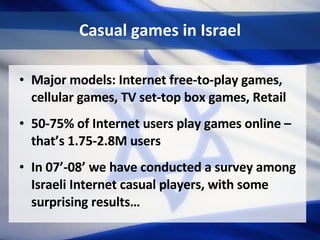

Casual games are becoming increasingly popular in Israel. A survey found that over 60% of Israeli internet casual game players are over 35, showing casual games appeal to all ages. Several new companies in Israel are exploring business models for casual games, including subscription and microtransaction-based games on mobile phones and skill-based games. While the Israeli casual game market is still developing, it shows promise as casual games are highly relevant to Israeli players.