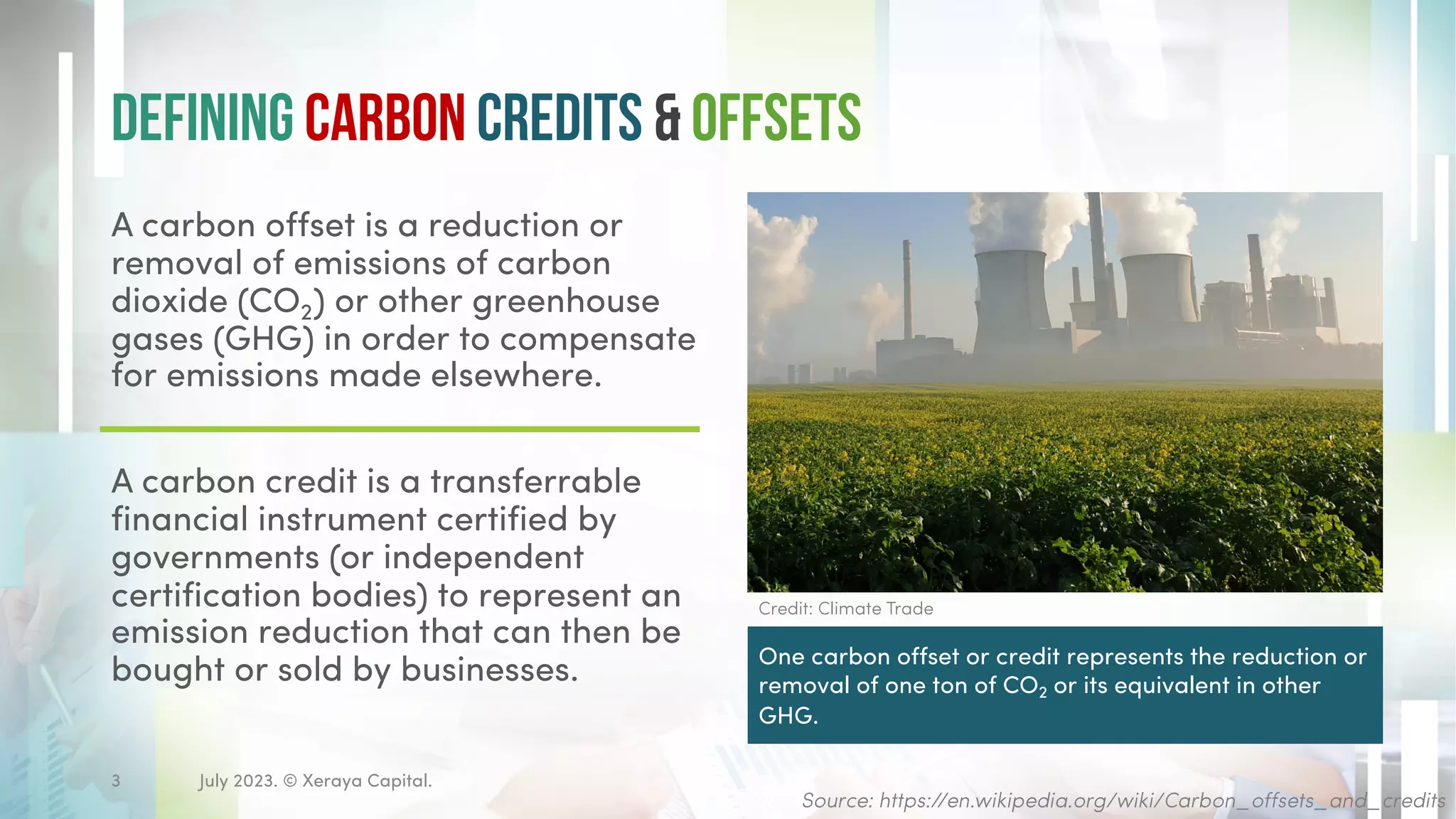

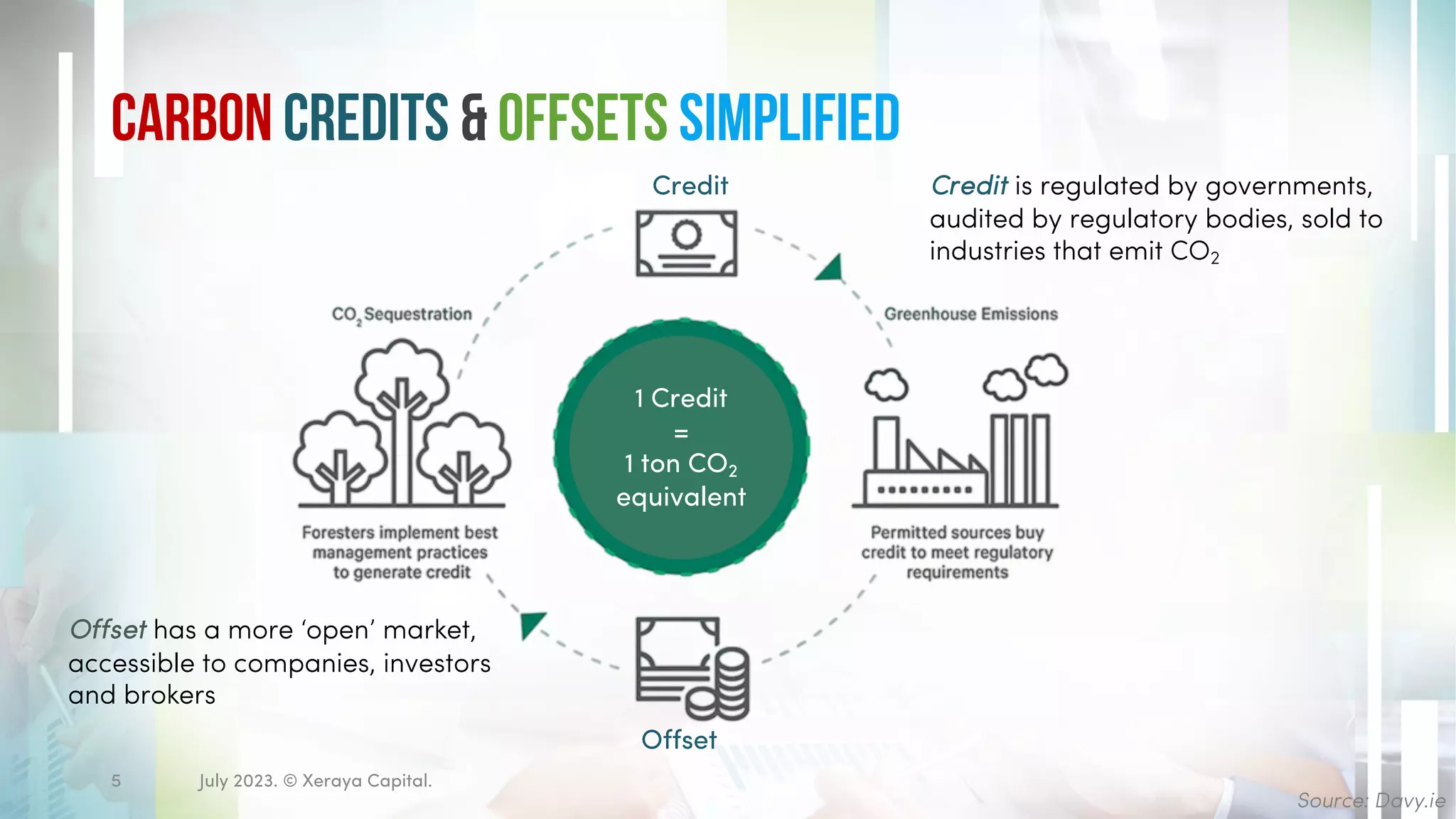

The document provides an overview of carbon credits and carbon offsets, highlighting their definitions, key differences, and the evolution of emissions trading. Carbon credits are government-regulated tradeable permits for CO2 emissions, while carbon offsets are voluntary projects aimed at reducing greenhouse gases. It also discusses the carbon market's growth, with the EU emissions trading system being the largest segment, worth 751 billion euros in 2022.