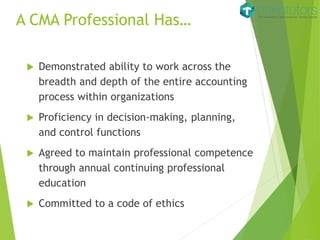

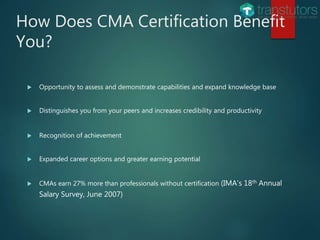

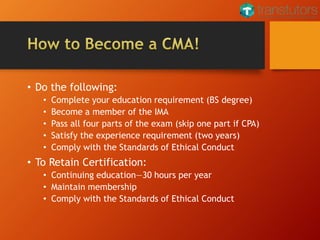

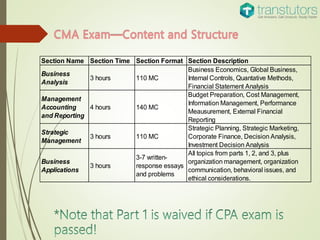

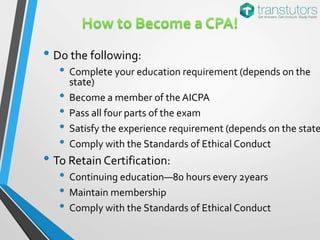

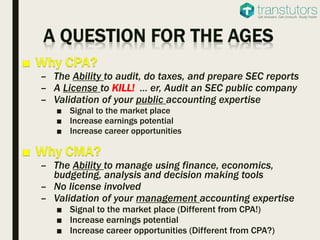

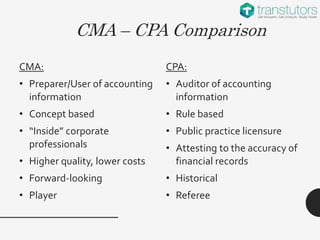

The document outlines the qualifications and benefits of obtaining a Certified Management Accountant (CMA) certification, highlighting its impact on career opportunities and earning potential. It details the requirements for certification, including educational prerequisites, exam completion, and ethical conduct standards. Additionally, it compares the roles of CMA and CPA professionals, emphasizing the unique skills and forward-looking perspective of CMAs.