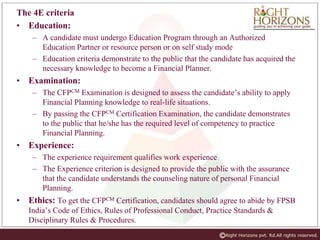

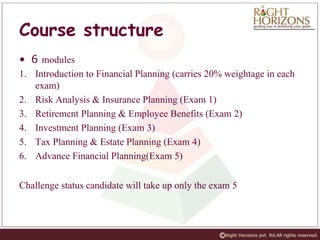

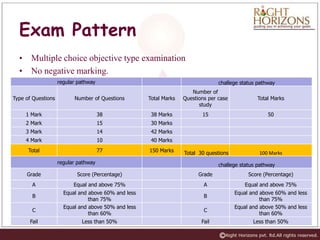

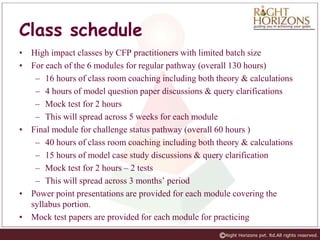

The document provides information about the Certified Financial Planner (CFP) certification. It discusses the 4E criteria of education, examination, experience, and ethics required to obtain the certification. It also outlines the course structure, exam pattern, registration process, fees, class schedule, and faculty for CFP training programs offered by Right Horizons Academy. The certification is recognized globally and demonstrates competency in providing financial planning services.