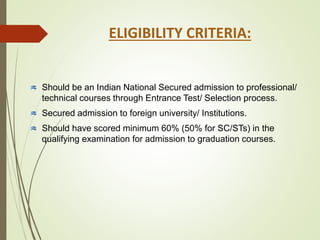

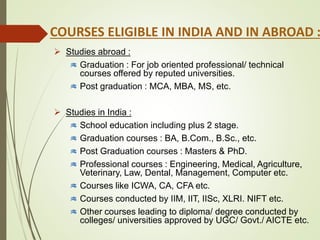

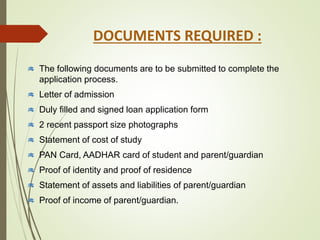

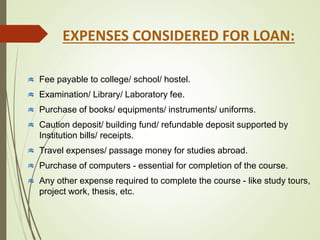

This document provides an overview of education loans in India. It defines education loans and outlines their purpose of helping students pay for higher education costs. It discusses eligibility criteria, documents required, expenses covered, loan amounts and interest rates. It also analyzes trends in education loan disbursal and non-performing assets. Key factors to consider when choosing an education loan like interest rates, repayment periods and security requirements are also summarized. The conclusion emphasizes the importance of education loans while advising students to carefully compare loan options.