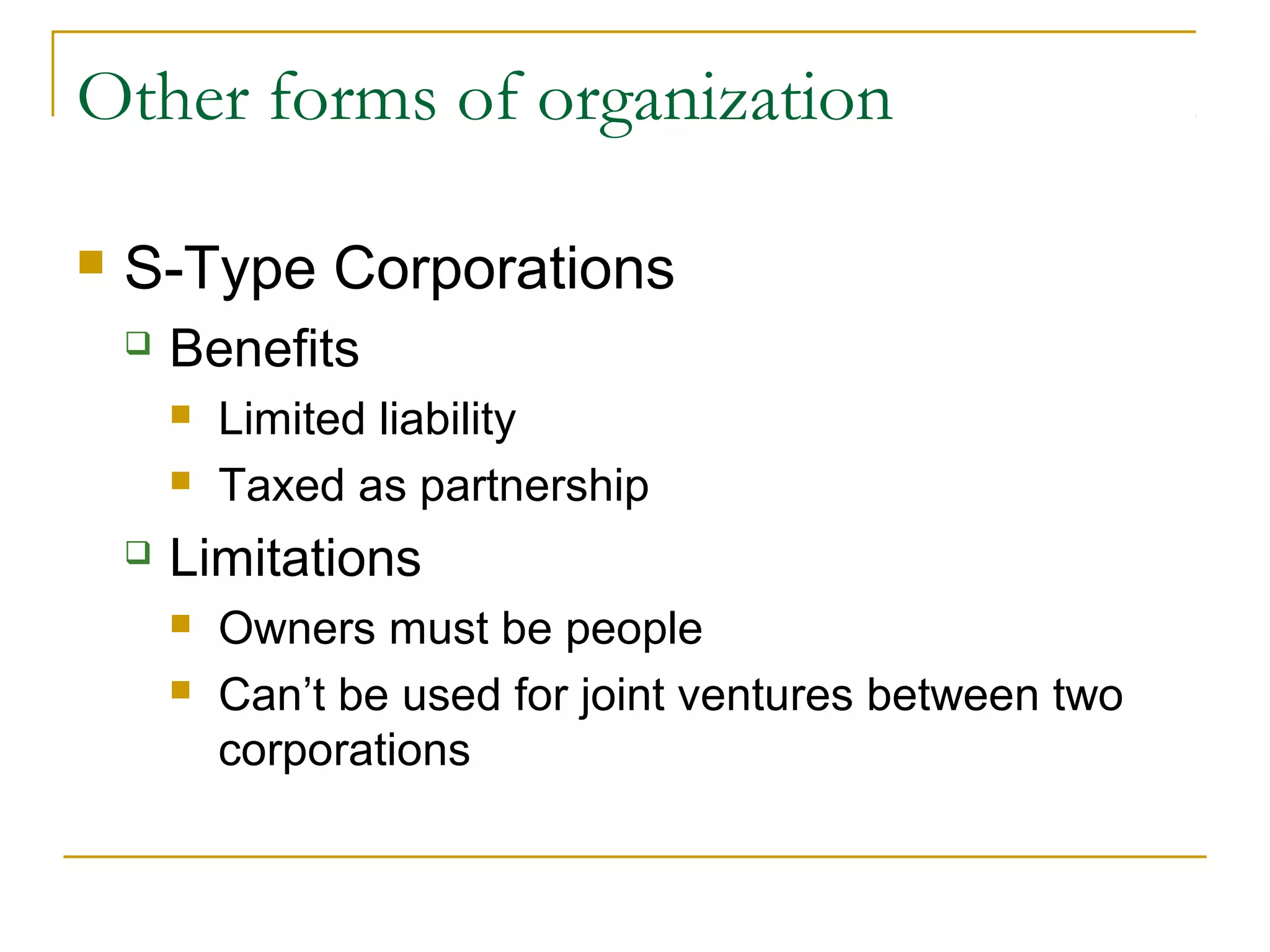

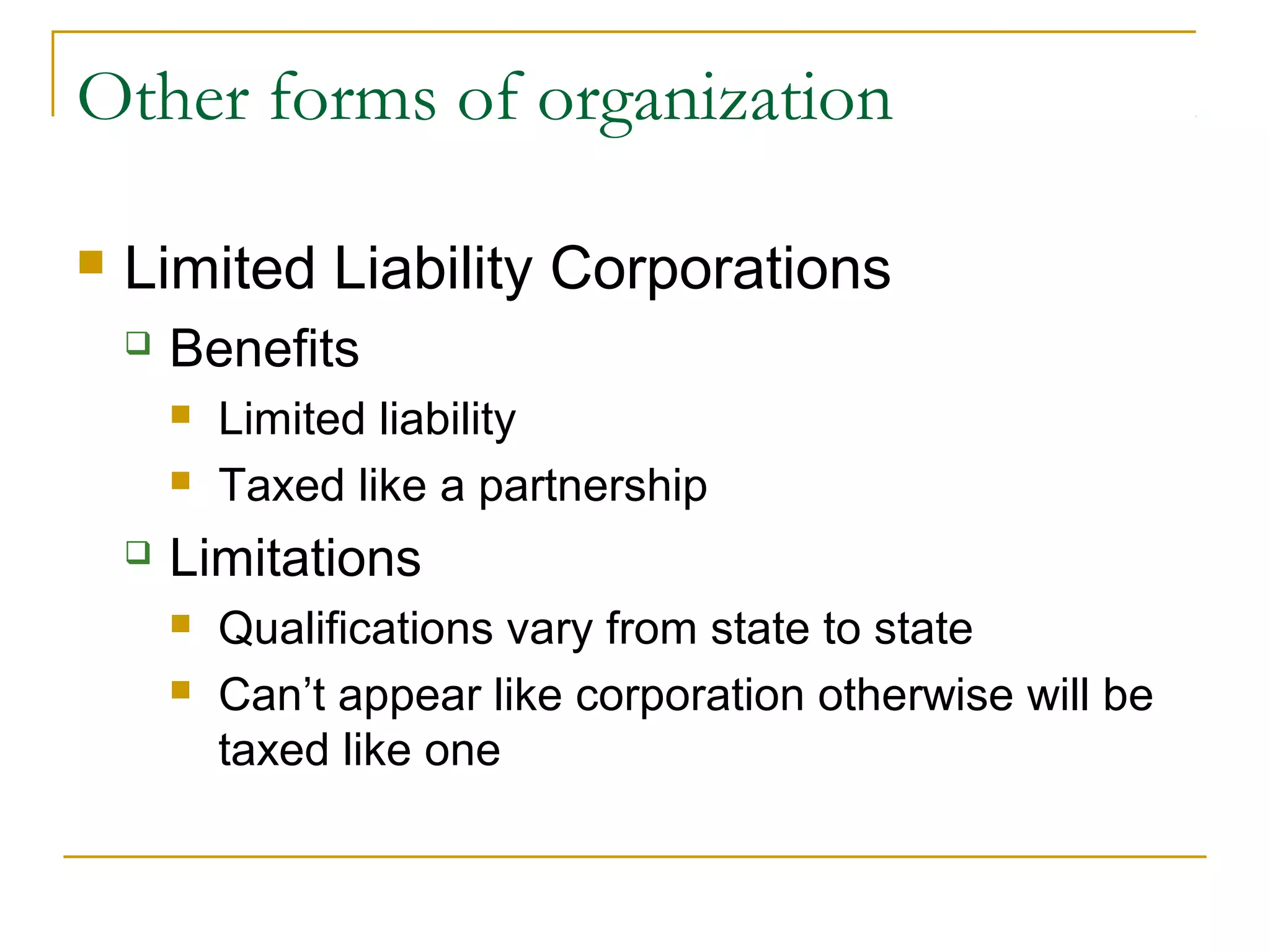

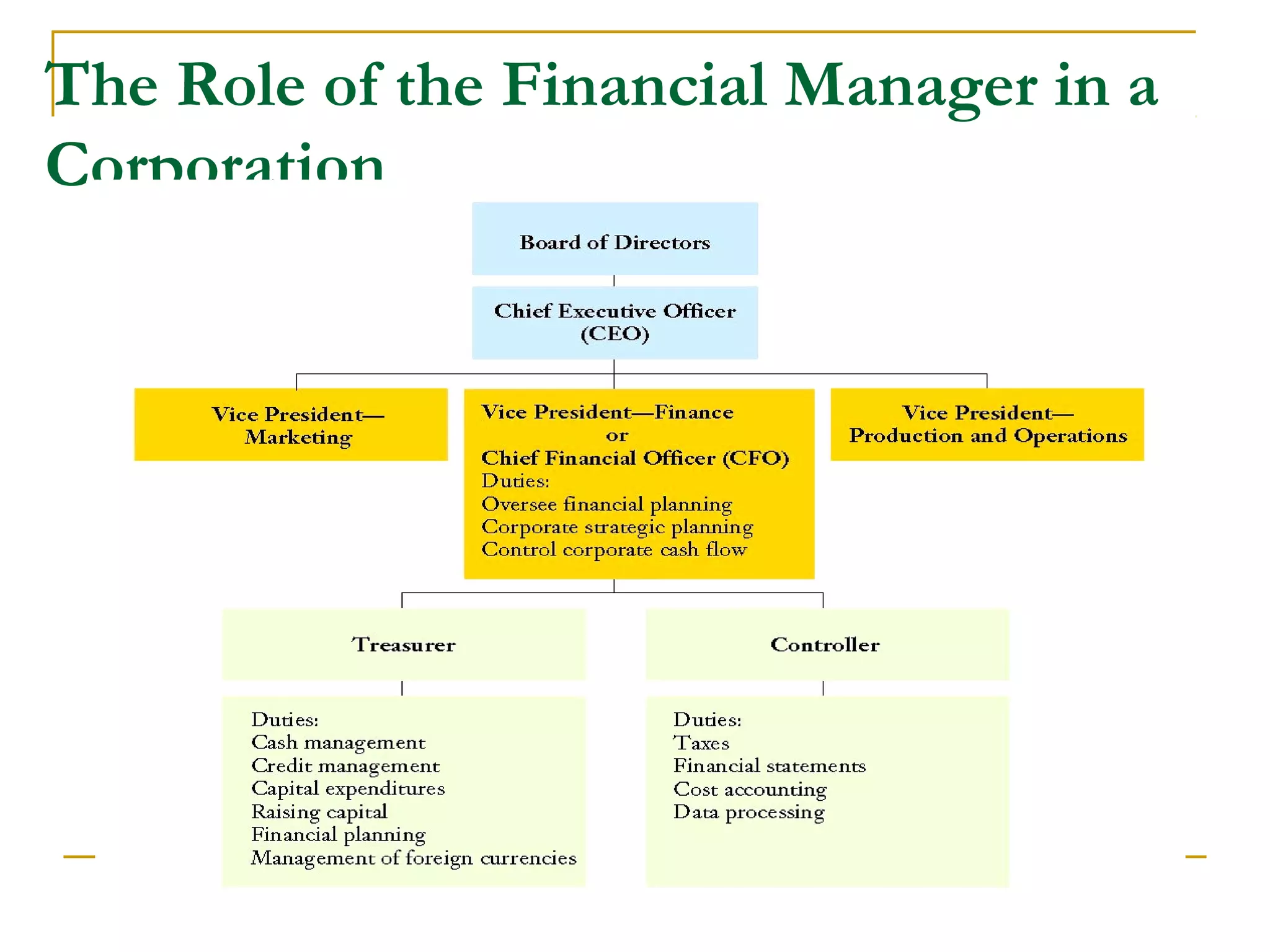

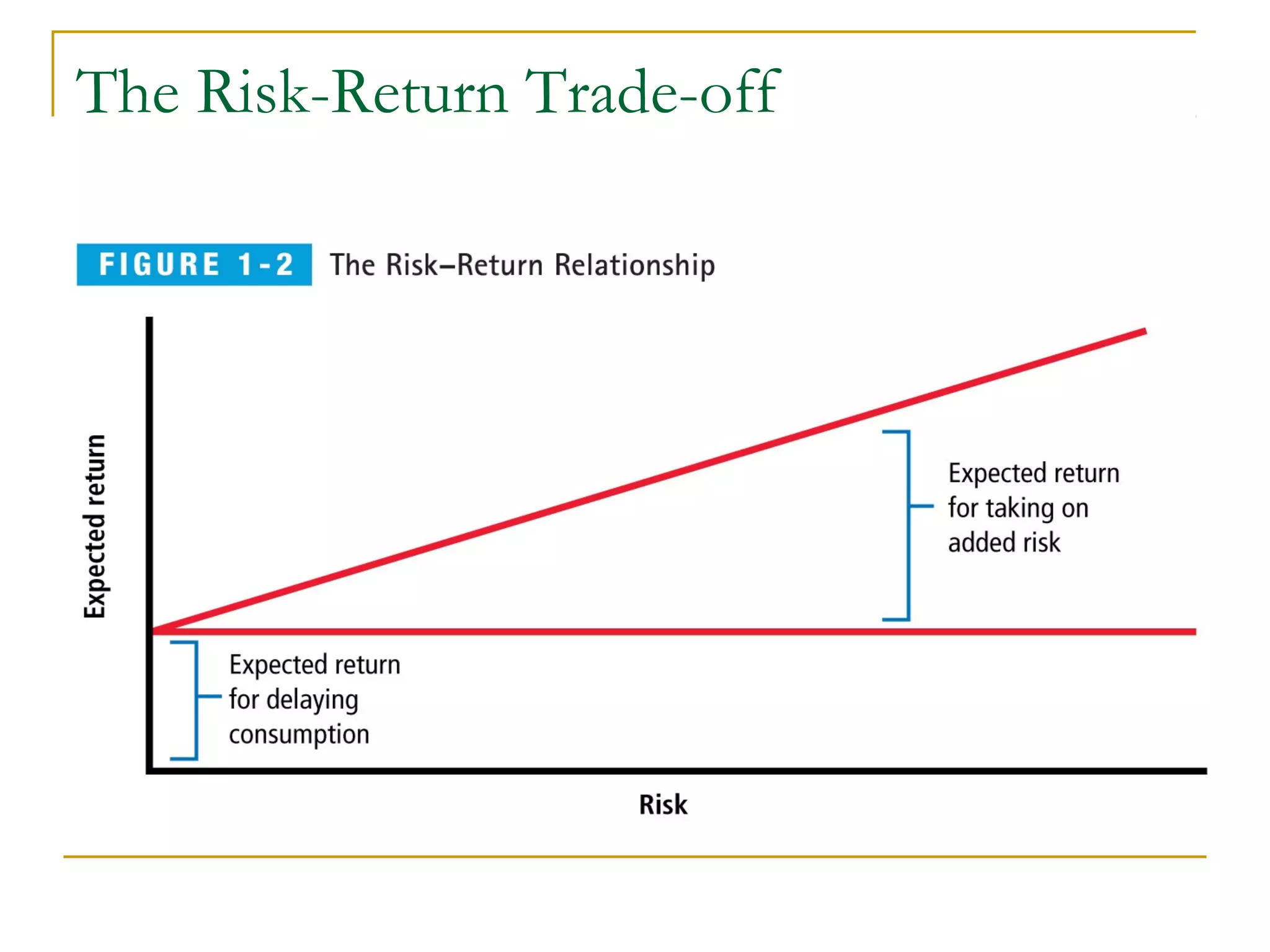

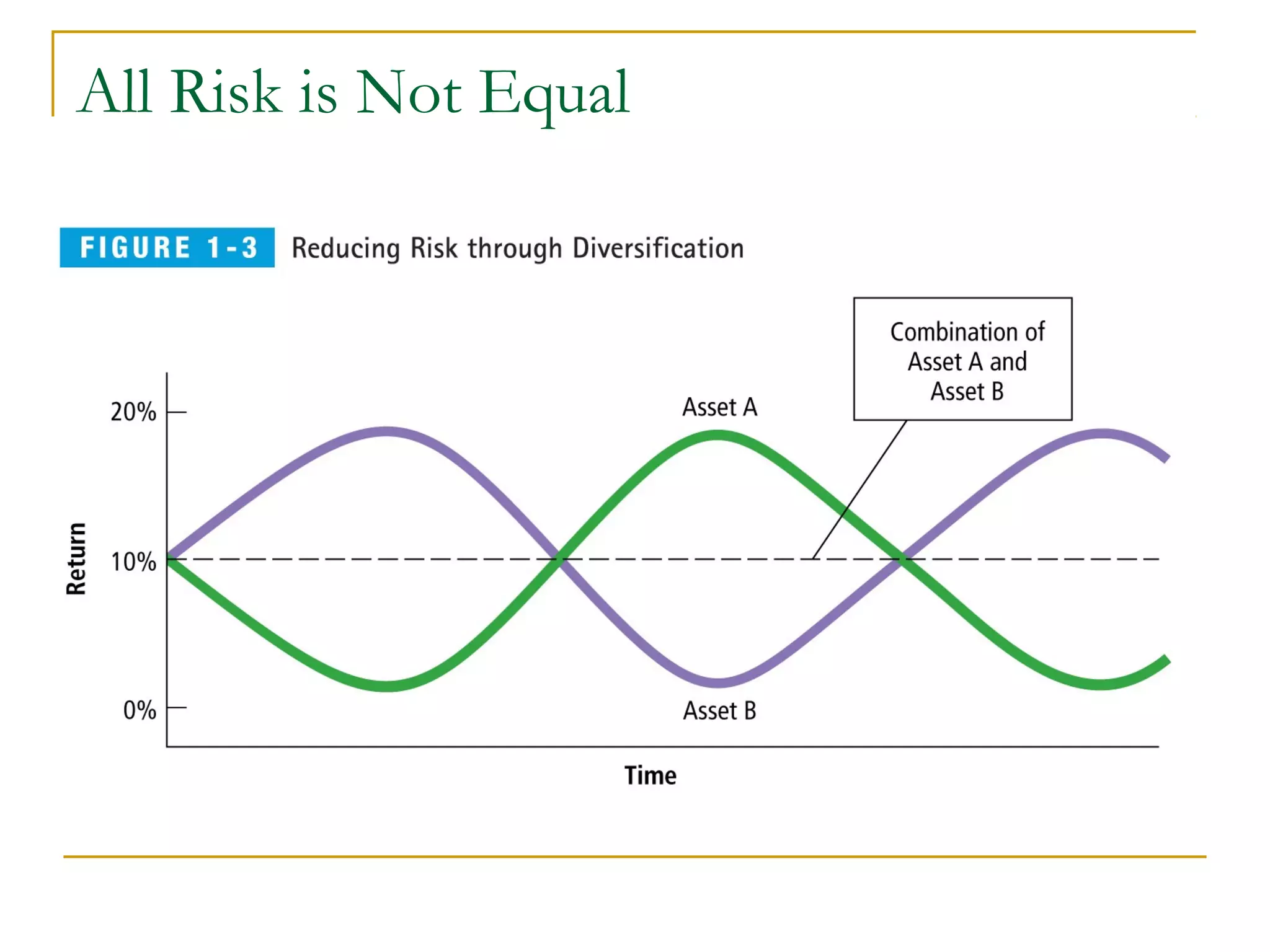

This chapter introduces key concepts in financial management. It discusses that financial management focuses on wealth creation and value-maximizing decisions. It also outlines different forms of business organization like sole proprietorships, partnerships, and corporations. Additionally, it presents 10 principles of finance, including that risk and return are positively correlated, cash flows rather than profits matter, taxes impact decisions, and ethics are important in finance. The goal of financial managers is to maximize shareholder wealth over the long run.