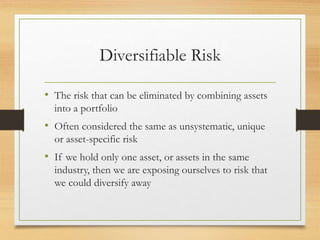

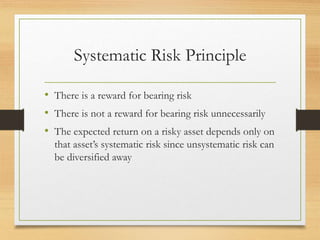

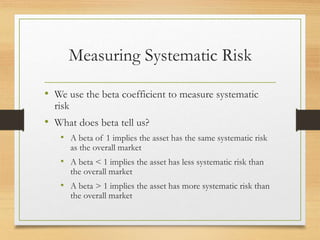

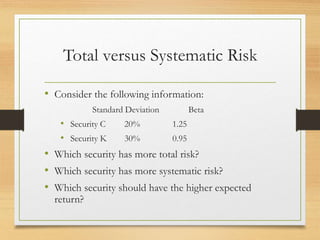

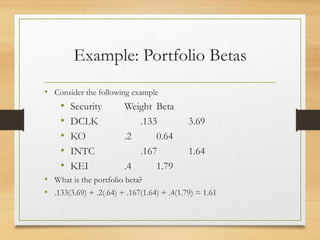

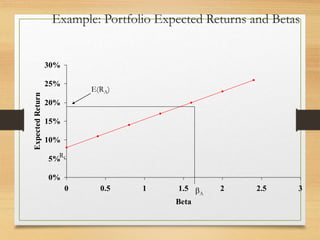

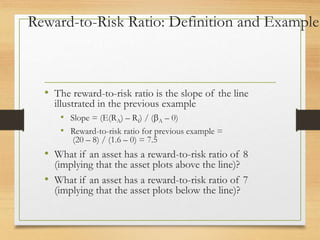

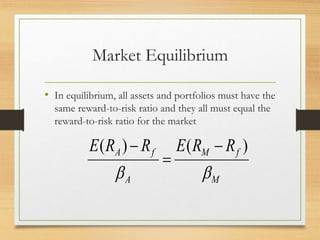

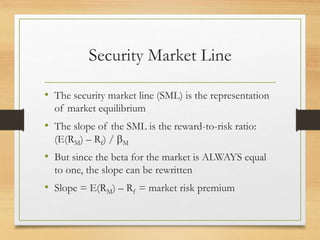

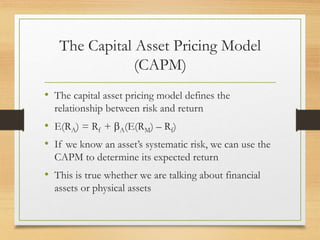

This chapter discusses risk and return, including key concepts like portfolios, diversification, systematic and unsystematic risk, beta, and the security market line. It introduces the capital asset pricing model (CAPM), which defines the relationship between an asset's expected return and its systematic risk as measured by beta. Specifically, the CAPM states that an asset's expected return is equal to the risk-free rate plus the asset's beta times the market risk premium. The security market line illustrates market equilibrium where all assets offer the same risk-adjusted return based on their beta.