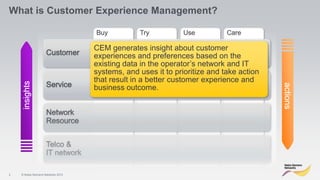

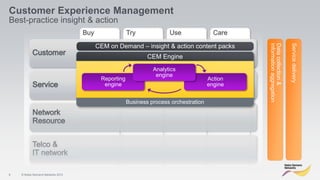

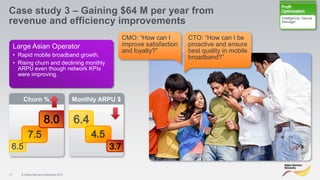

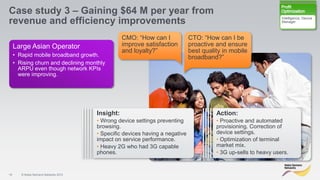

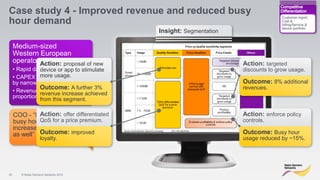

The document discusses customer experience management. It defines customer experience management as generating insights about customer experiences and preferences based on existing network and IT data to prioritize actions that improve customer experience and business outcomes. It provides examples of how customer experience management helped telecom operators gain operational efficiencies, increase competitive differentiation, and optimize profits by automating proactive and predictive actions throughout the customer journey.