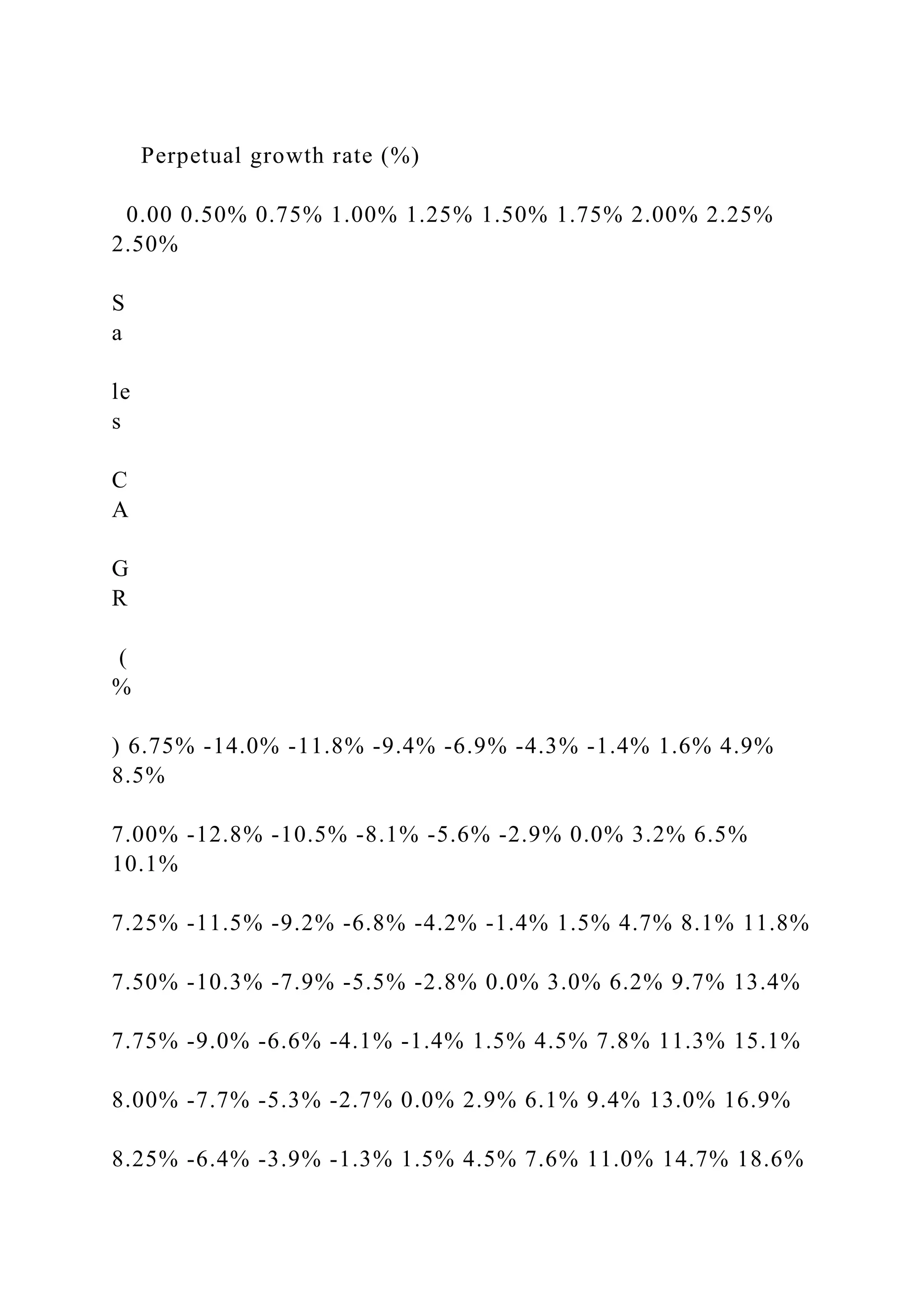

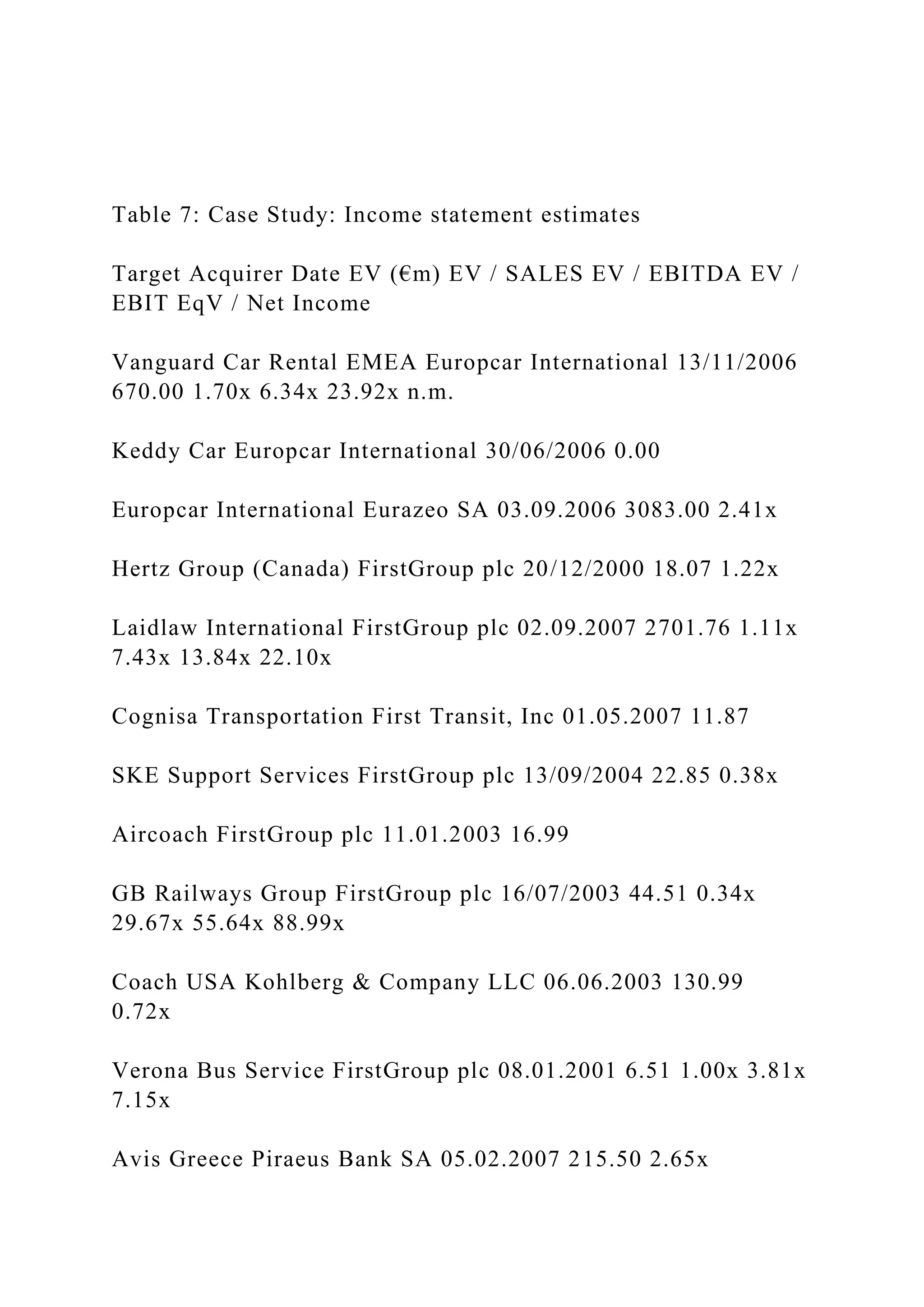

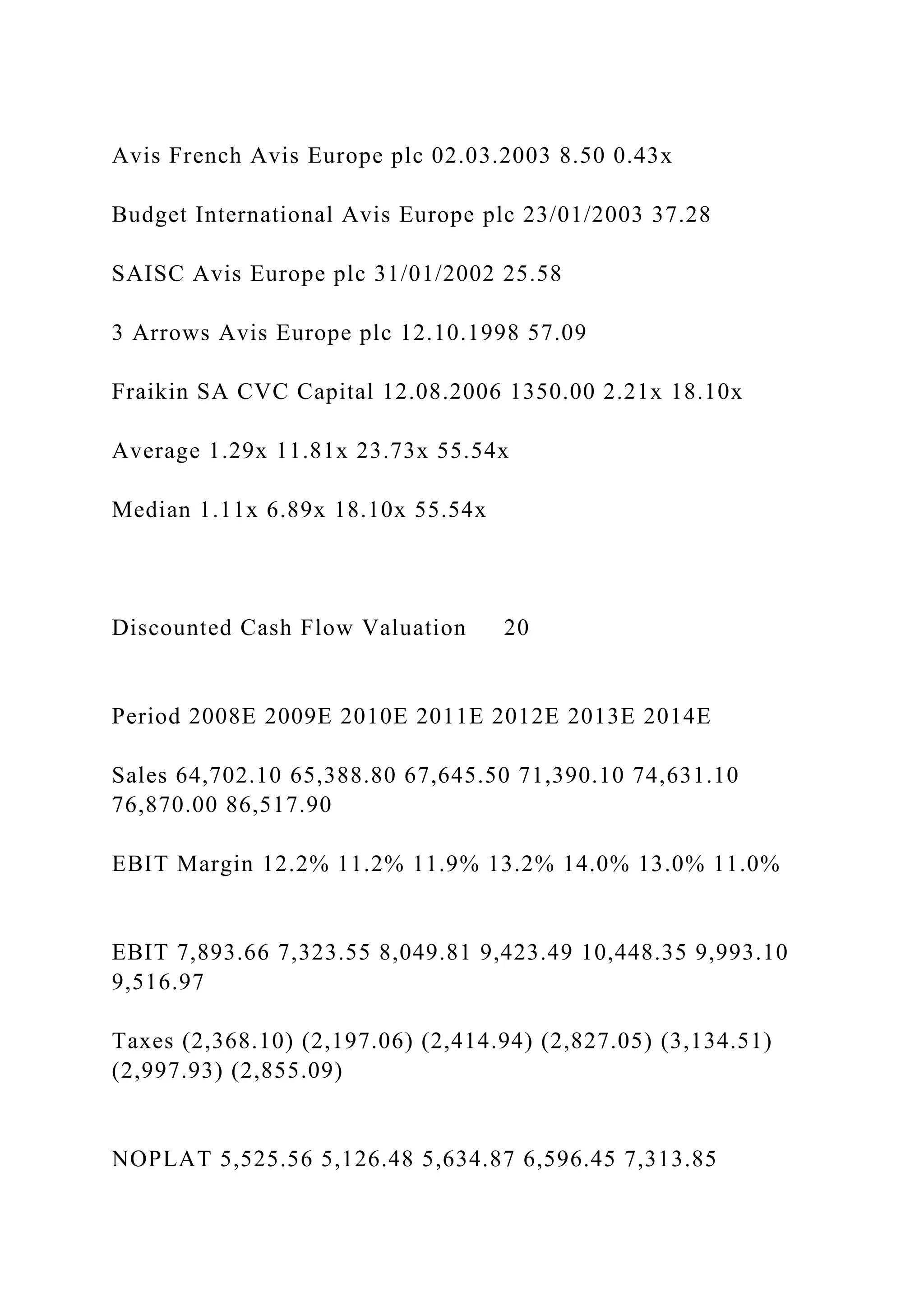

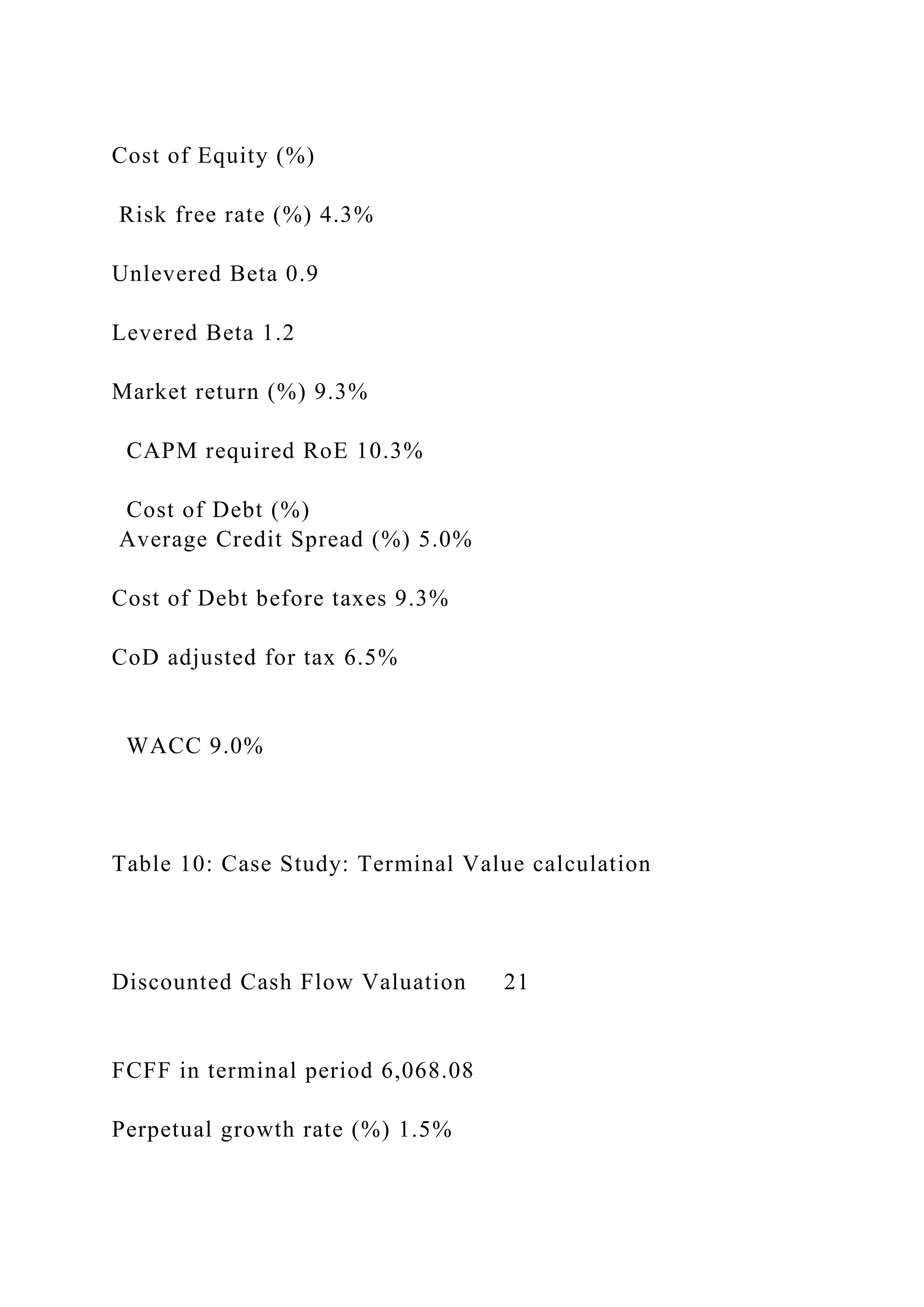

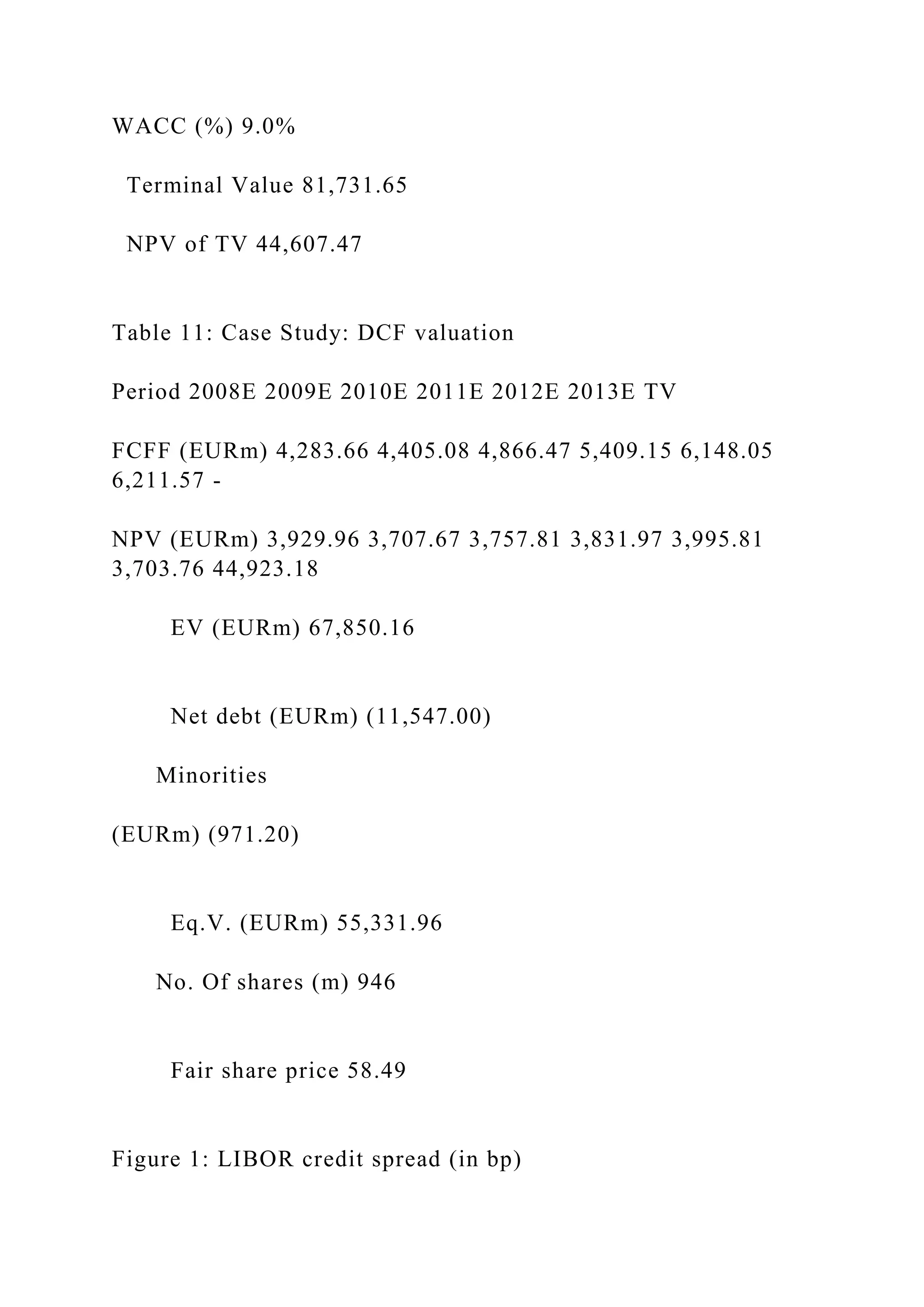

The document outlines the process of calculating the weighted average cost of capital (WACC) for a company, emphasizing the significance of the cost of capital and various methods to compute it. It explains the necessary components, such as the cost of equity and debt, and the importance of historical financial data for accurate estimation. Additionally, the text discusses the discounted cash flow (DCF) valuation method, its applications, and the impact of assumptions on company valuation.

![FIN 430 — Finance Theory and PracticeProject Assignments

Calculating theWeighted Average Cost of Capital (WACC)

foryour Company

For use in Conjunction with the Firm Valuation Project

First ensure that you have read relevant pages in the text. Some

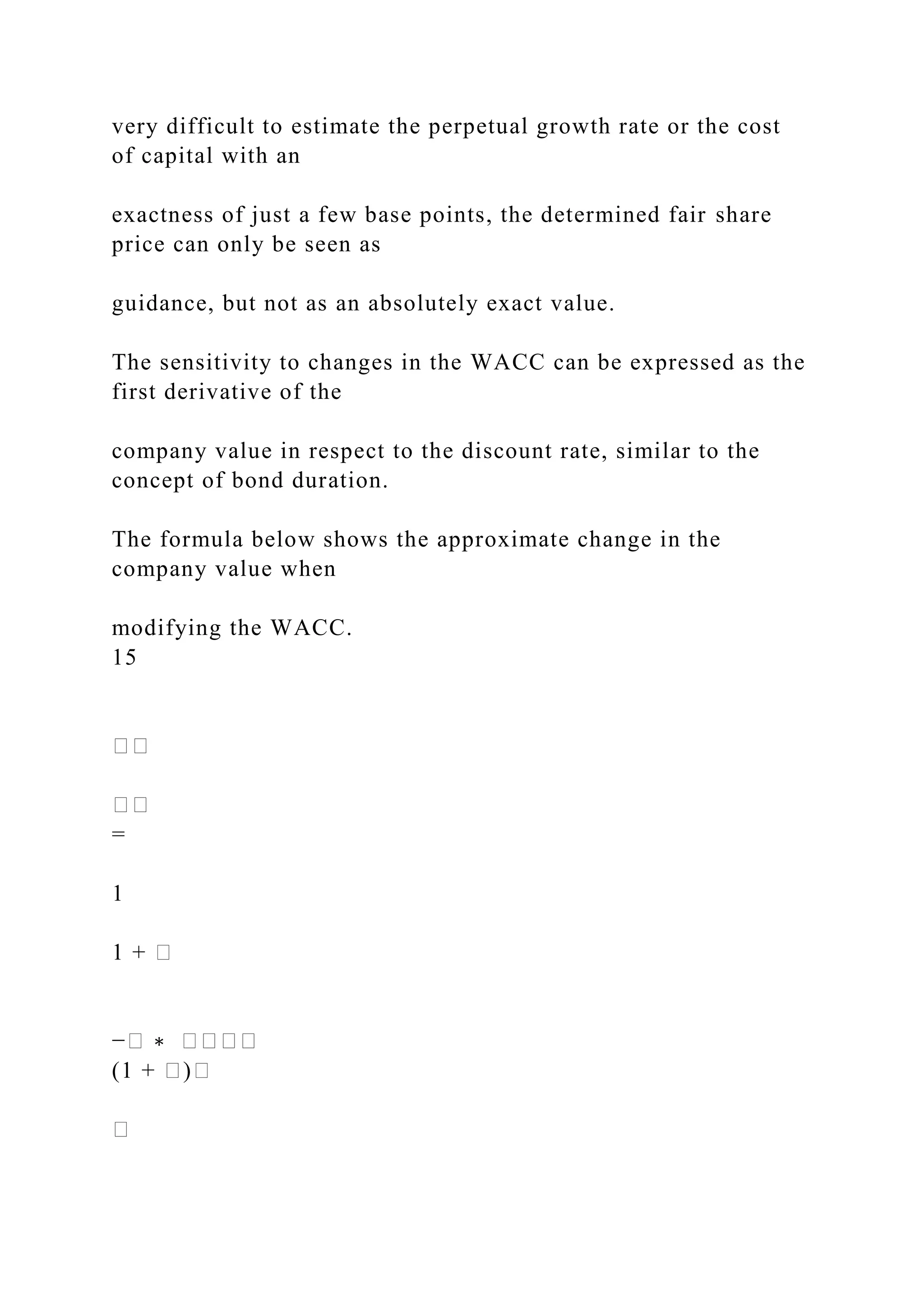

important sections would include the following, but you may

also double-check the references in the text by using the index

[see: Cost of Capital and Target (optimal) Capital Structure,

etc.]:

The important Chapter in the text is the one entitled "The Cost

of Capital," – with a particular focus on the section entitled

“The Weighted Average Cost of Capital” and the section “Four

Mistakes to Avoid” at the end of the chapter.

The WACC formula discussed below does not include Preferred

Stock. Should your company use PS, be sure to adjust the

equation for it, and see the section in the chapter on the Cost of

Preferred Stock.

The WACC formula that we use is:

WACC = wdrd(1-T) + wsrs

We need to know how to calculate:

1. rsthe cost of common equity. Use the Security Market

Line (SML) – this is why you learn how to calculate a

company’s beta and also why you learn how to find the

appropriate risk-free rate and market-risk premium. For a](https://image.slidesharecdn.com/fin430financetheoryandpracticeprojectassignmentscalculat-221031130230-ab53fe6e/75/FIN-430-Finance-Theory-and-PracticeProject-AssignmentsCalculat-docx-1-2048.jpg)

![review, see the section the text, The CAPM Approach.

2. The weights (wd and ws – note that: wd + ws = 1; so you

only have to calculate one of them). We need to calculate the

weight of debt and the weight of equity (for the cost of debt,

this simply means: what proportion of the firm’s financing is by

debt?). There is a lot to say here, simplified as Theory 1,

Theory 2 and Practice:

a. Theory 1: Theory says that we should use the target

weights along with the market values of both debt and equity

(see the Four Mistakes to Avoid). But the market value of debt

is typically difficult to calculate, because we need to know the

YTM (which is rd) for all of the company’s debt, but we cannot

calculate the YTM without having the current prices of the

company’s outstanding bonds, and most company’s bonds do

not trade (i.e., they will not have up-to-date or current prices –

remember how to calculate the price (value) of a bond on your

calculators?!). As a result, at least for the group project, we go

to Theory 2.

b. Theory 2: Theory also says that we should use the

TARGET weights, but this is a management decision, and as

“outsiders” we do not have access to the thoughts of the CFO or

CEO. So we should look instead to the historical pattern of the

use of debt (mix of debt and equity), and this is one reason that

you should have about 10 years of financial data.

c. Practice: Since we cannot “work” according to the strict

theory of finance, we have to estimate the relevant weights. As

a result, we will use the formula:

wd = Book Value of Debt / [Market Value of Equity + Book

Value of Debt]

The book value of debt is calculated by adding up ALL of the](https://image.slidesharecdn.com/fin430financetheoryandpracticeprojectassignmentscalculat-221031130230-ab53fe6e/75/FIN-430-Finance-Theory-and-PracticeProject-AssignmentsCalculat-docx-2-2048.jpg)

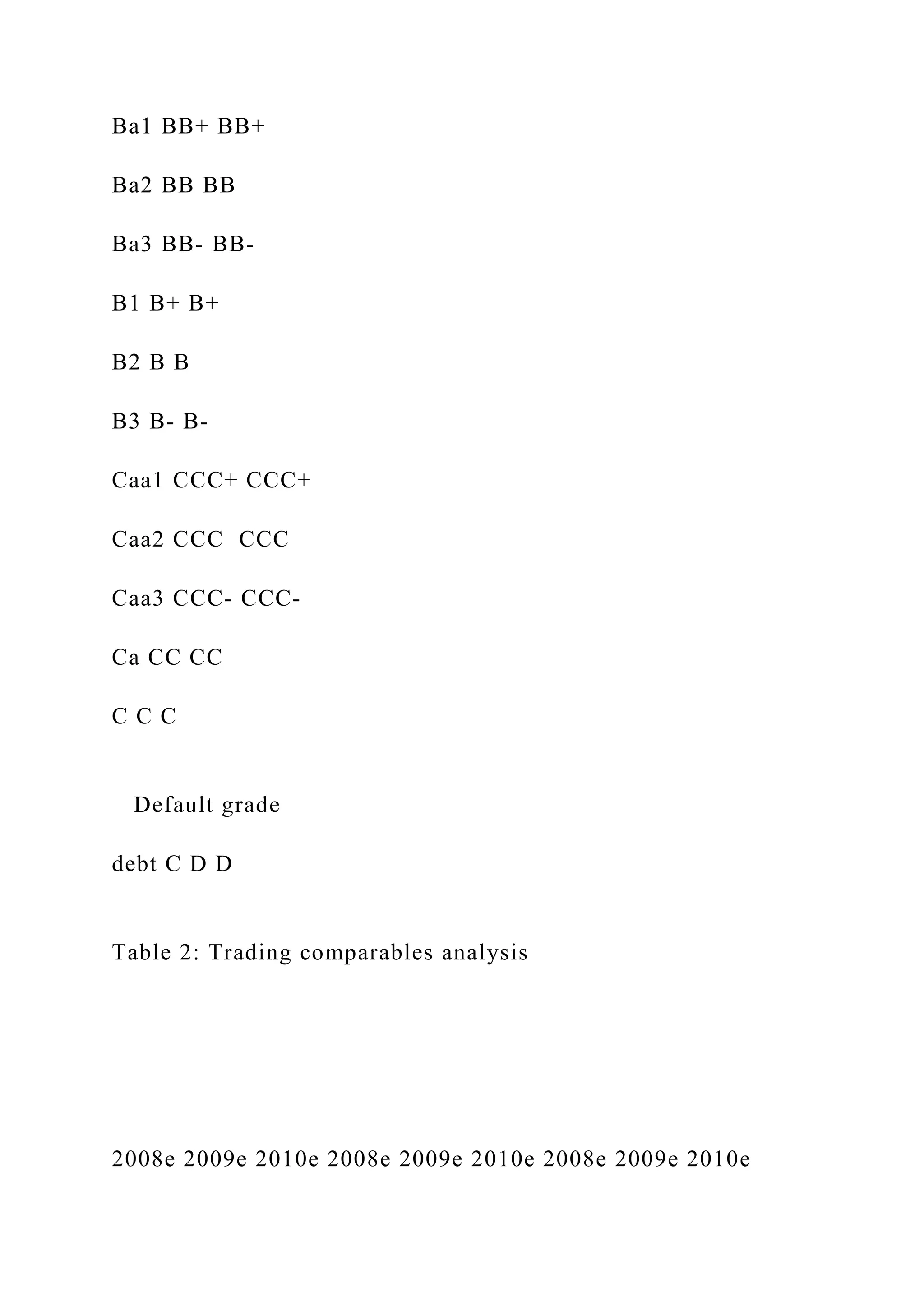

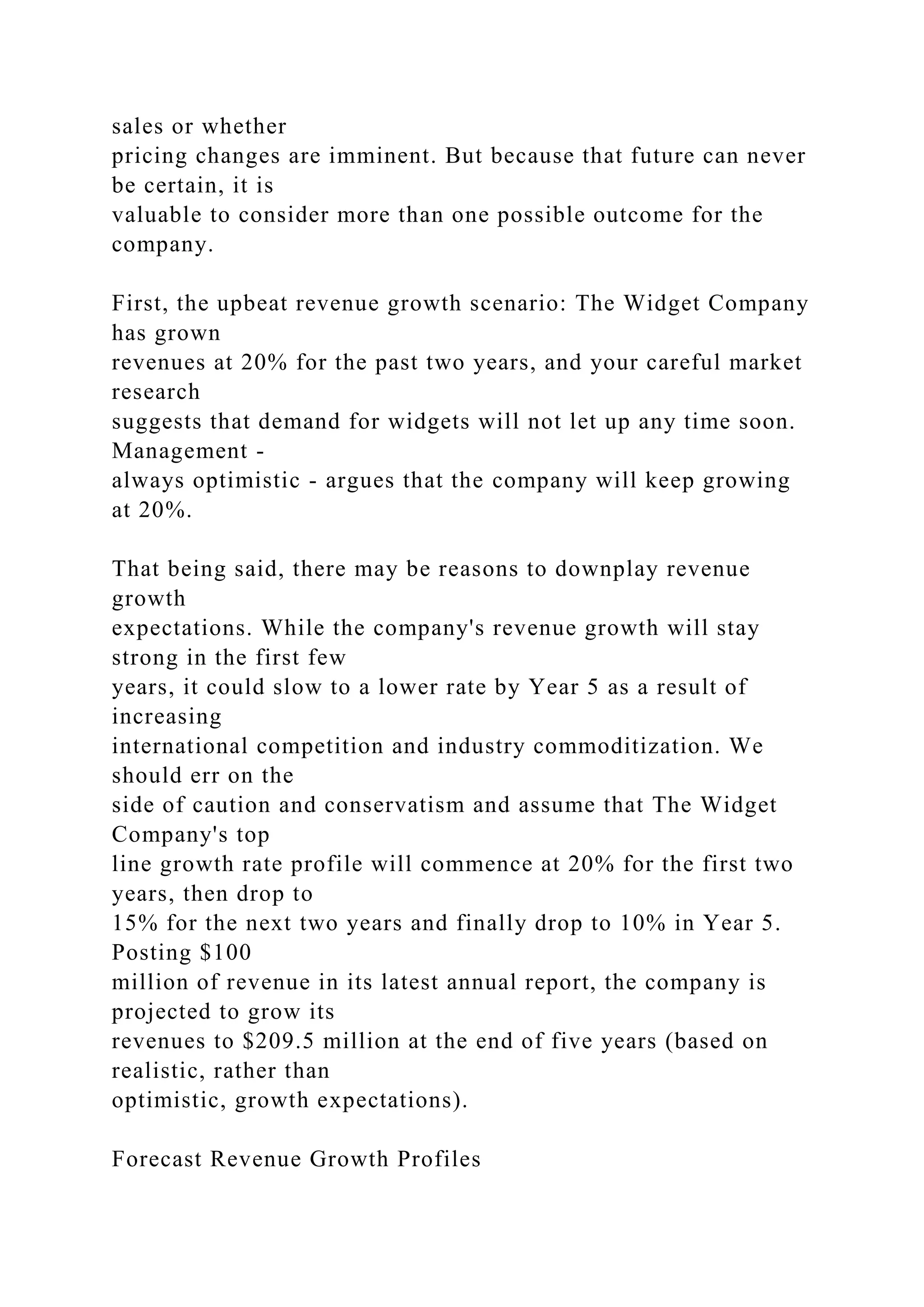

![Seminar Paper

Fall 2008

Abstract

This paper closely examines theoretical and practical aspects of

the widely used discounted

cash flows (DCF) valuation method. It assesses its potentials as

well as several weaknesses. A

special emphasize is being put on the valuation of companies

using the DCF method. The

paper finds that the discounted cash flow method is a powerful

tool to analyze even complex

situations. However, the DCF method is subject to massive

assumption bias and even slight

changes in the underlying assumptions of an analysis can

drastically alter the valuation

results. A practical example of these implications is given using

a scenario analysis.

____________

1

Author: Florian Steiger, European Business School, e-mail:

[email protected]](https://image.slidesharecdn.com/fin430financetheoryandpracticeprojectassignmentscalculat-221031130230-ab53fe6e/75/FIN-430-Finance-Theory-and-PracticeProject-AssignmentsCalculat-docx-6-2048.jpg)

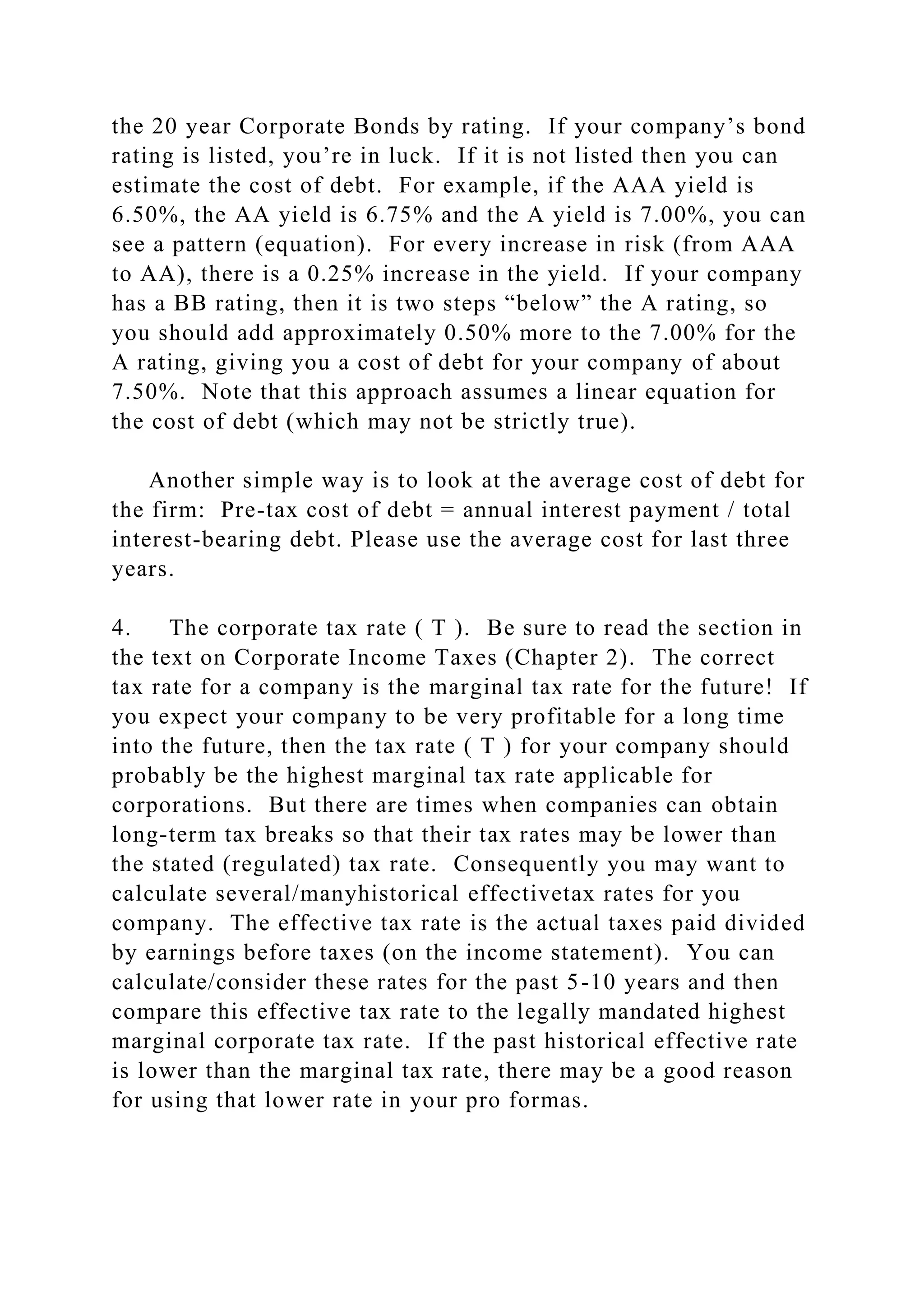

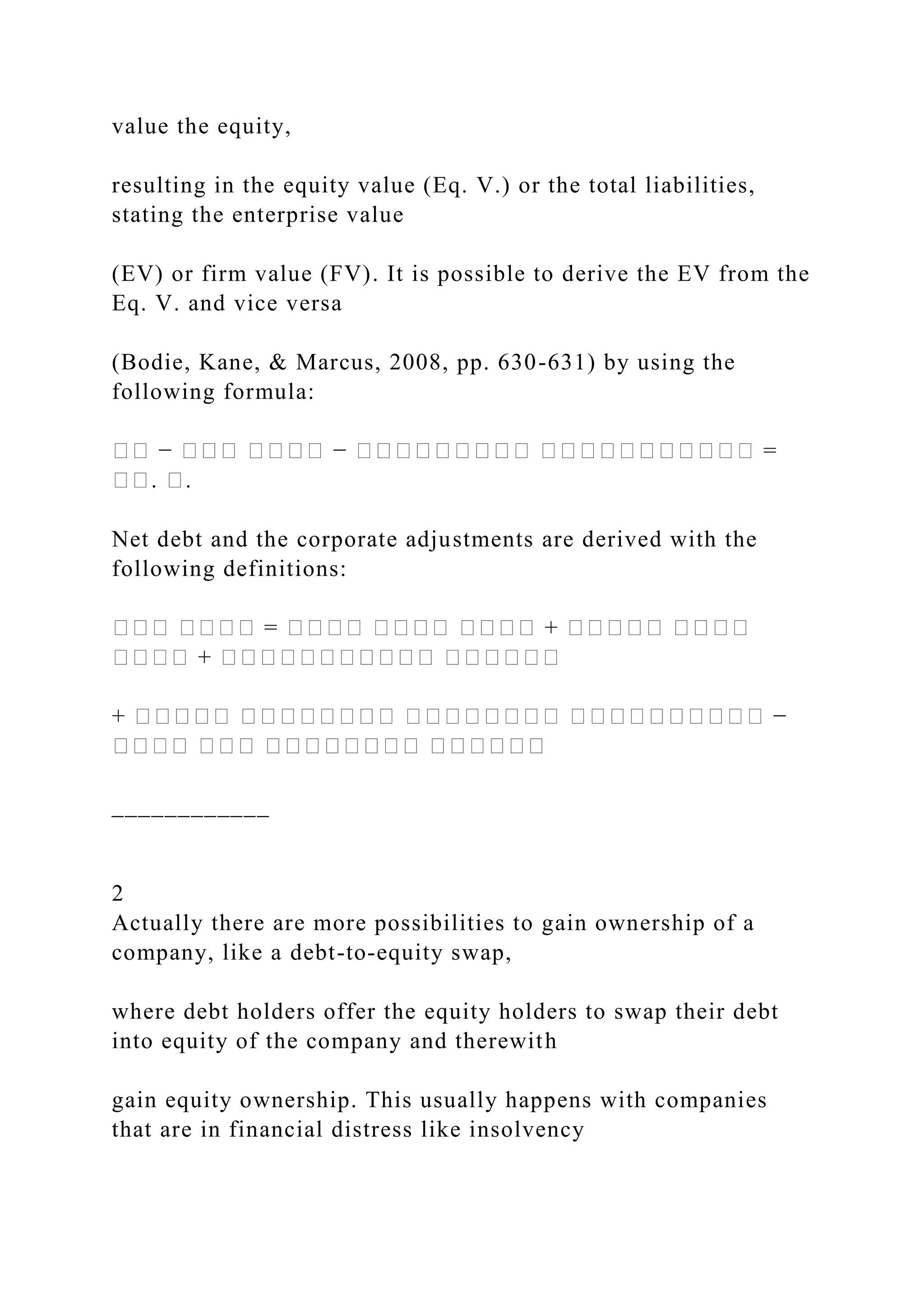

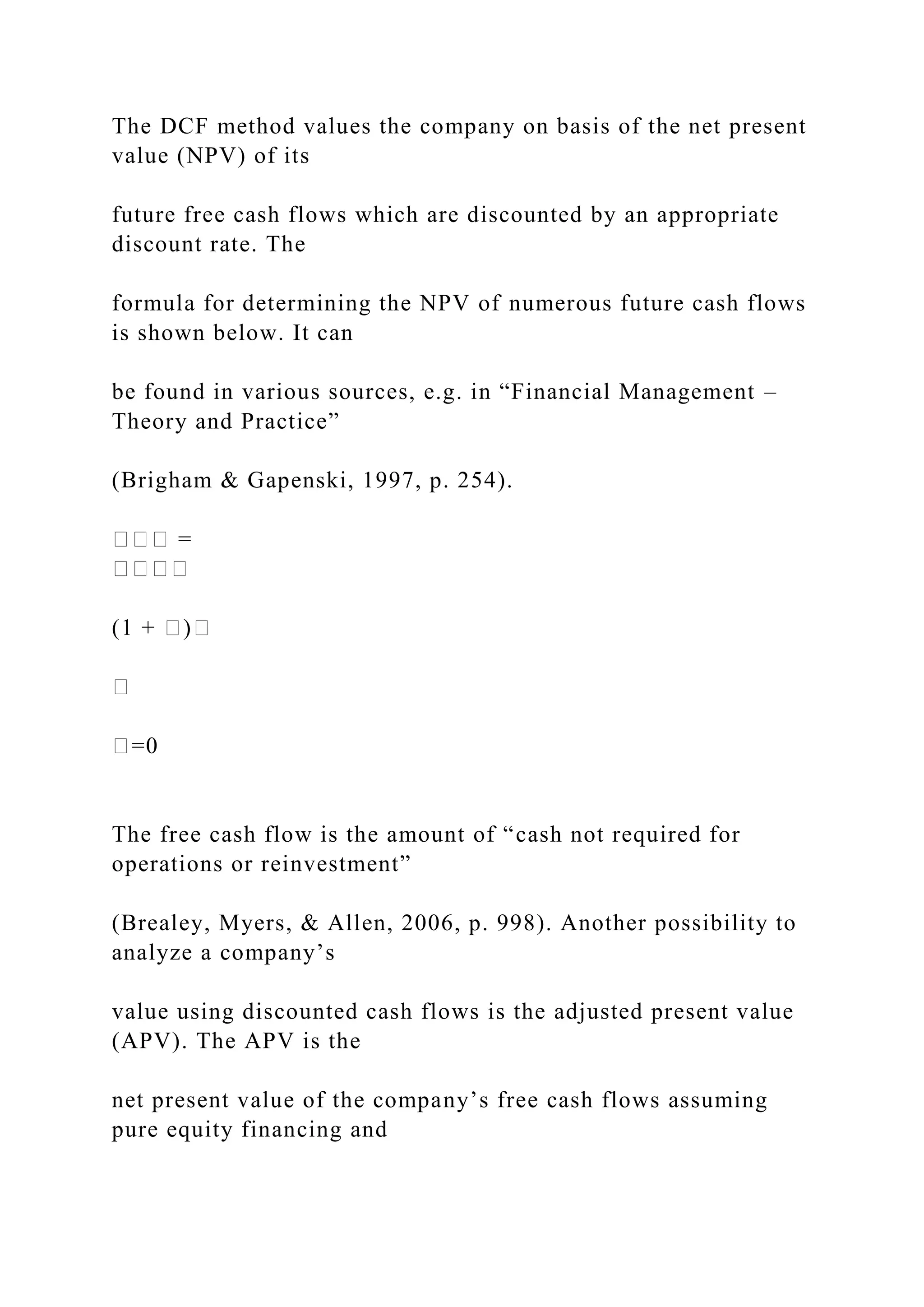

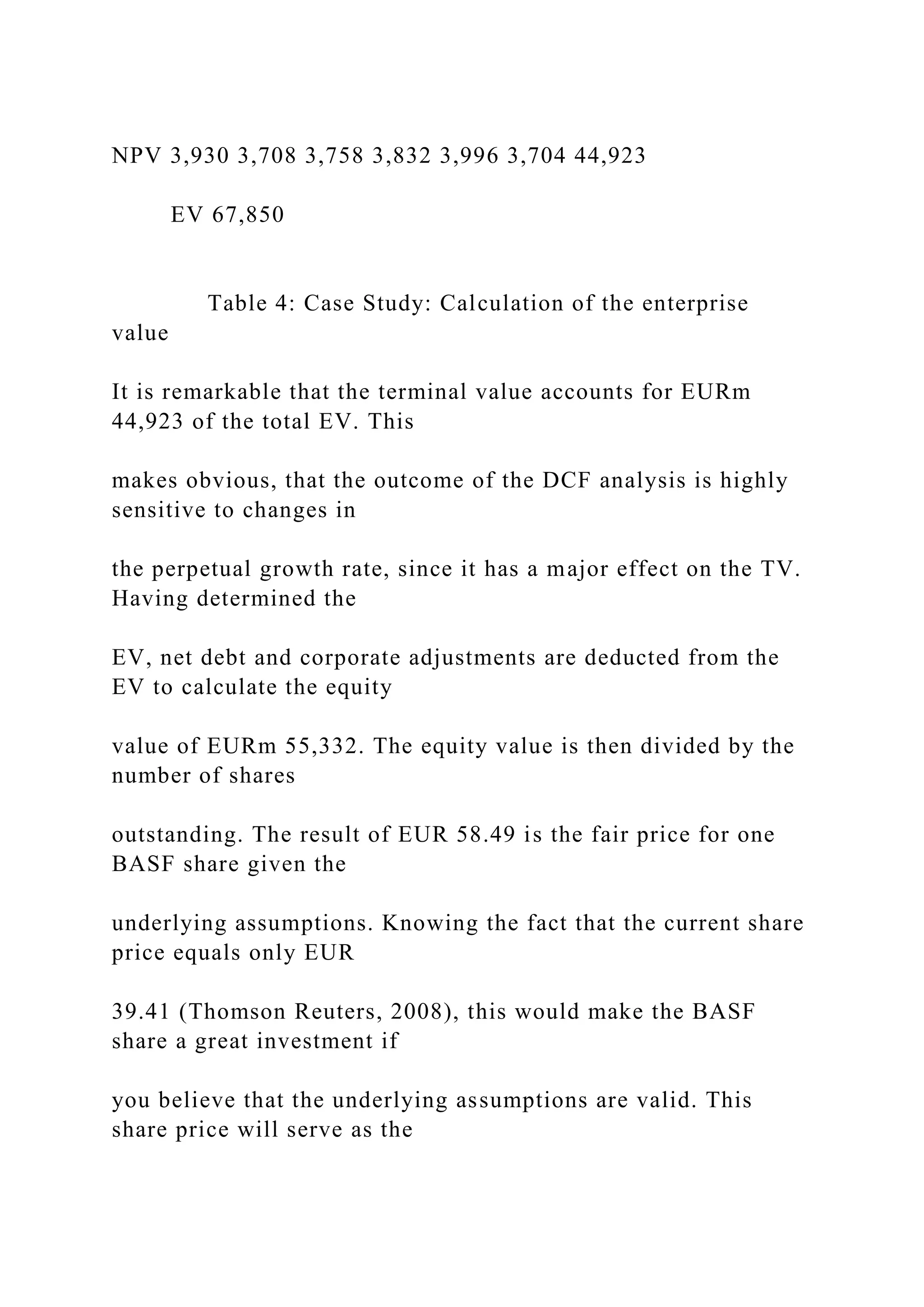

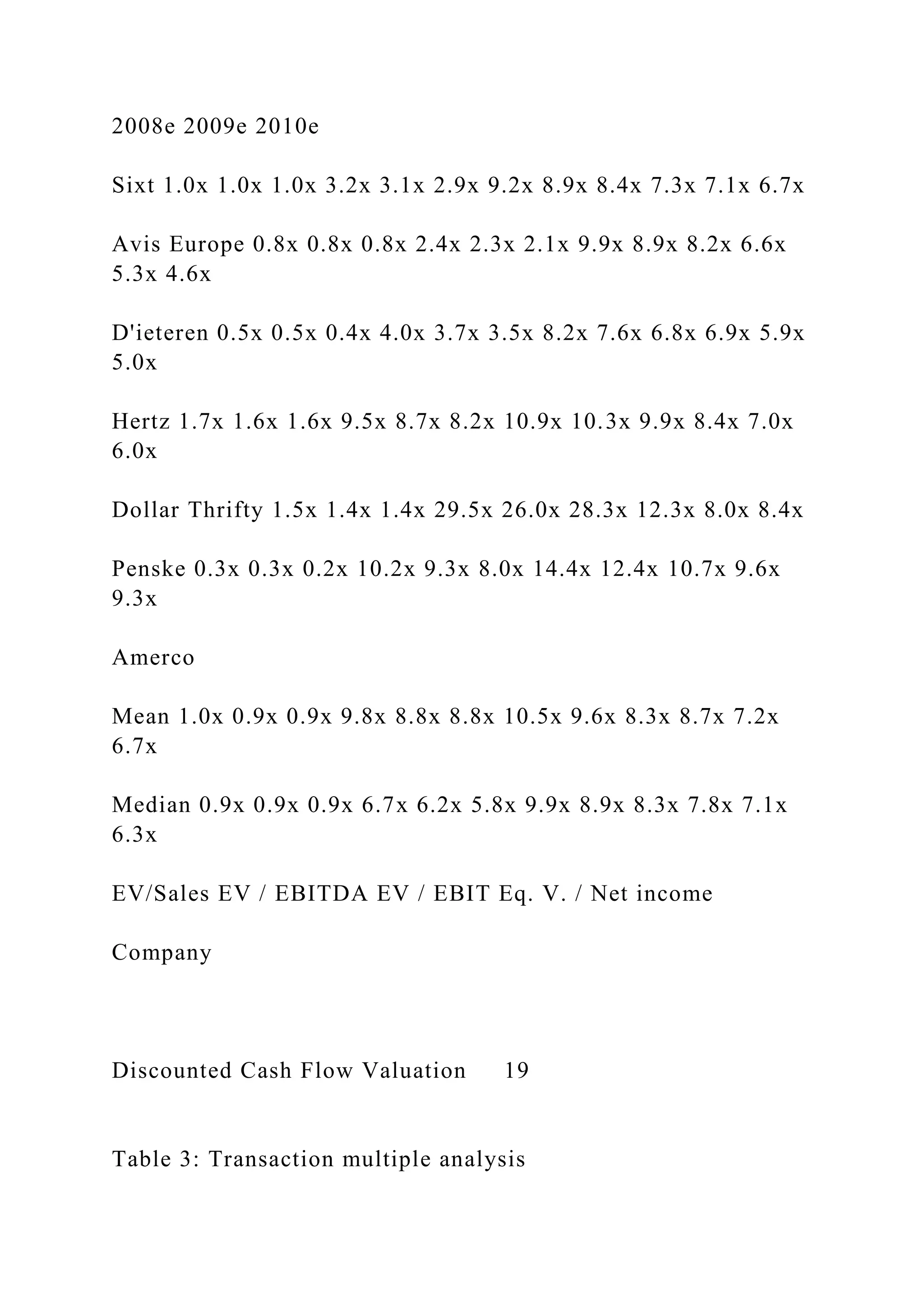

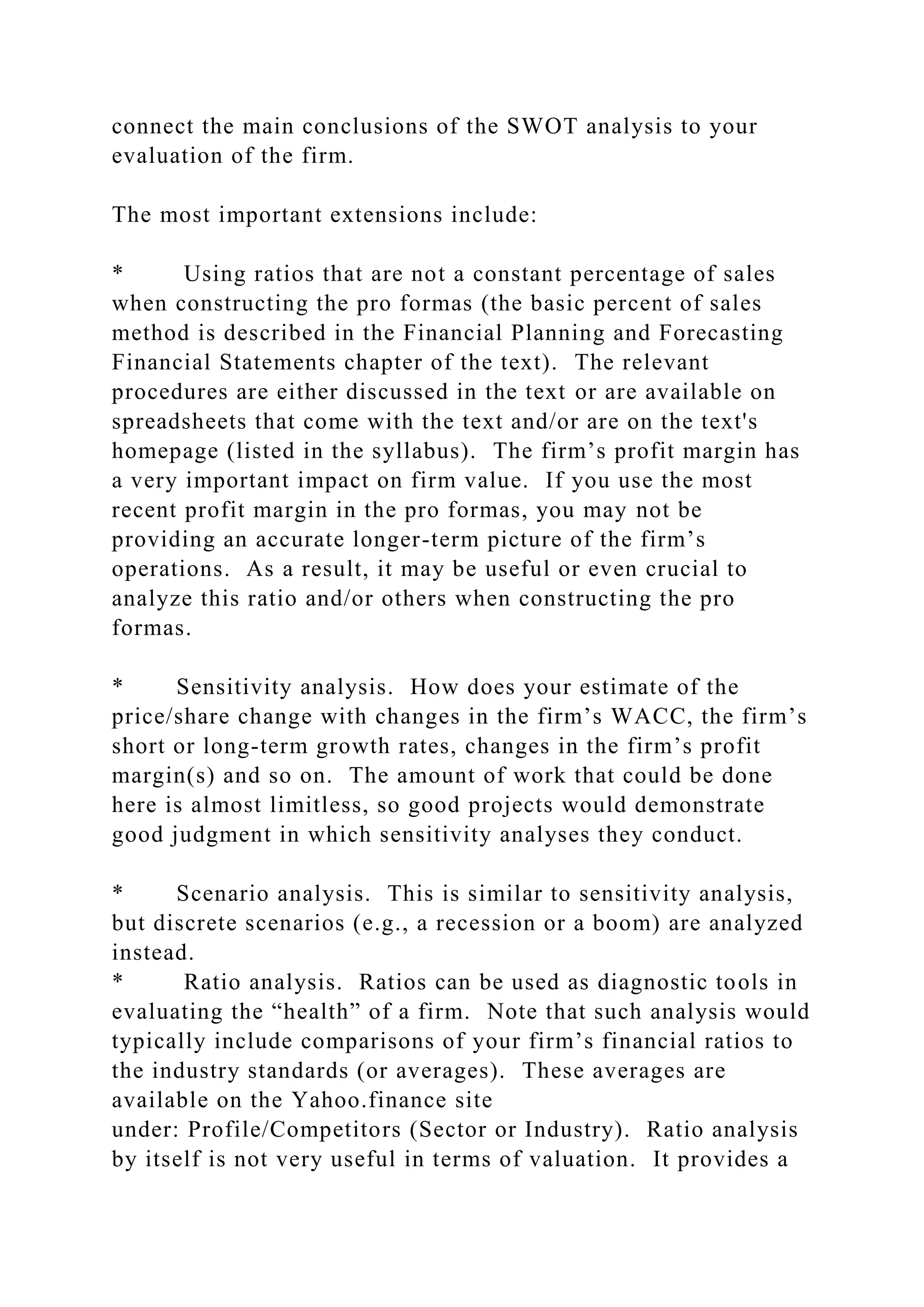

![which leads to the firm value as follows. Note that the present

value of the FCFs = the Value of Operations (see the CH 7 and

the formula runs as followings).

Value of Operations (Enterprise Value )

+ Value of non-operating assets (one example would be

marketable securities)

= Total Firm value

- Value of Debt [we use the book value of ST and LT debt;

though theory suggests that the market value

- Value of Preferred Shares [if any]

= Value of Equity

÷ Number of Shares of Common Stock outstanding

Price per share

This price per share is your estimate of the fundamental value

of the firm stock, which you would then use to argue that the

firm is either currently over/under/fairly valued according to the

market, i.e., by comparing your price/share to

the current market price/share. Warren Buffet calls this

estimate the "intrinsic value" of the firm. Remember that you

may consider the efficient market hypothesis in relation to your

price estimate.

2. Dividend Growth Model (Multi-stage growth model)

3. Comparables (Stock Price Multiples Model): This method is

relatively easy and provides some useful valuations that often

set the ranges for the stock price. The course packet lecture

entitled “Using Stock Price Multiples to Estimate Stock Price”

describes this method. You may use either a direct competitor

or industry averages. For example, if you are analyzing Ford

Motor Corp. it would be appropriate to use GM as a comparable

firm (and/or the auto industry). Note that sector/industry ratios

can be obtained on Yahoo.finance [look under profiles, then on

the left hand side under Financial Links you should

see competitors]. Many different financial ratios can be used,](https://image.slidesharecdn.com/fin430financetheoryandpracticeprojectassignmentscalculat-221031130230-ab53fe6e/75/FIN-430-Finance-Theory-and-PracticeProject-AssignmentsCalculat-docx-80-2048.jpg)

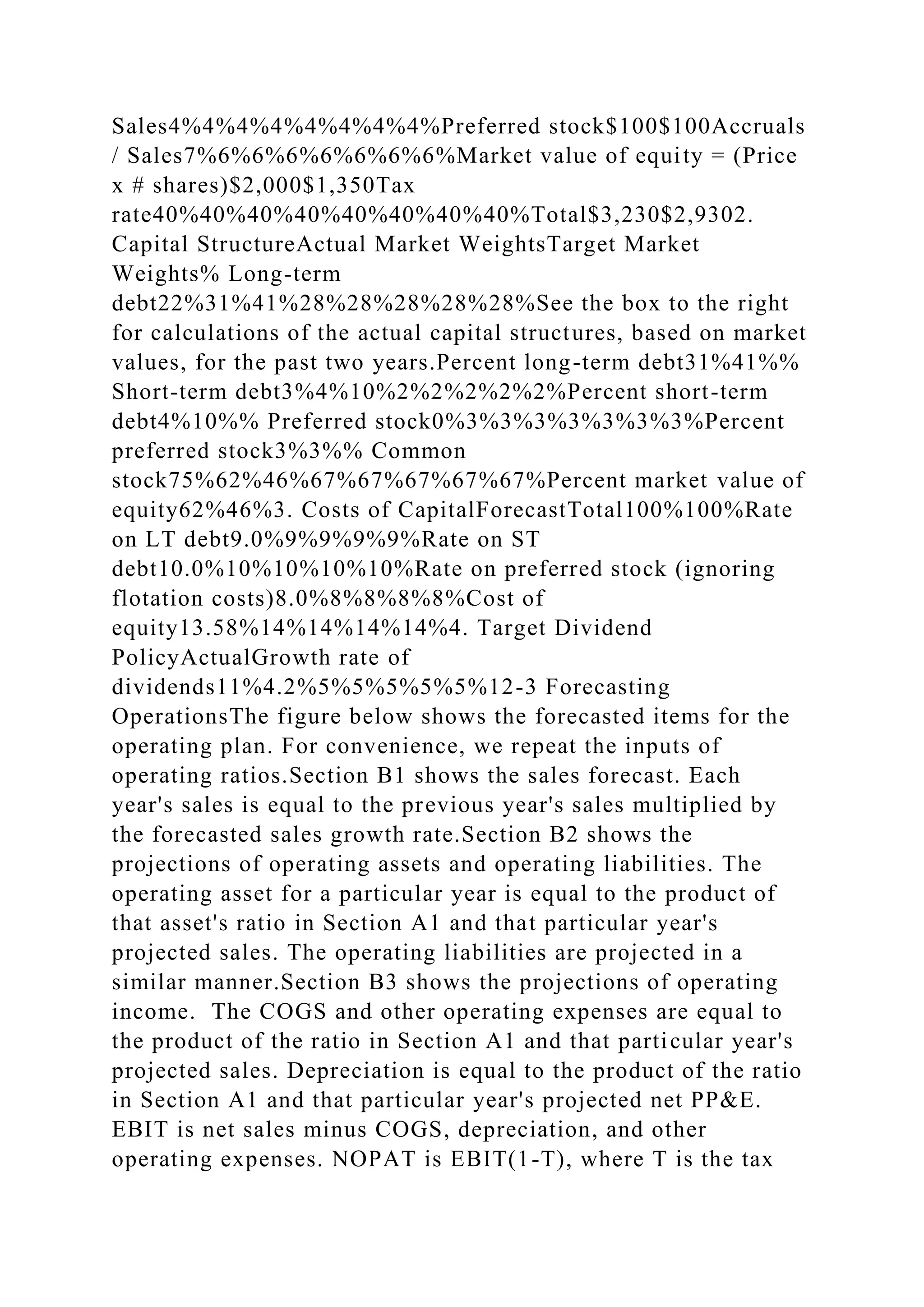

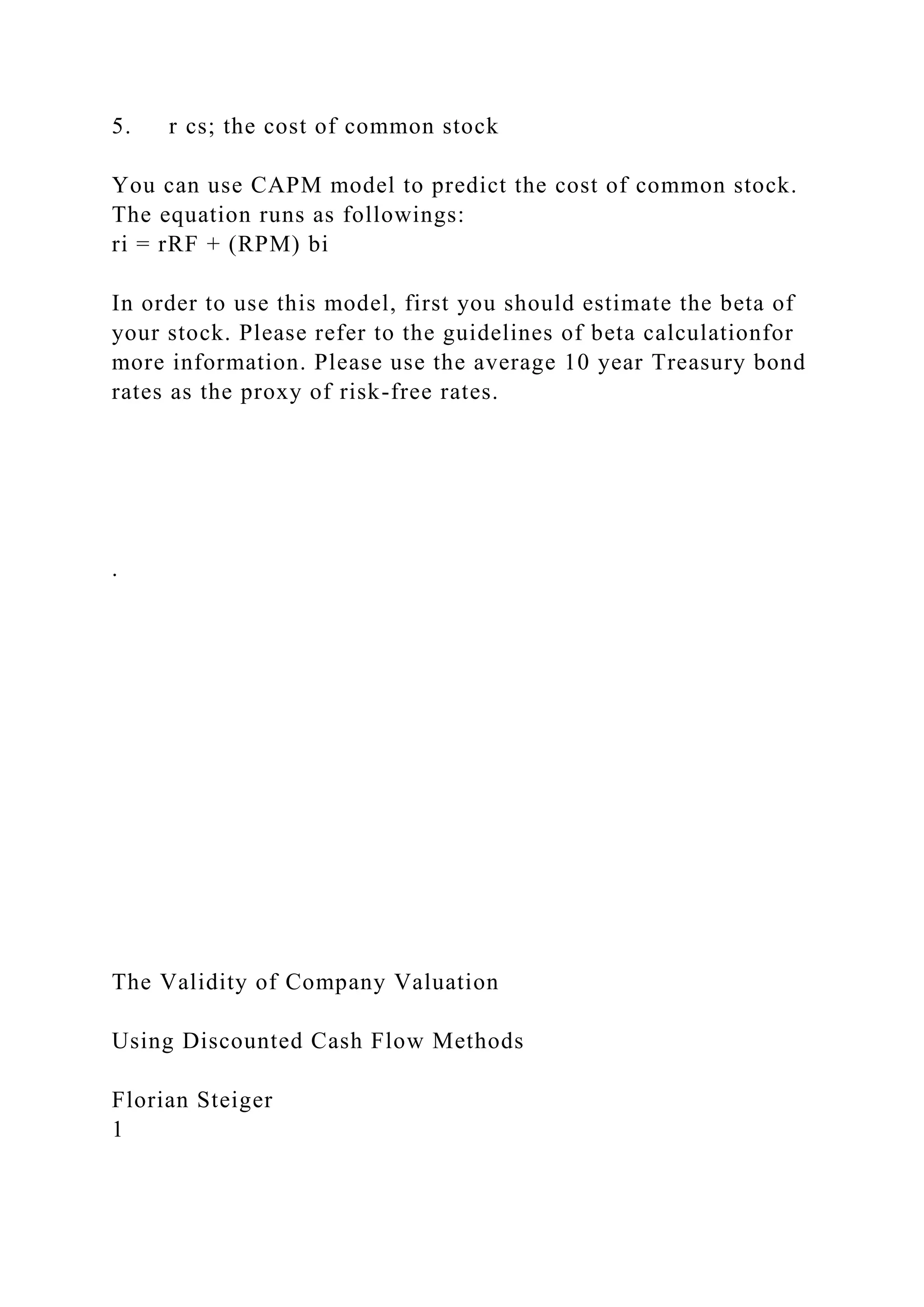

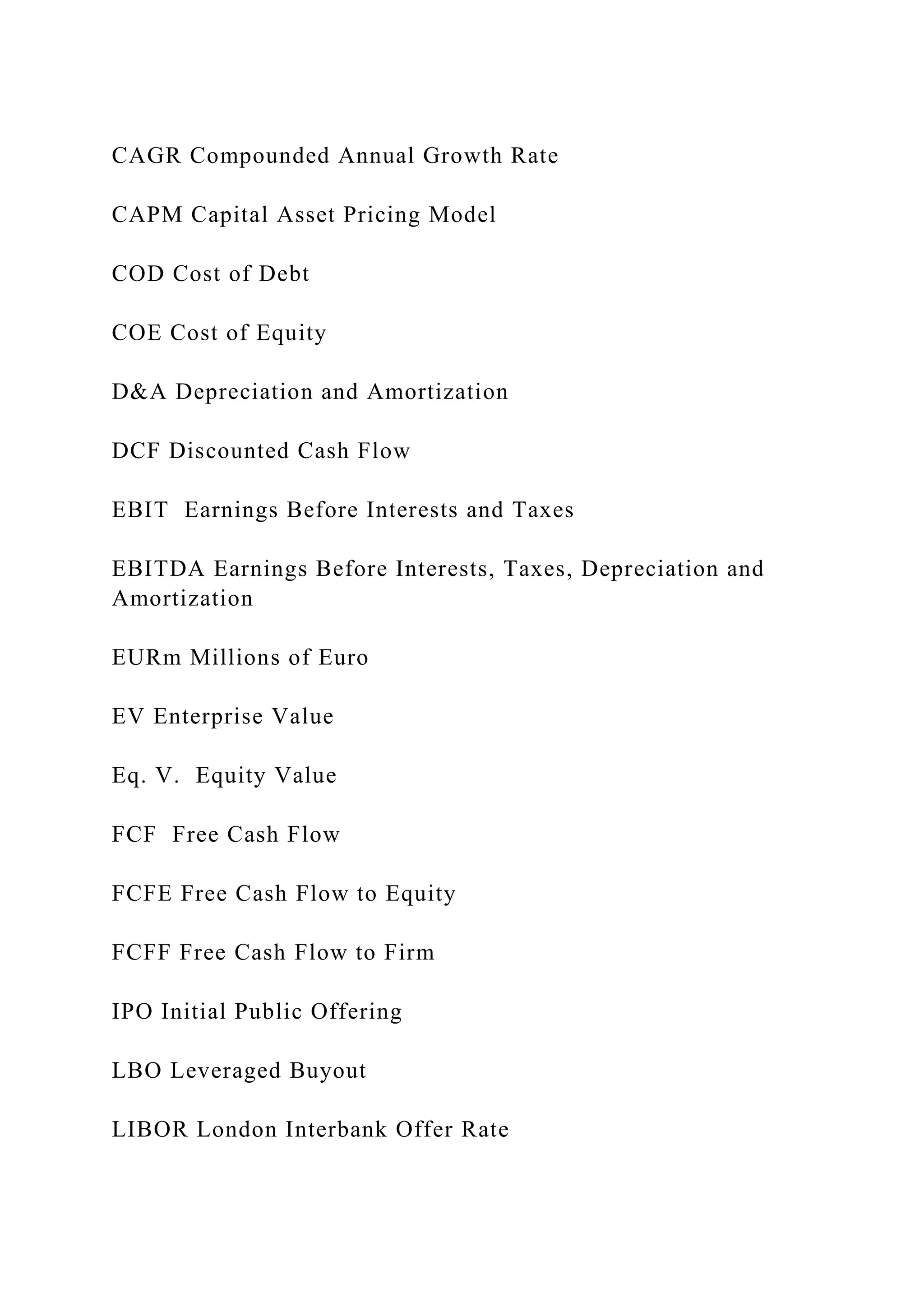

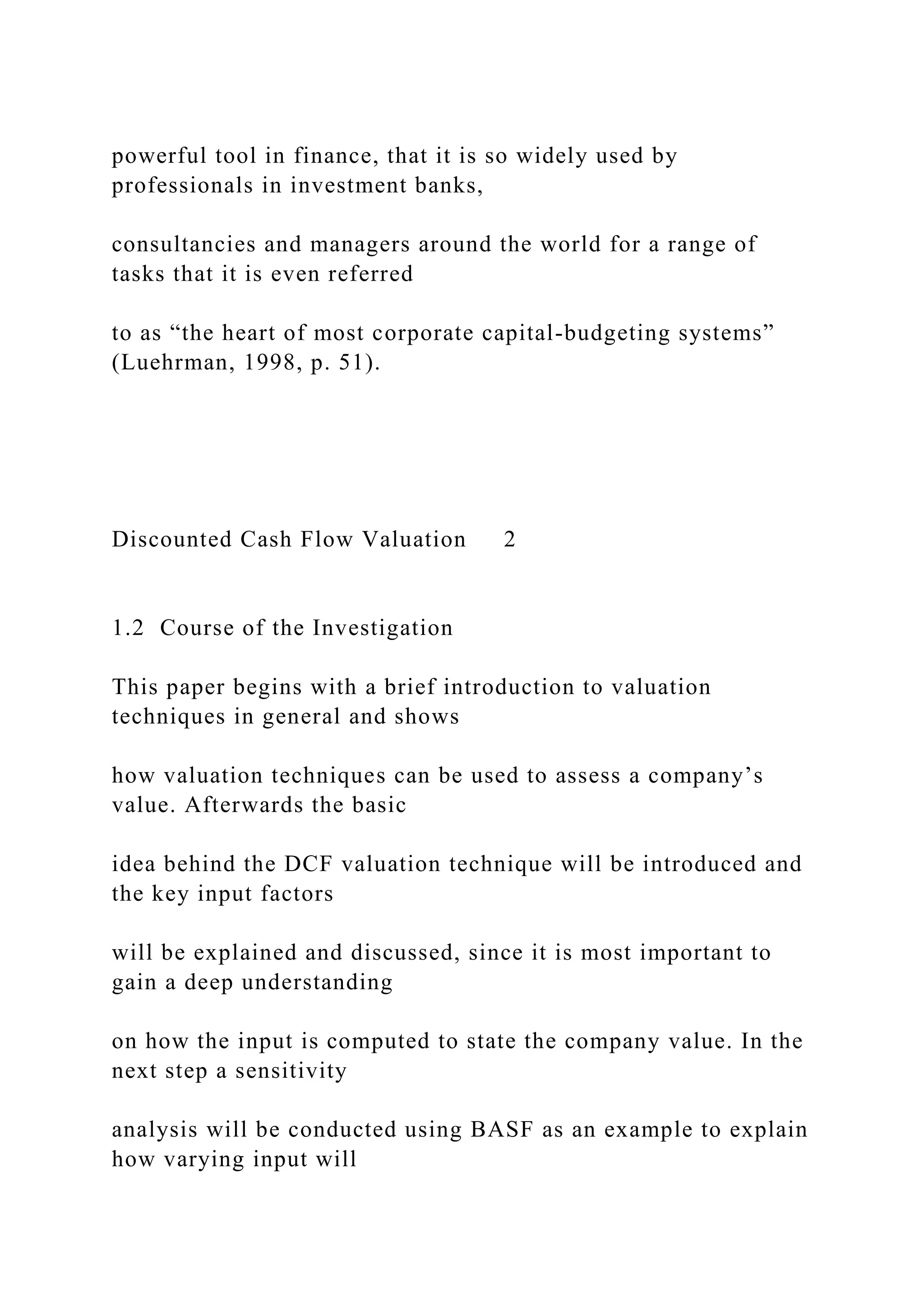

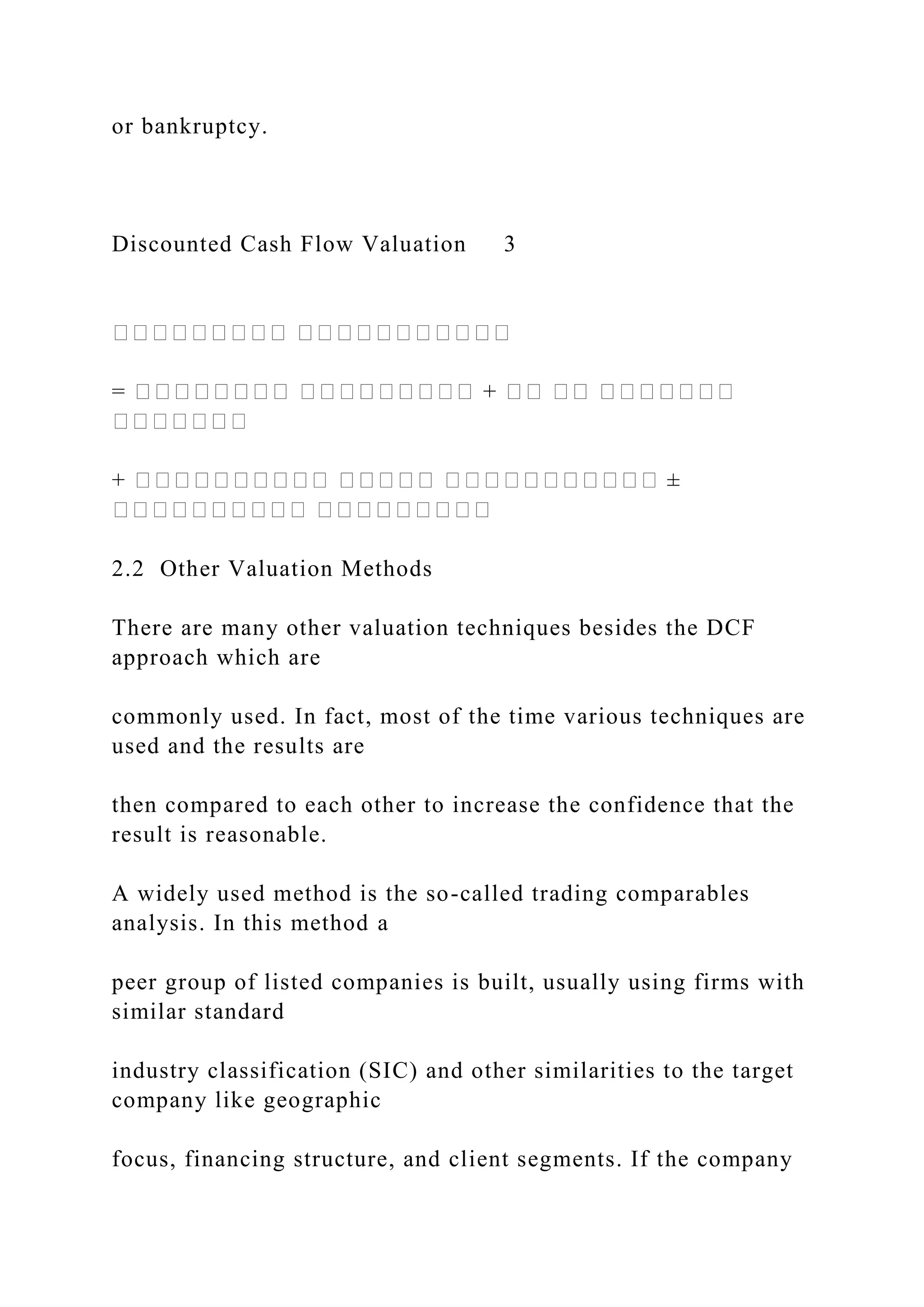

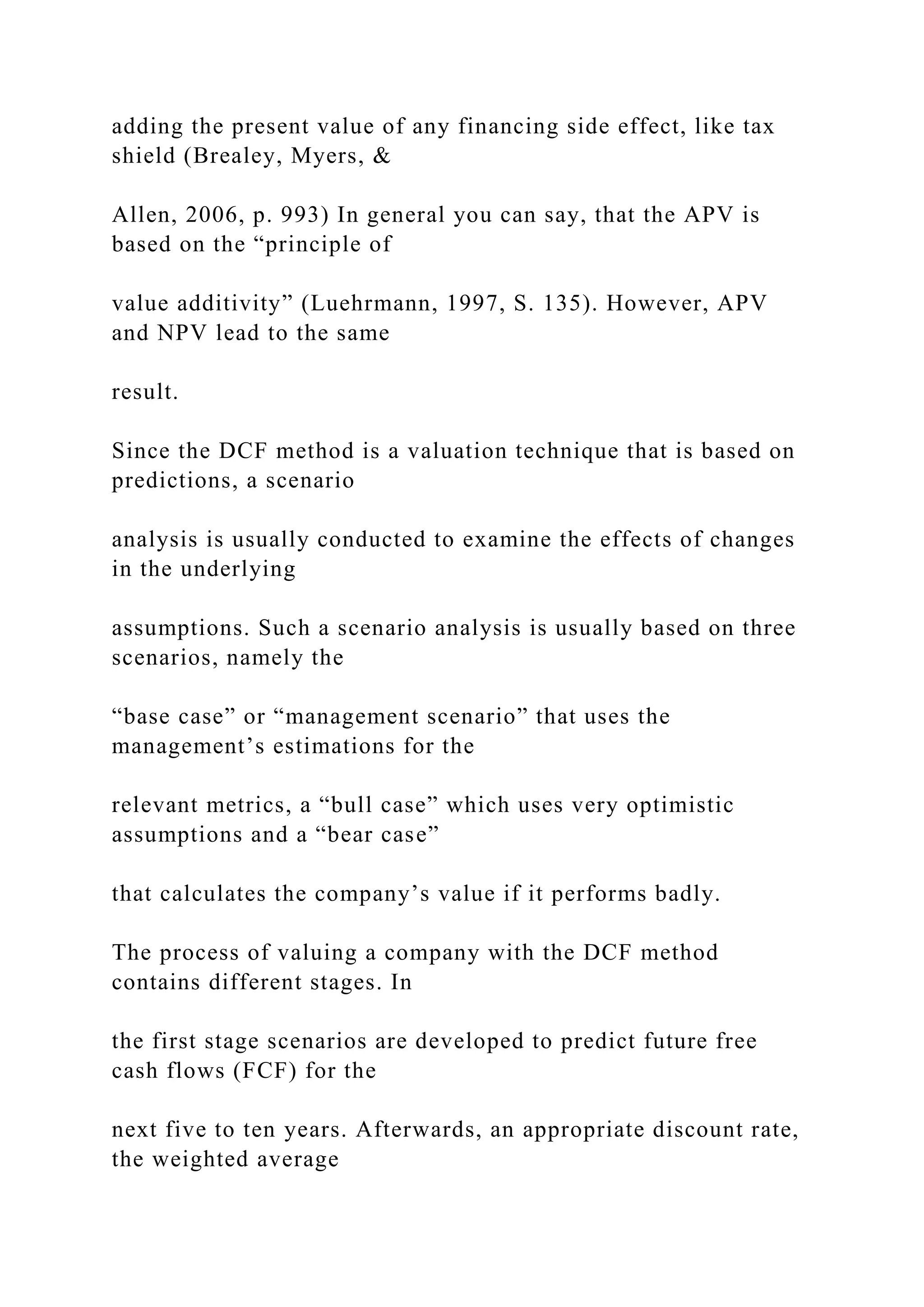

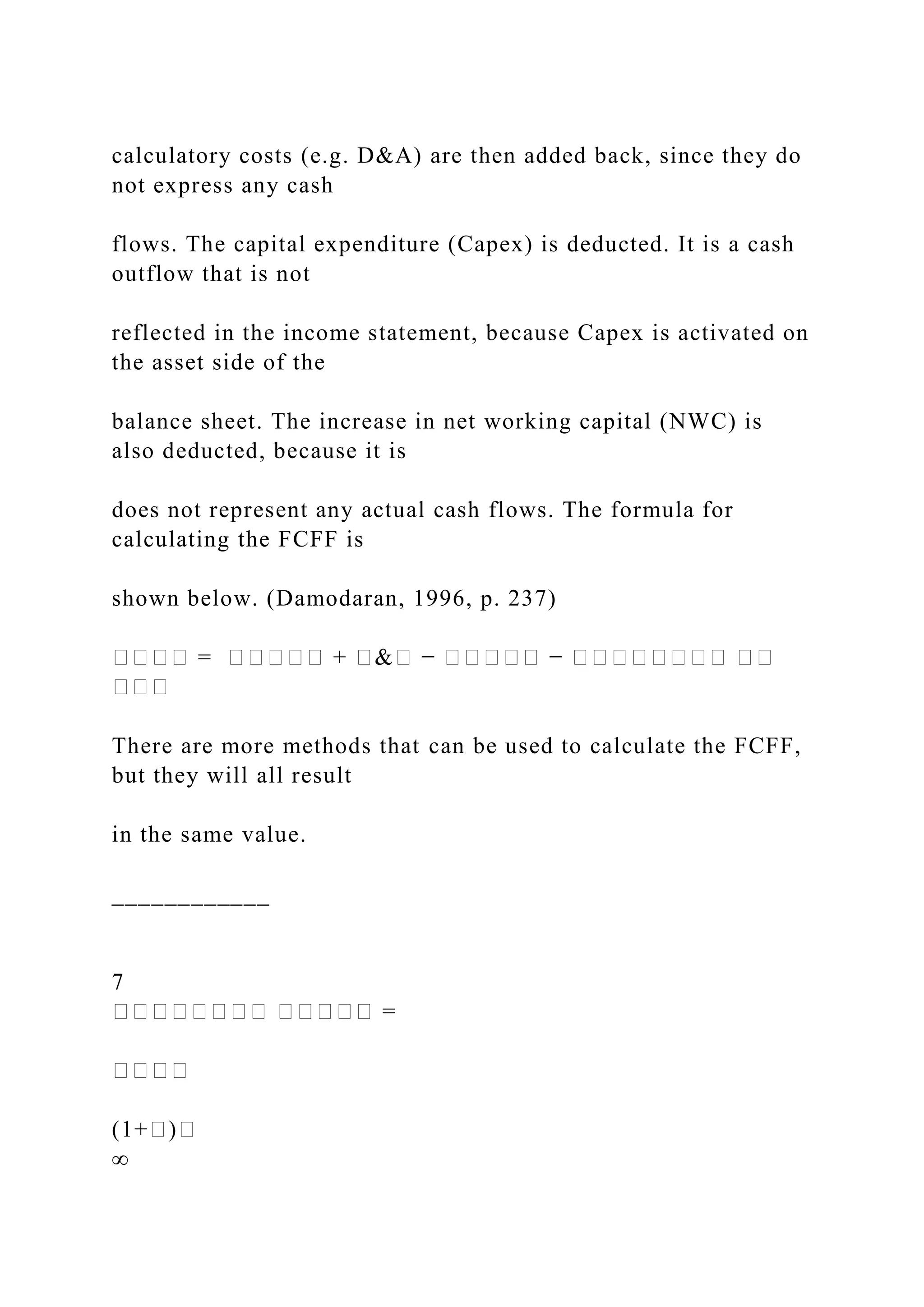

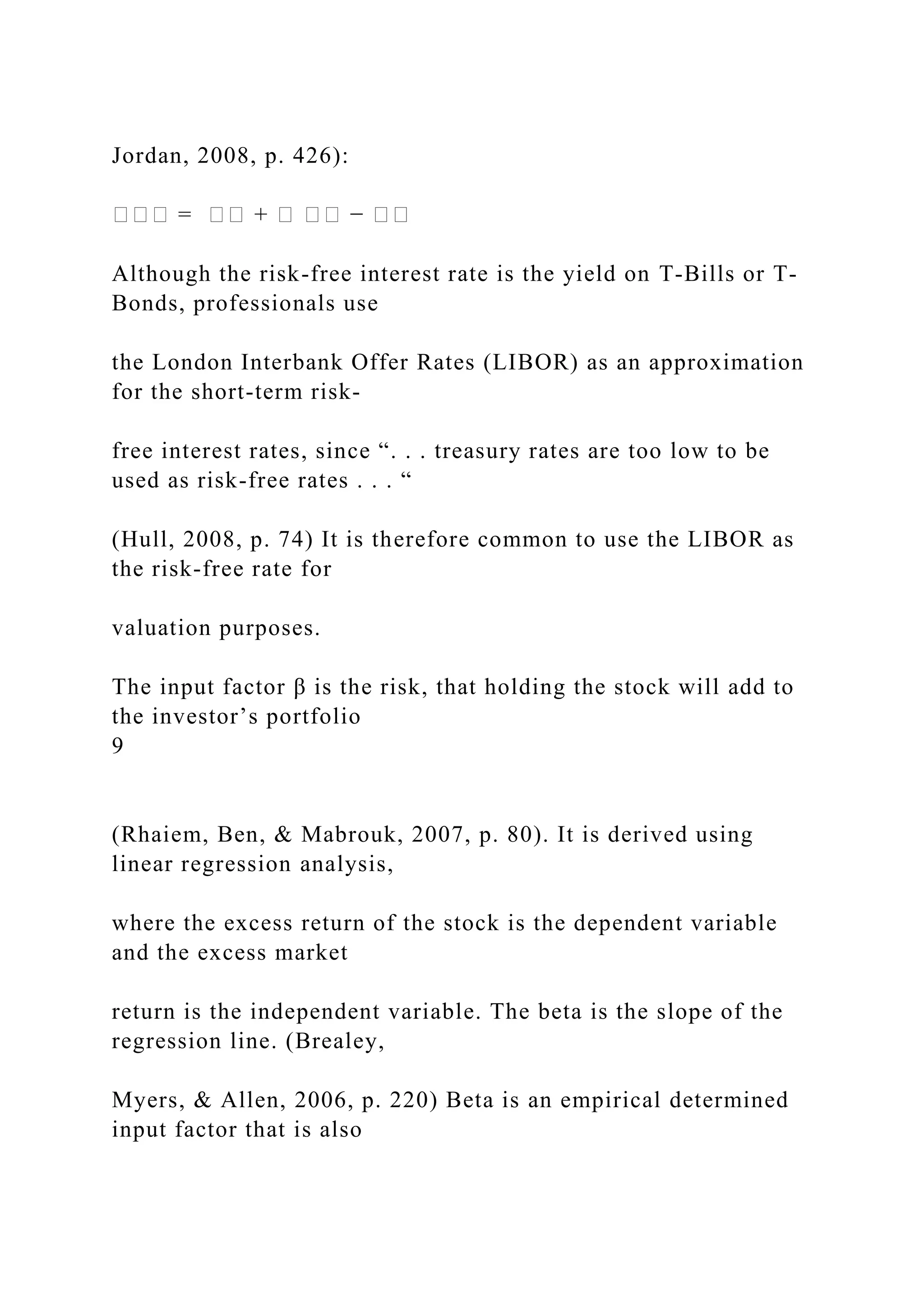

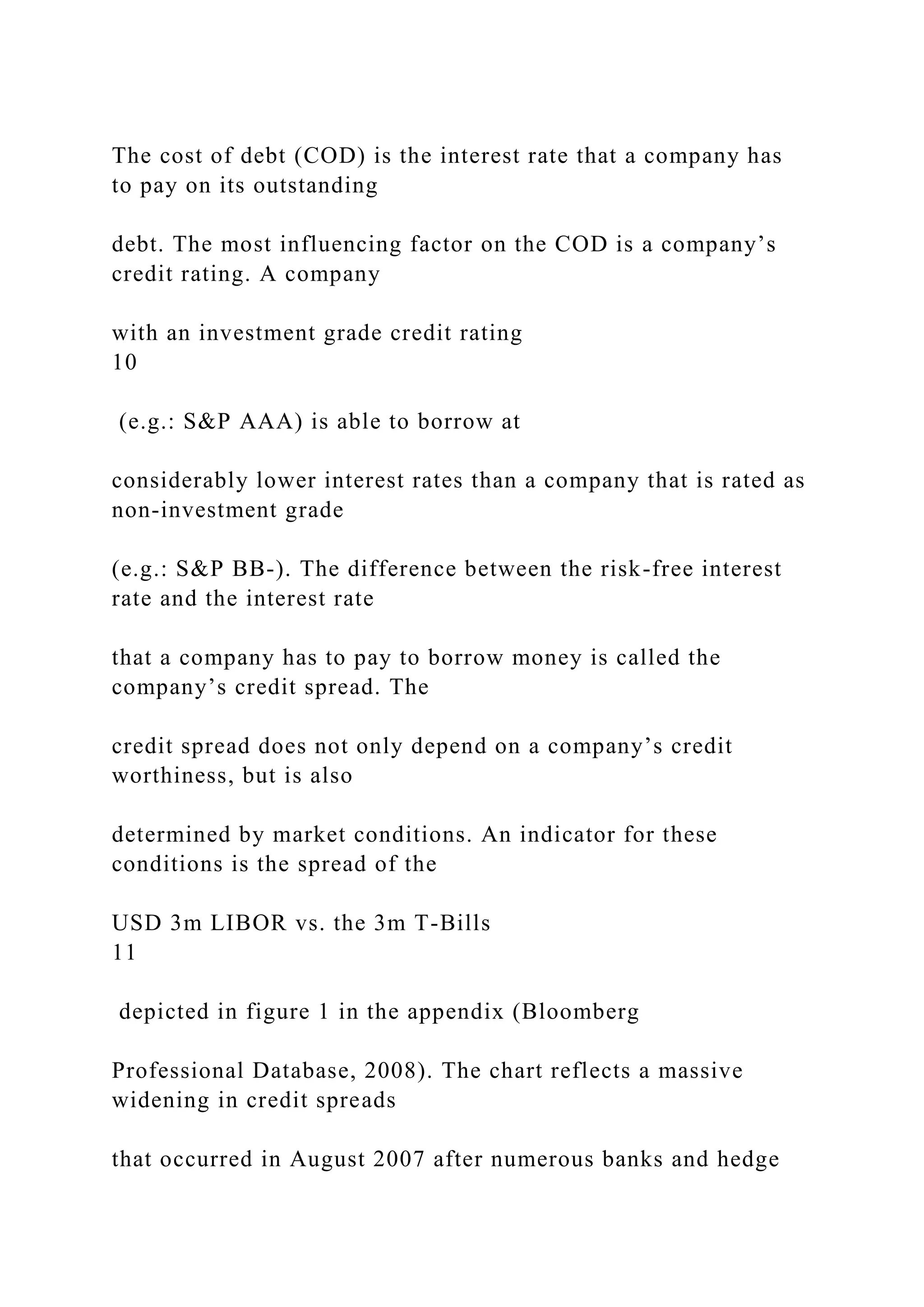

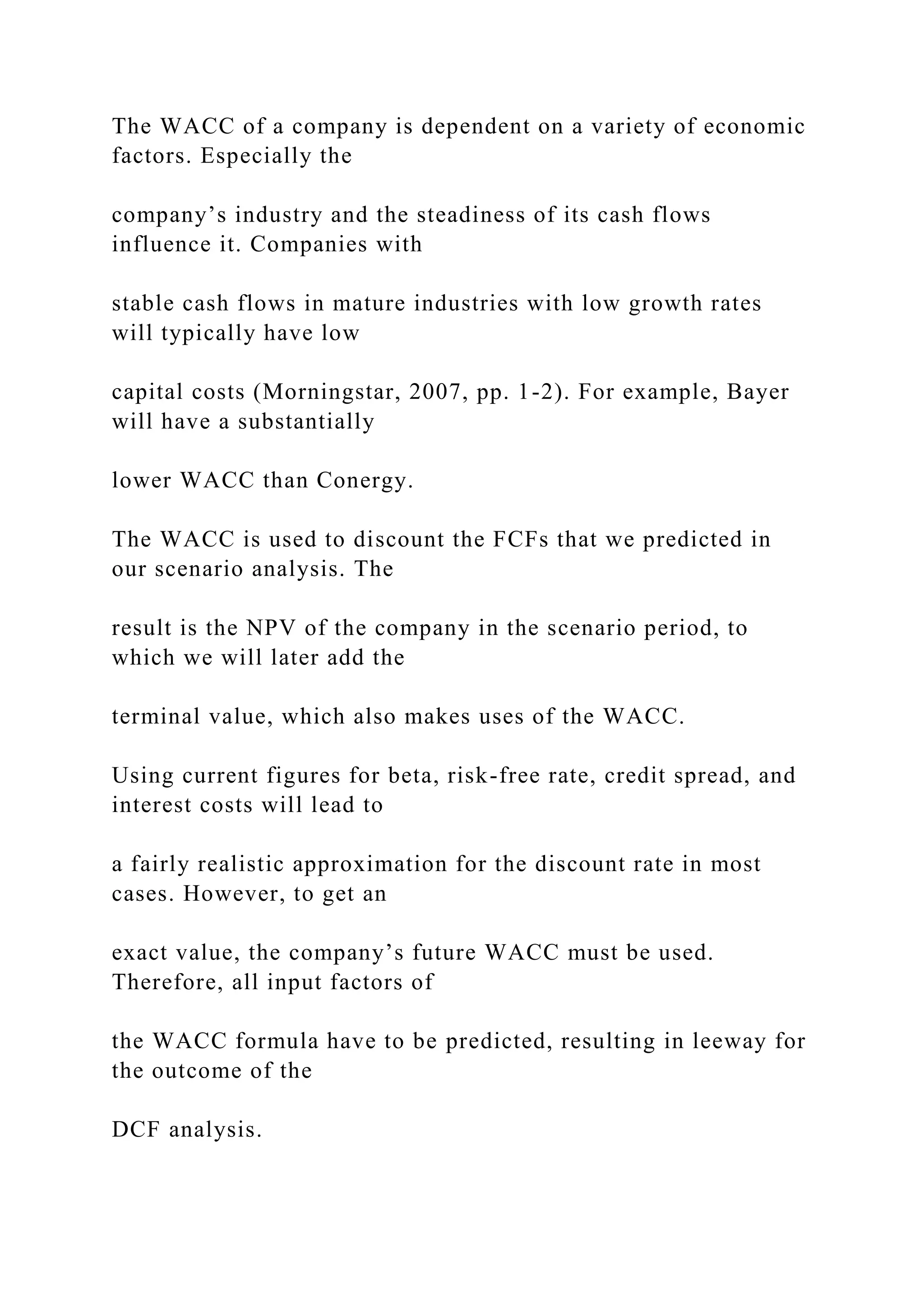

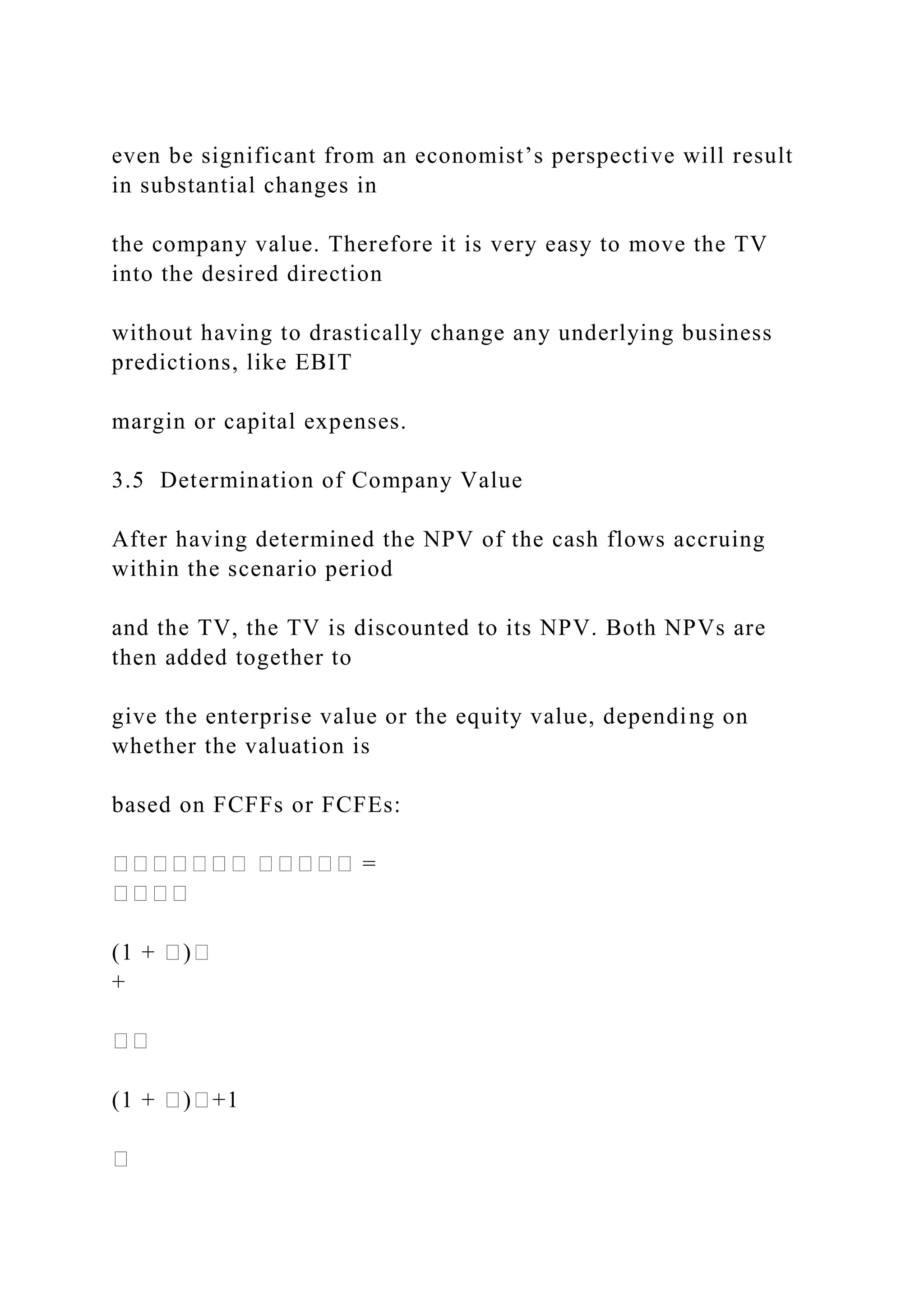

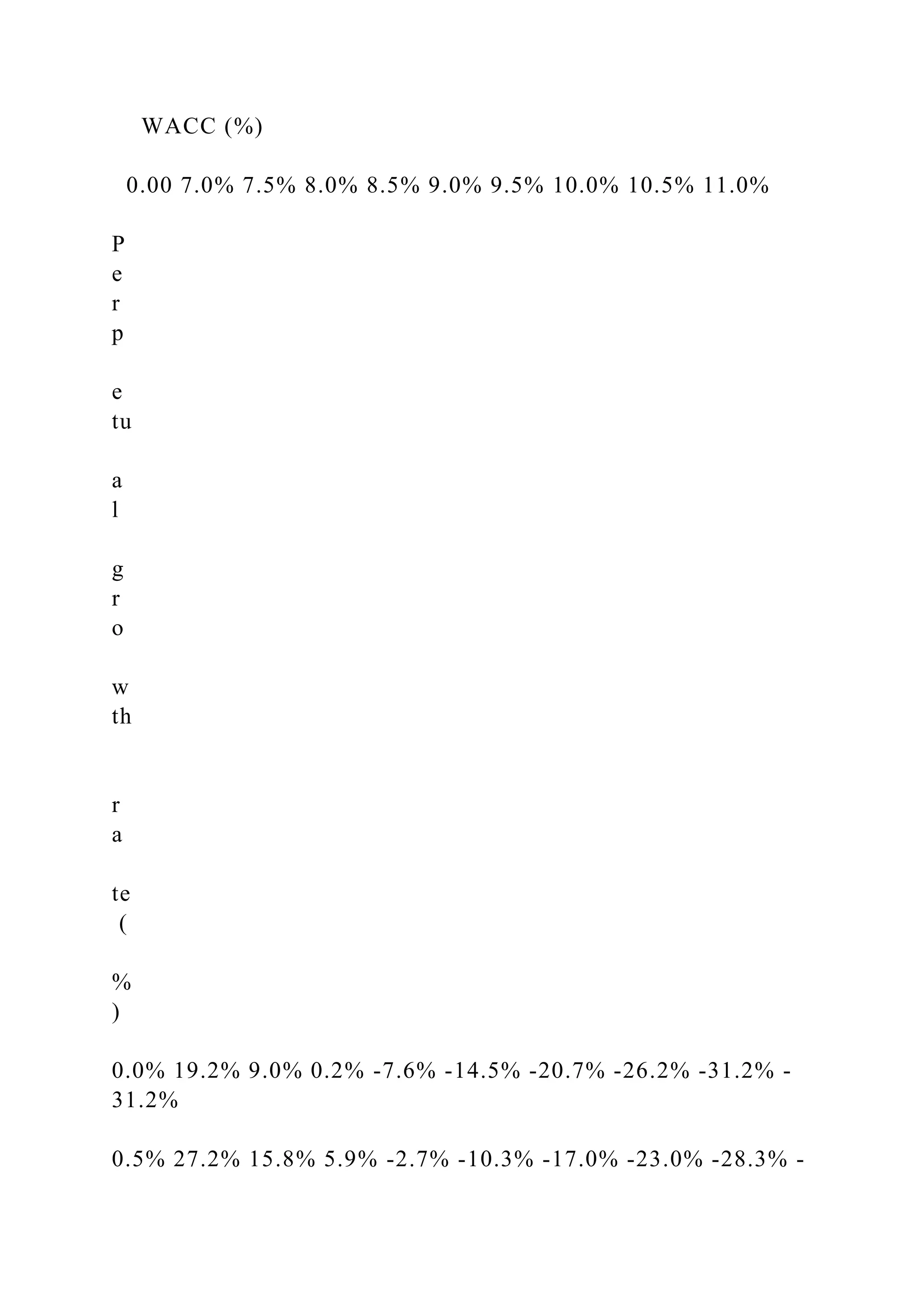

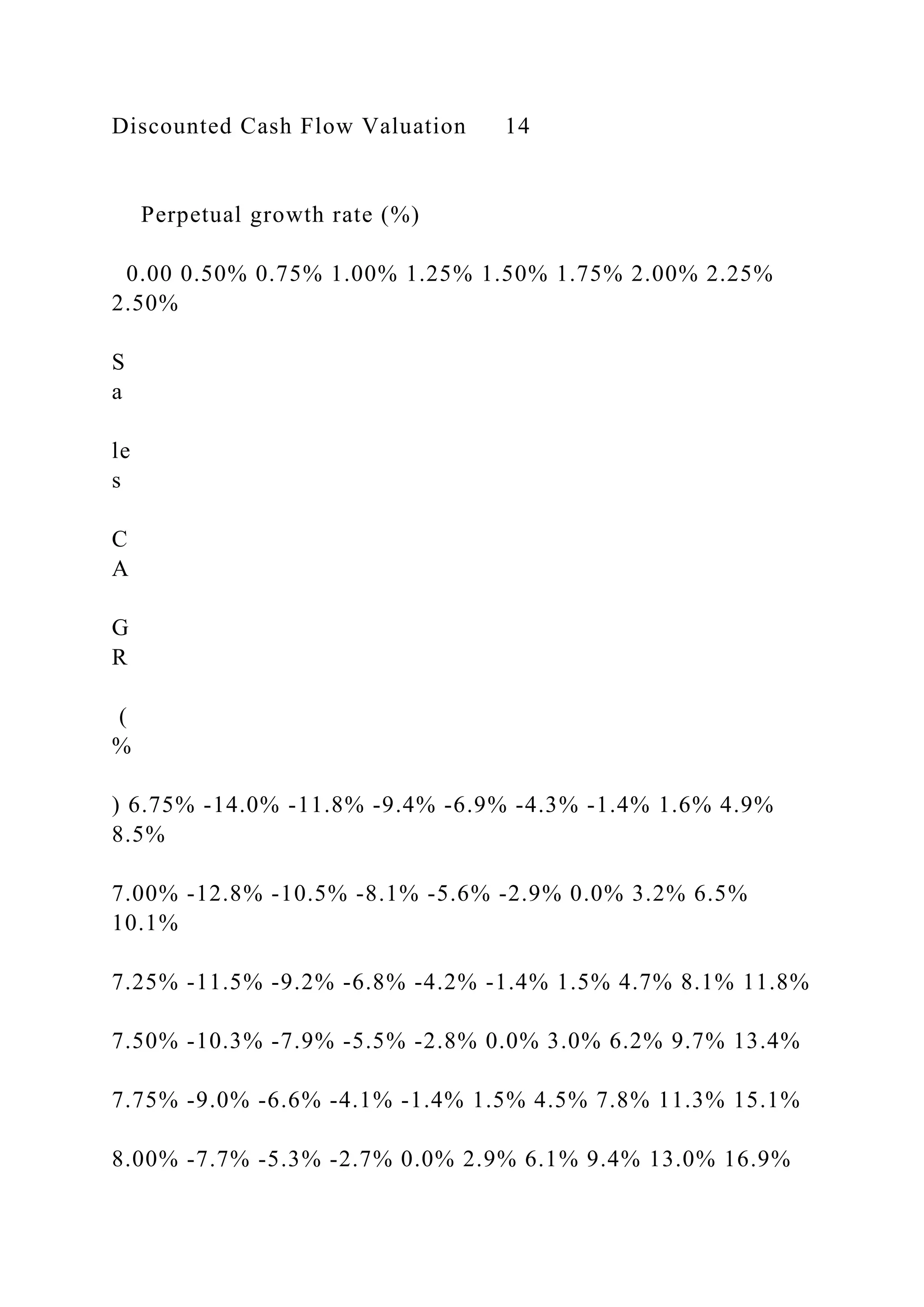

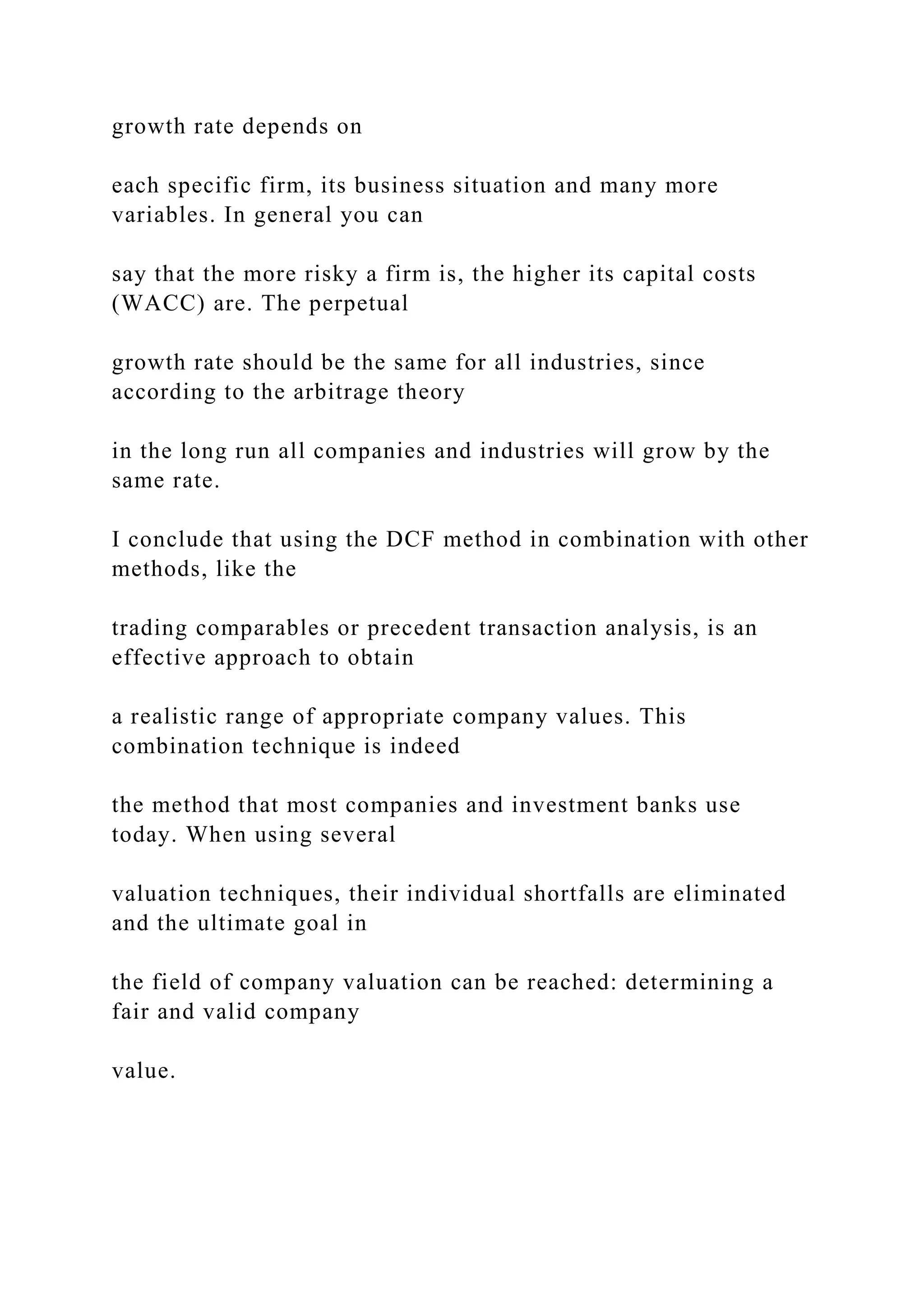

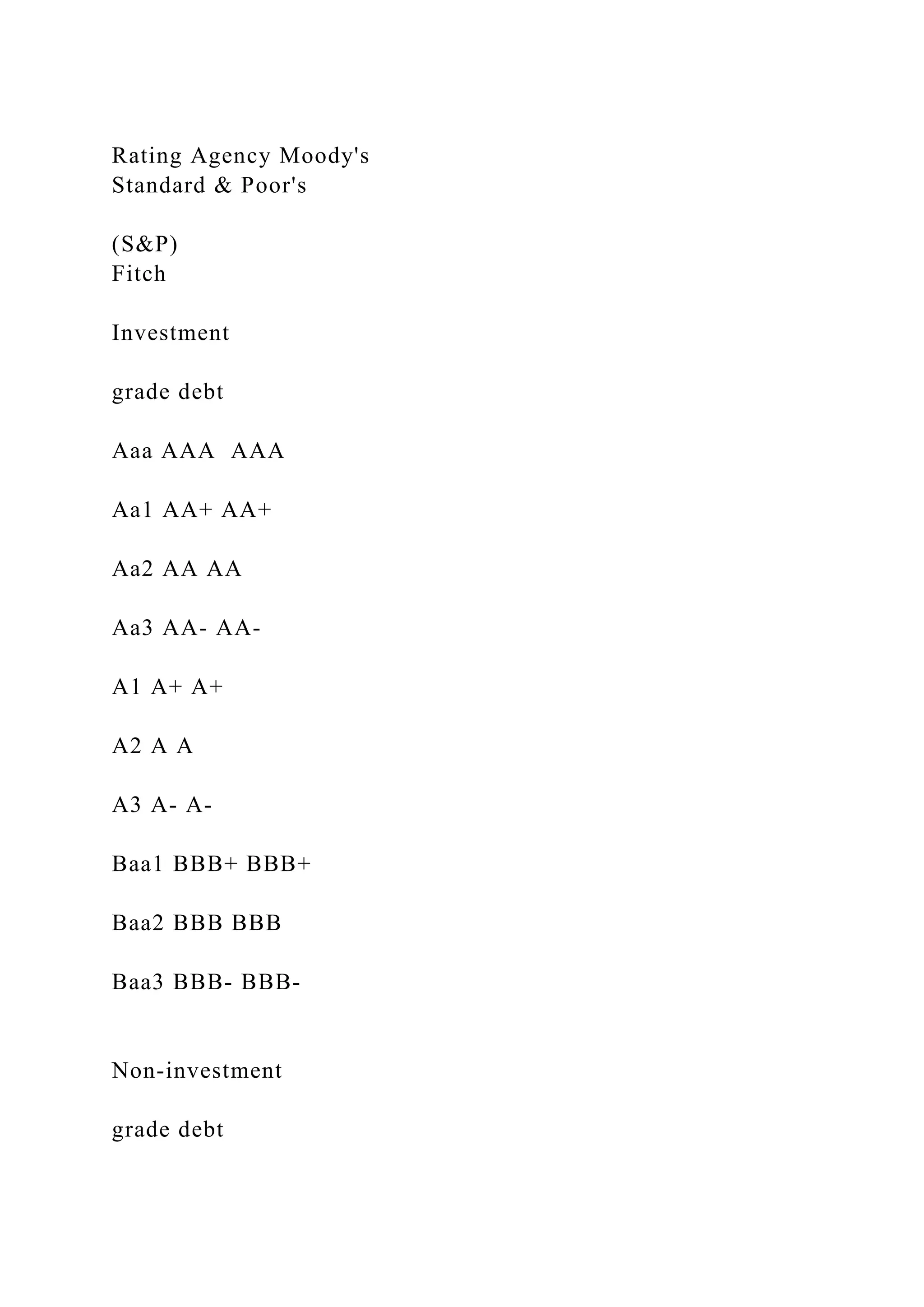

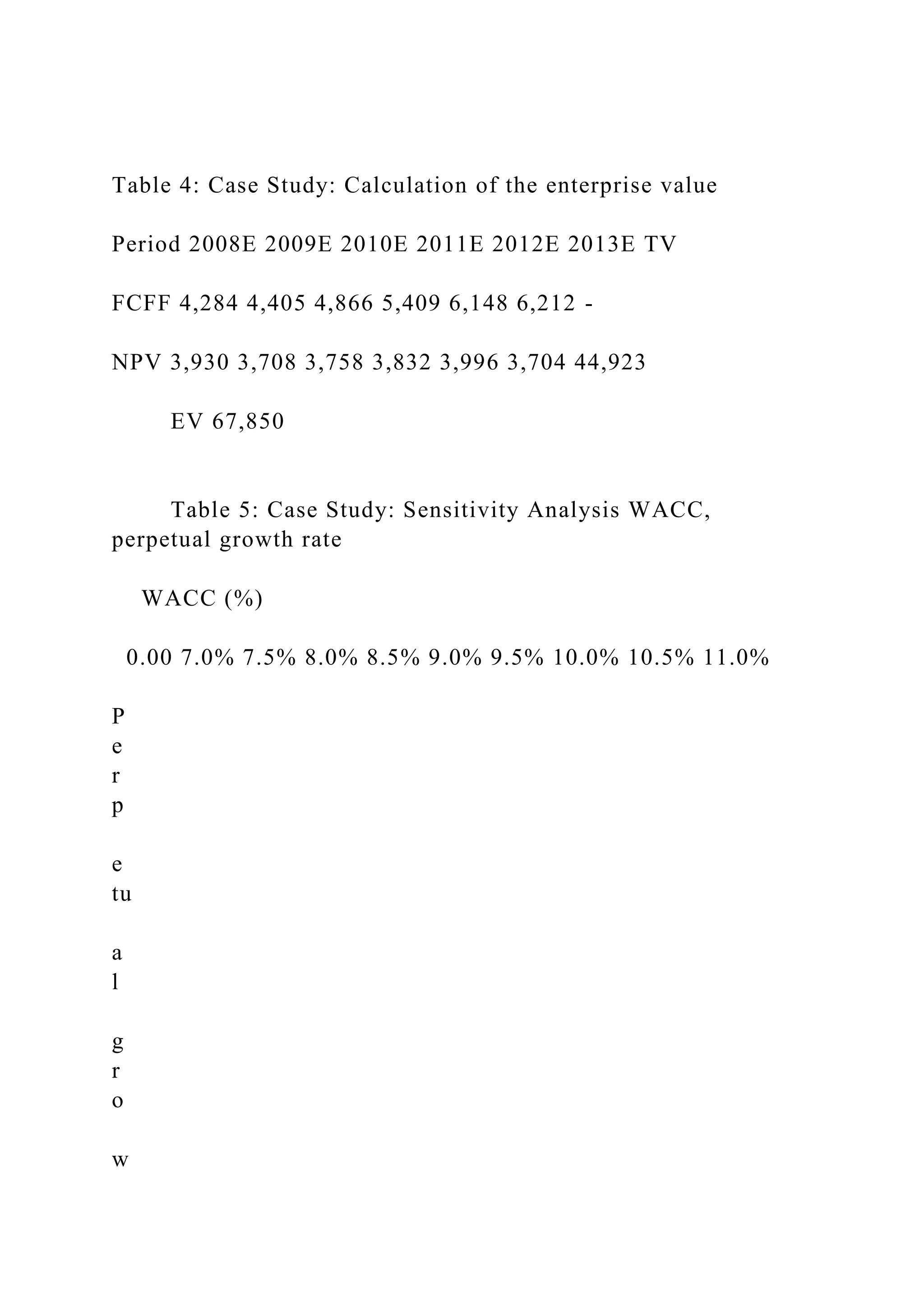

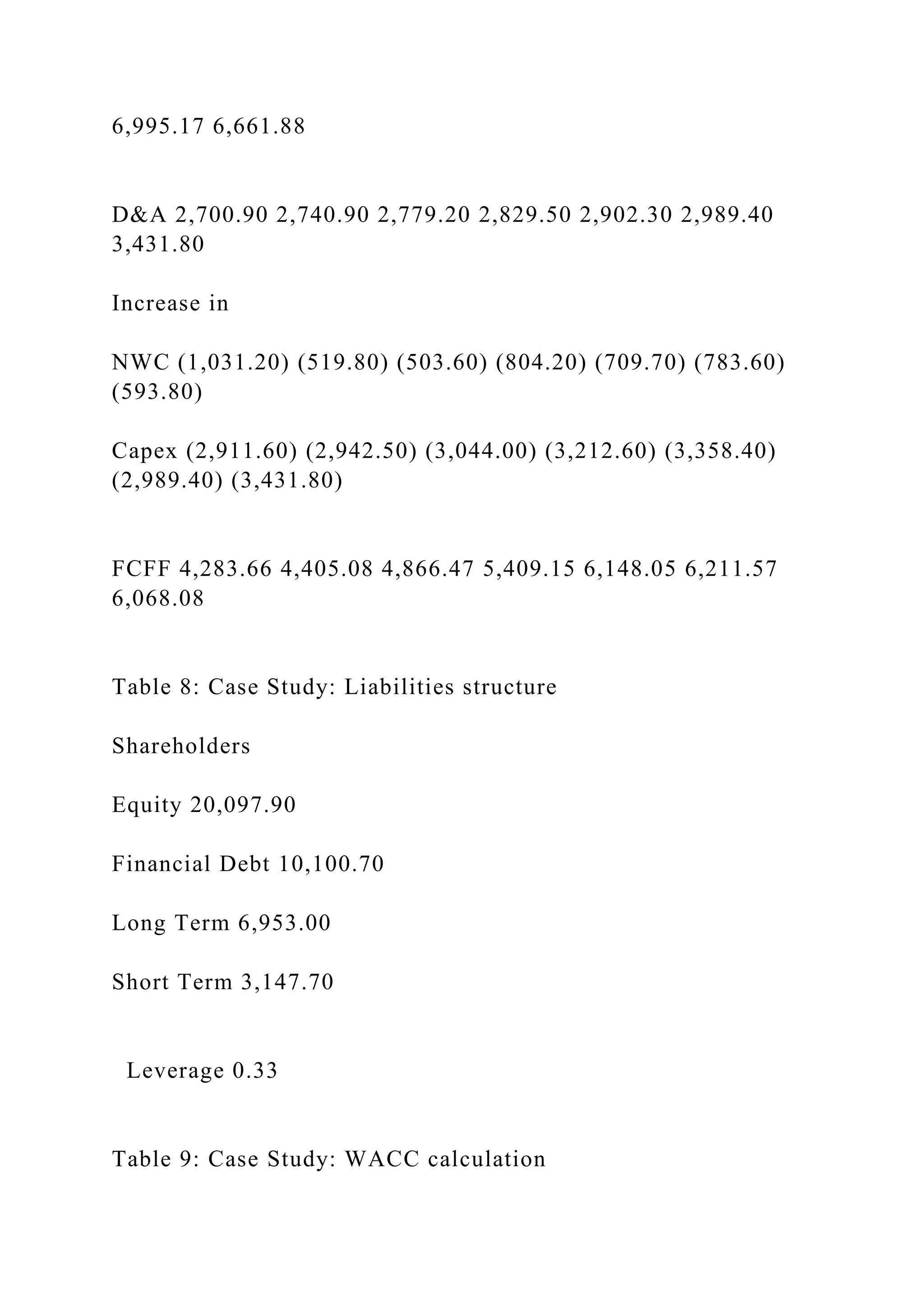

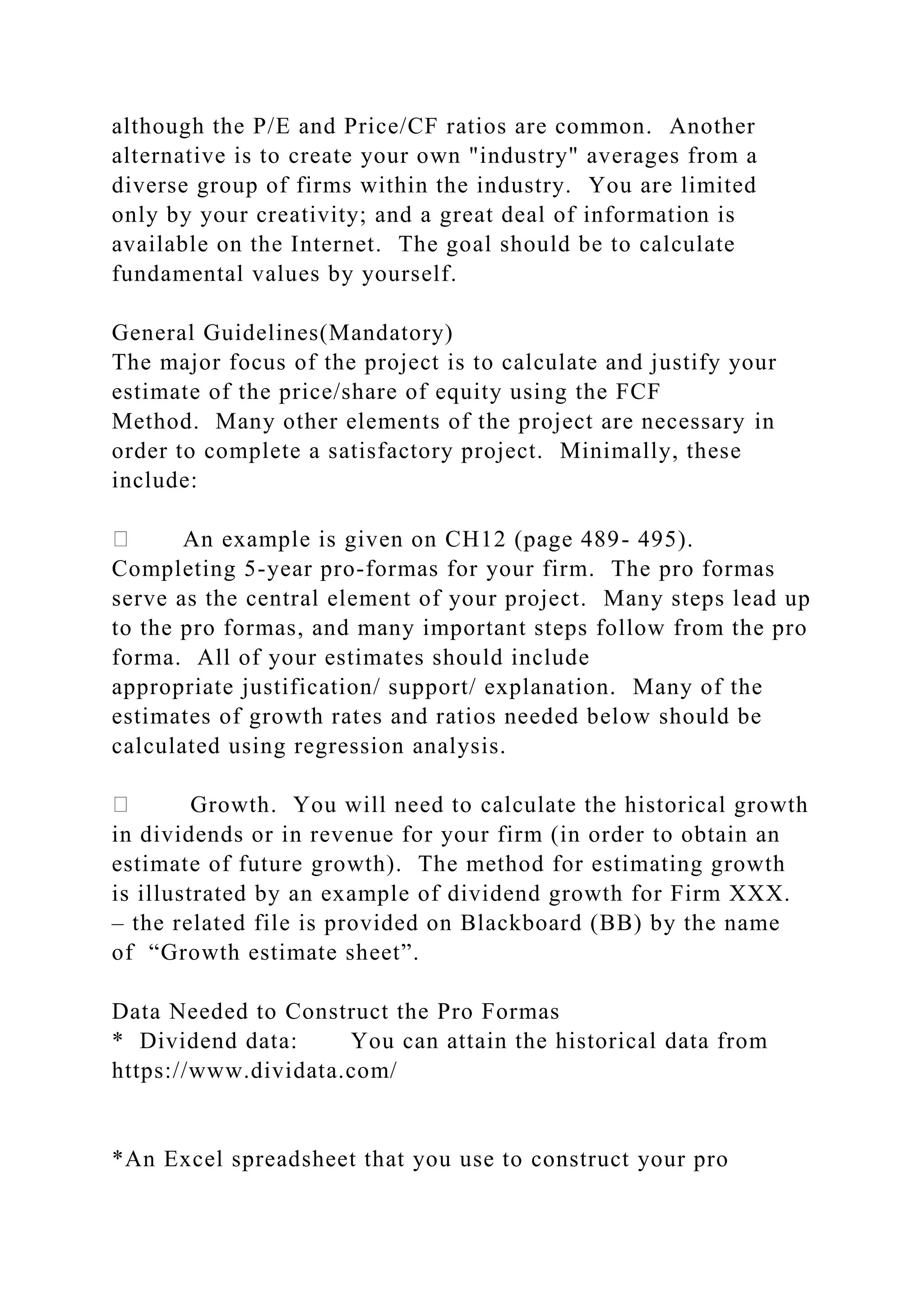

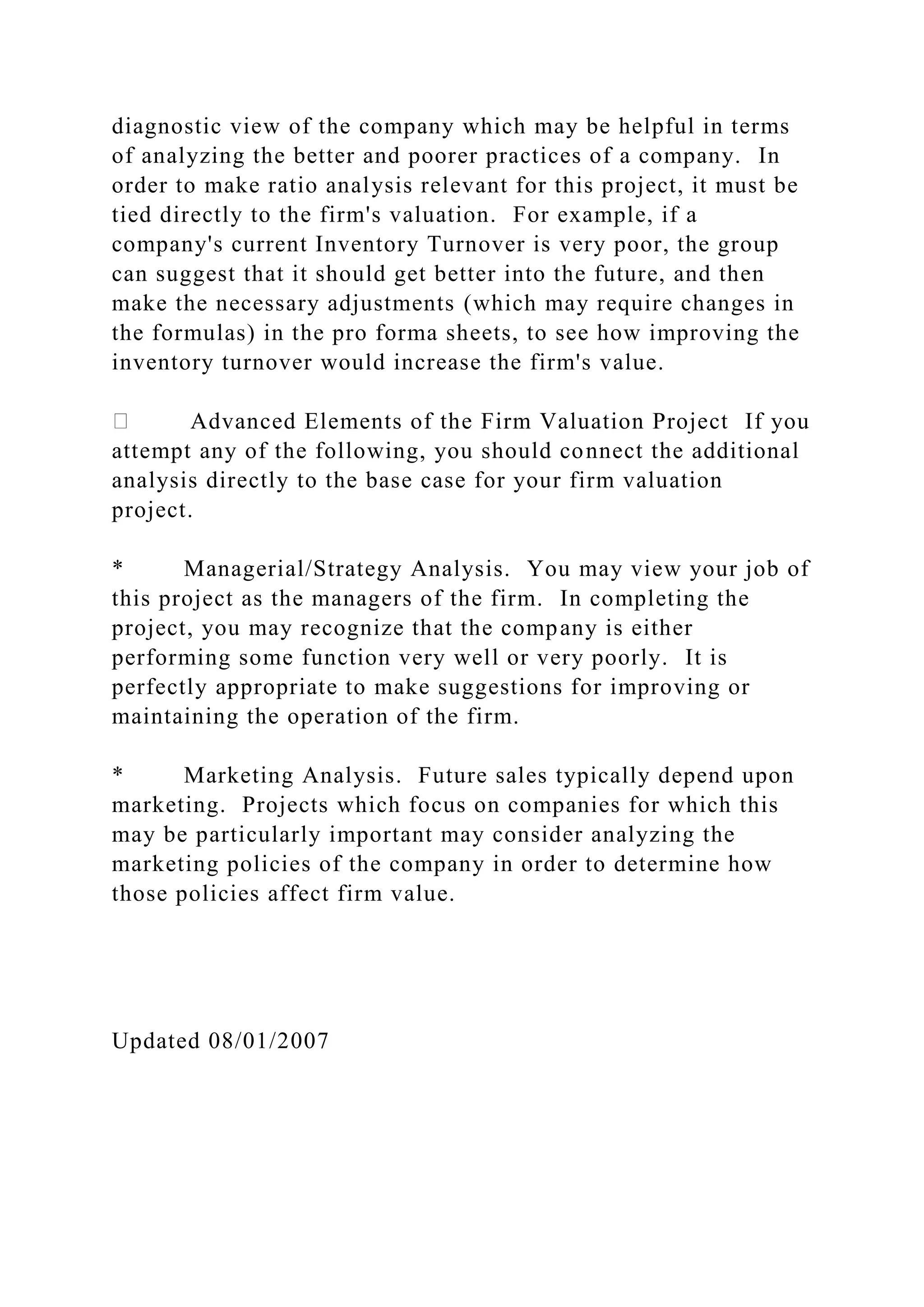

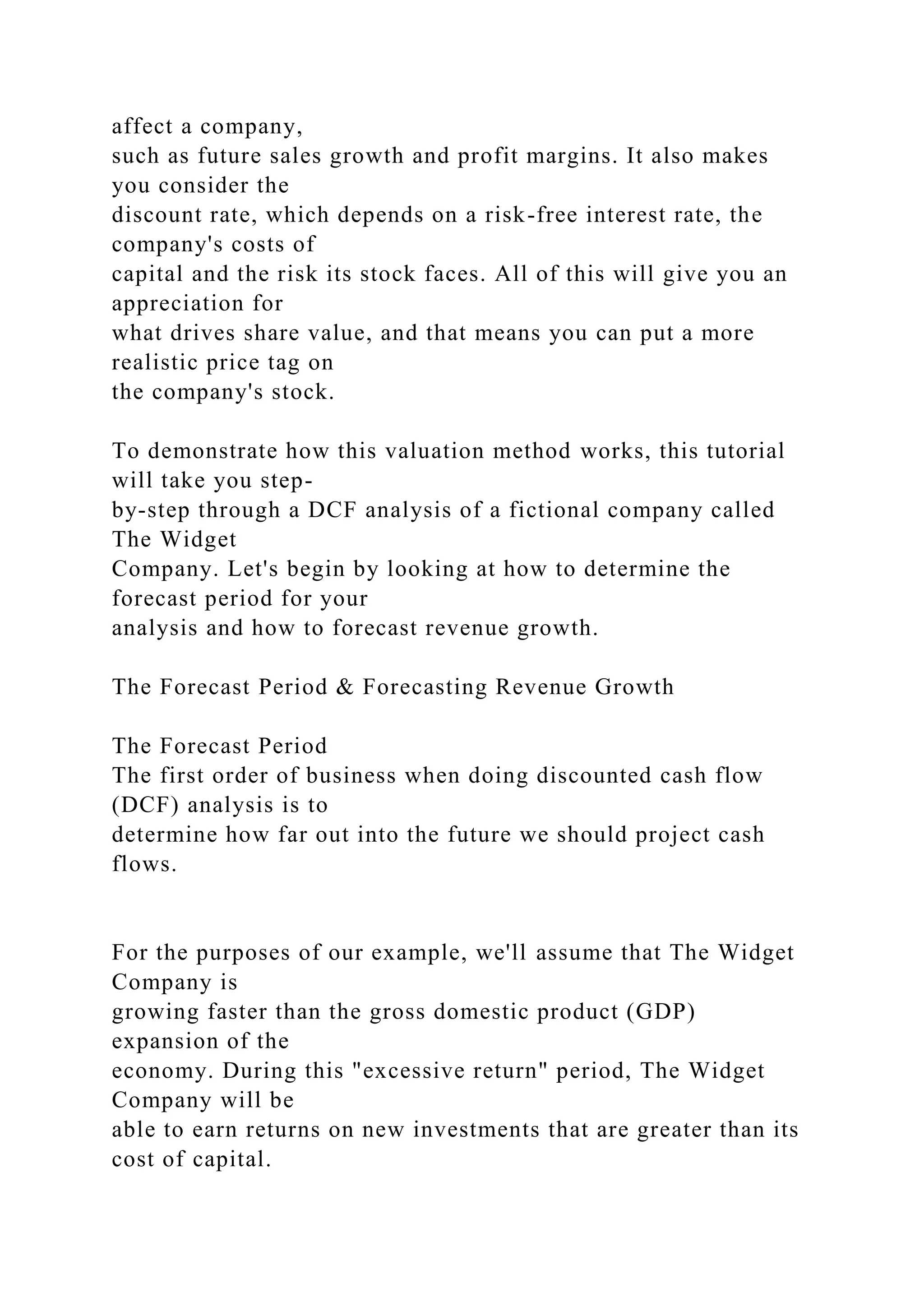

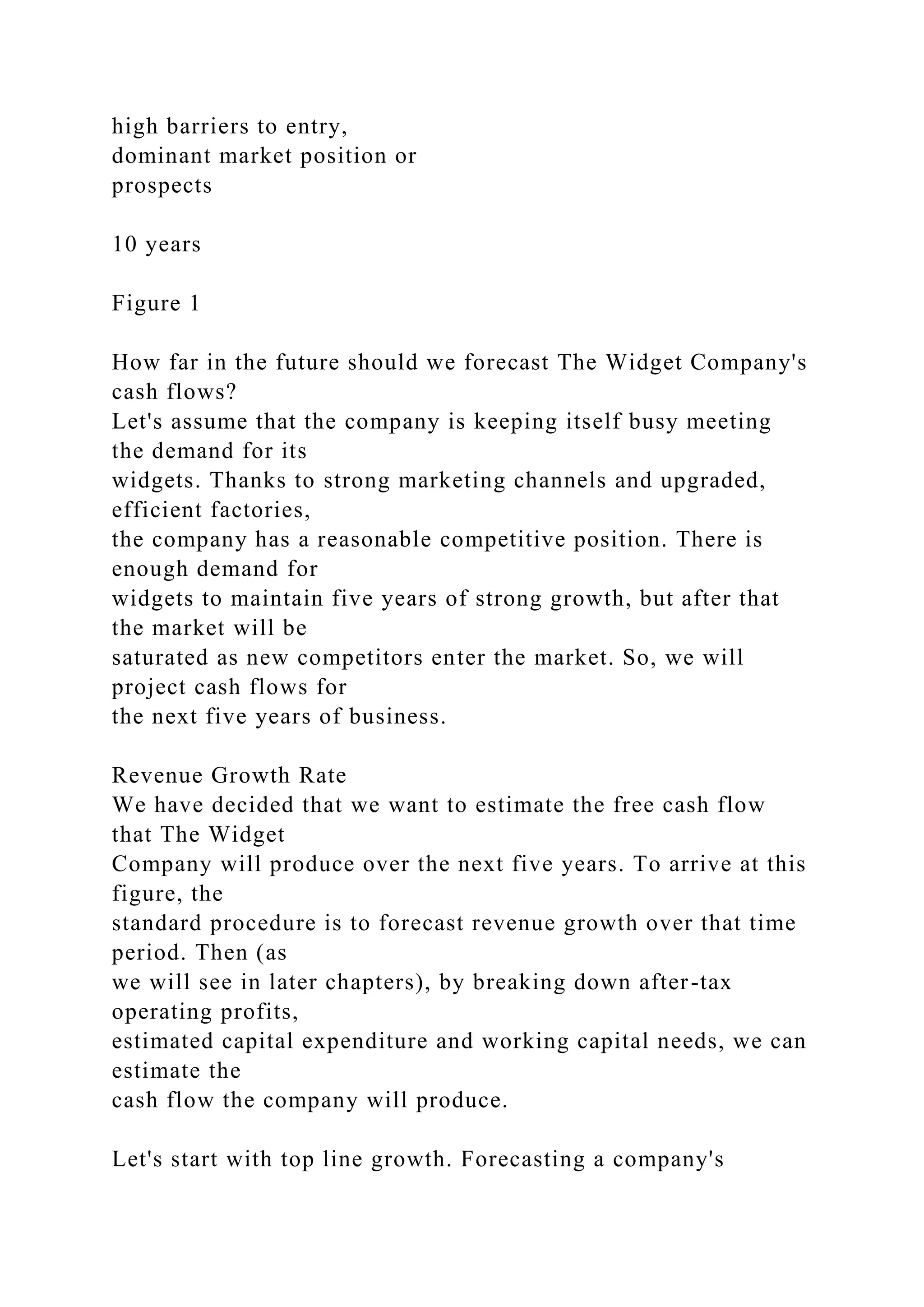

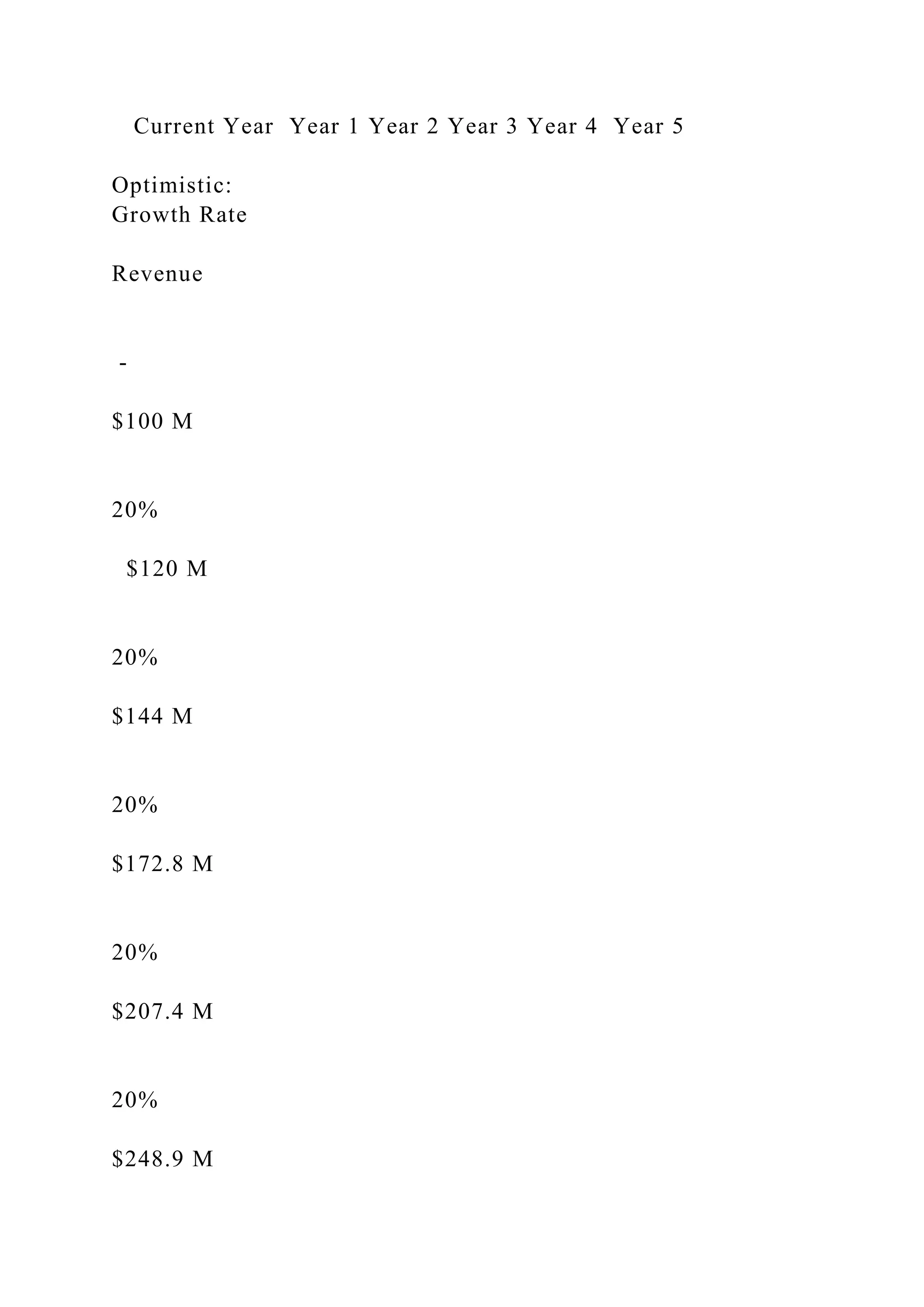

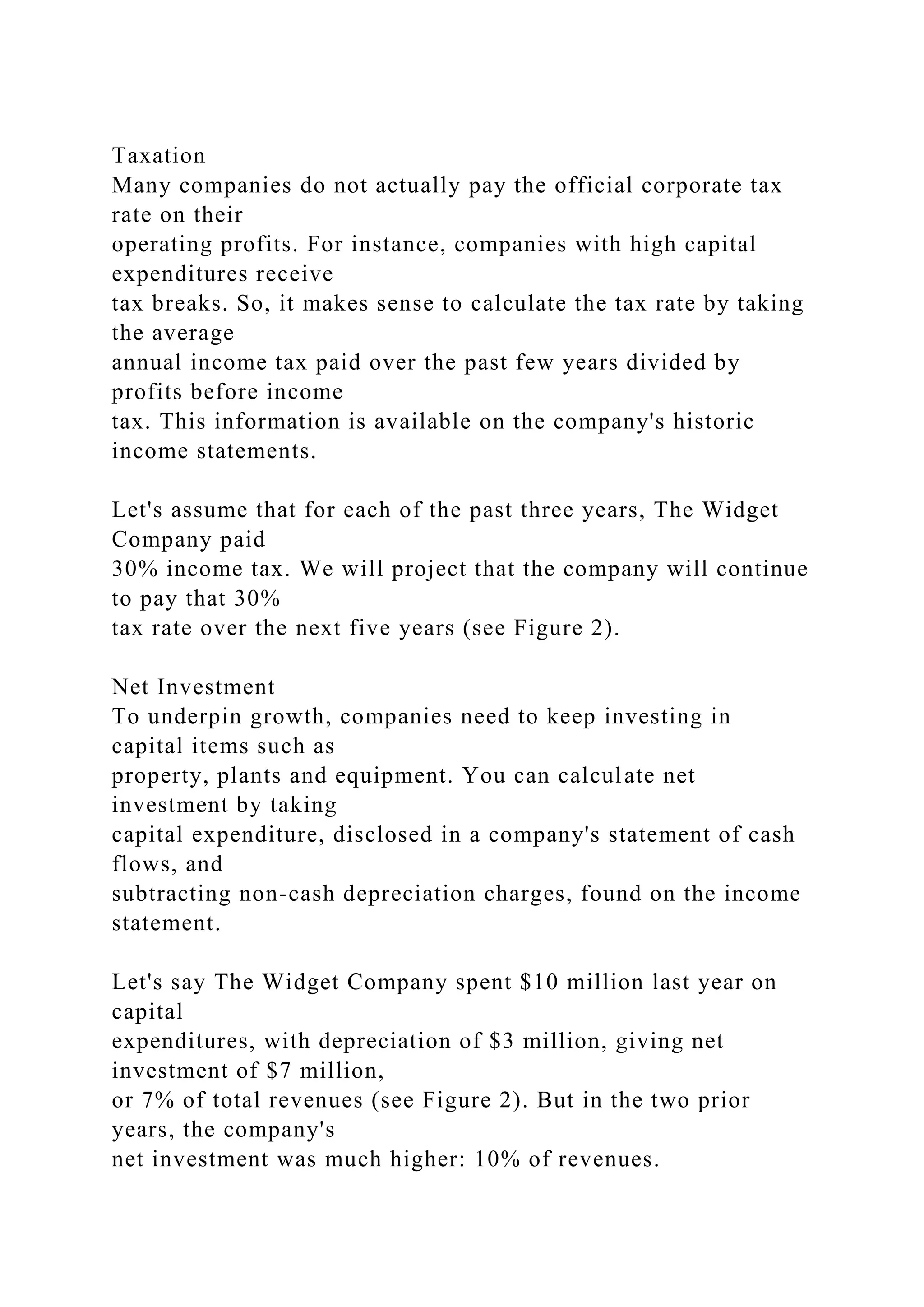

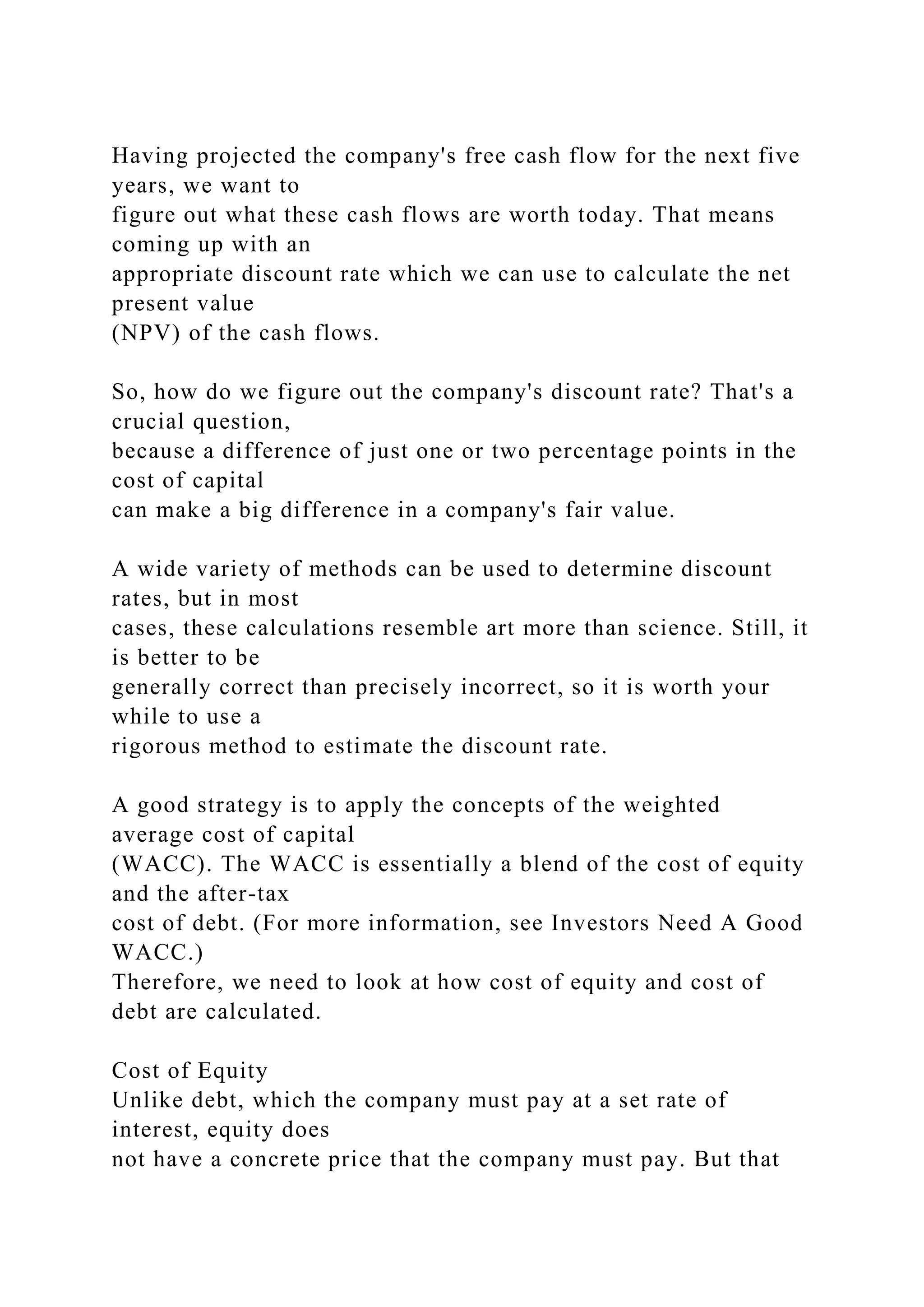

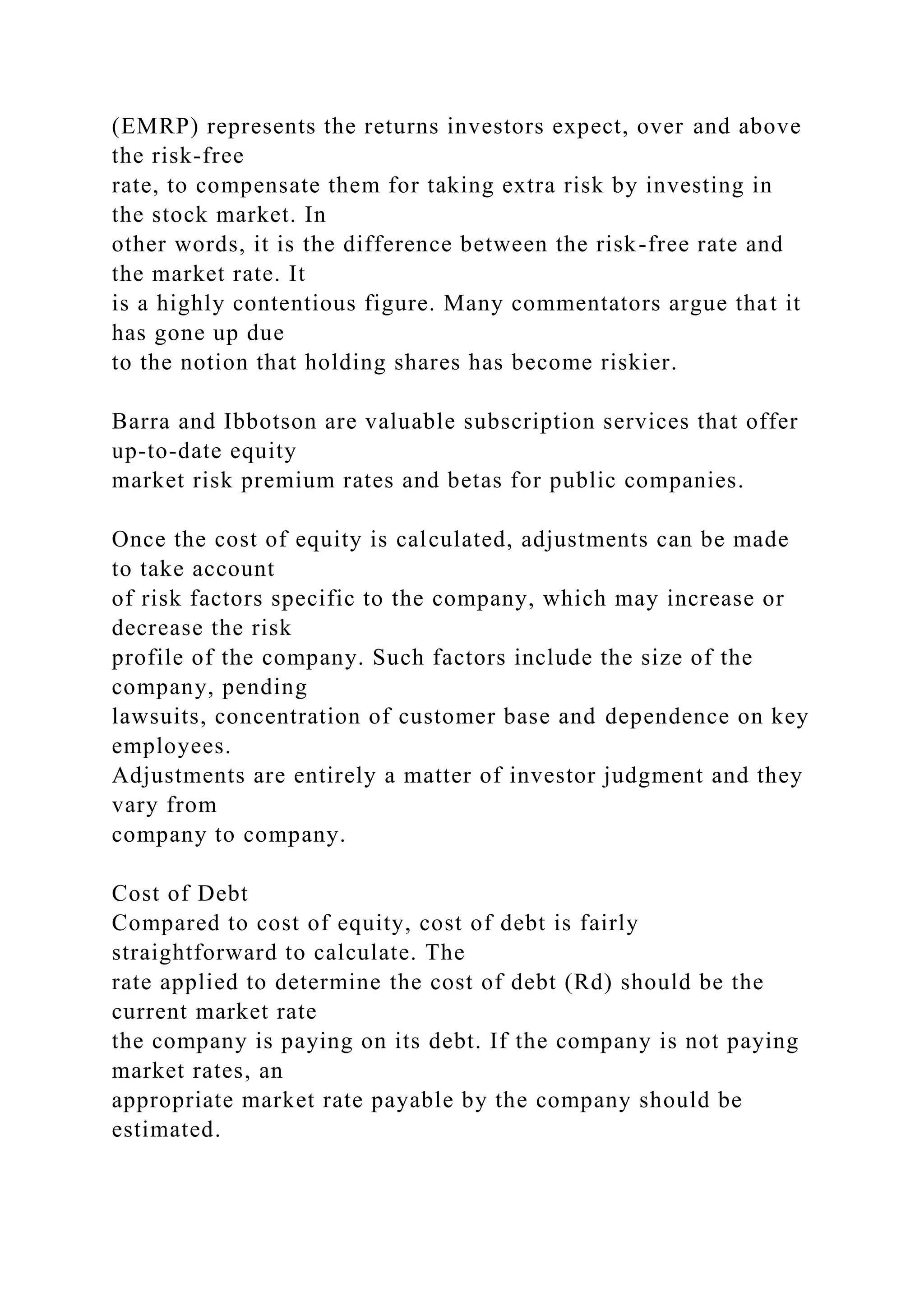

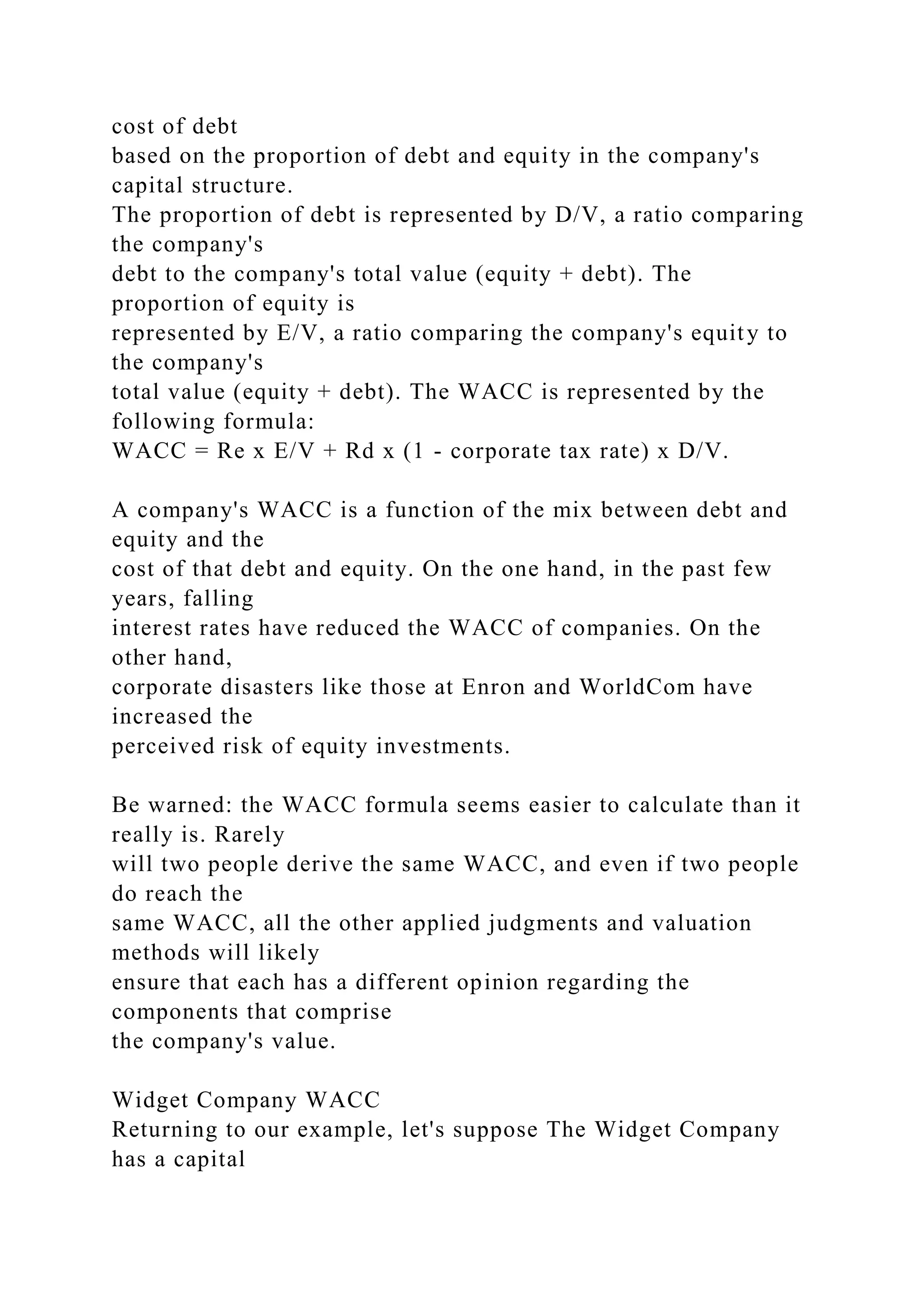

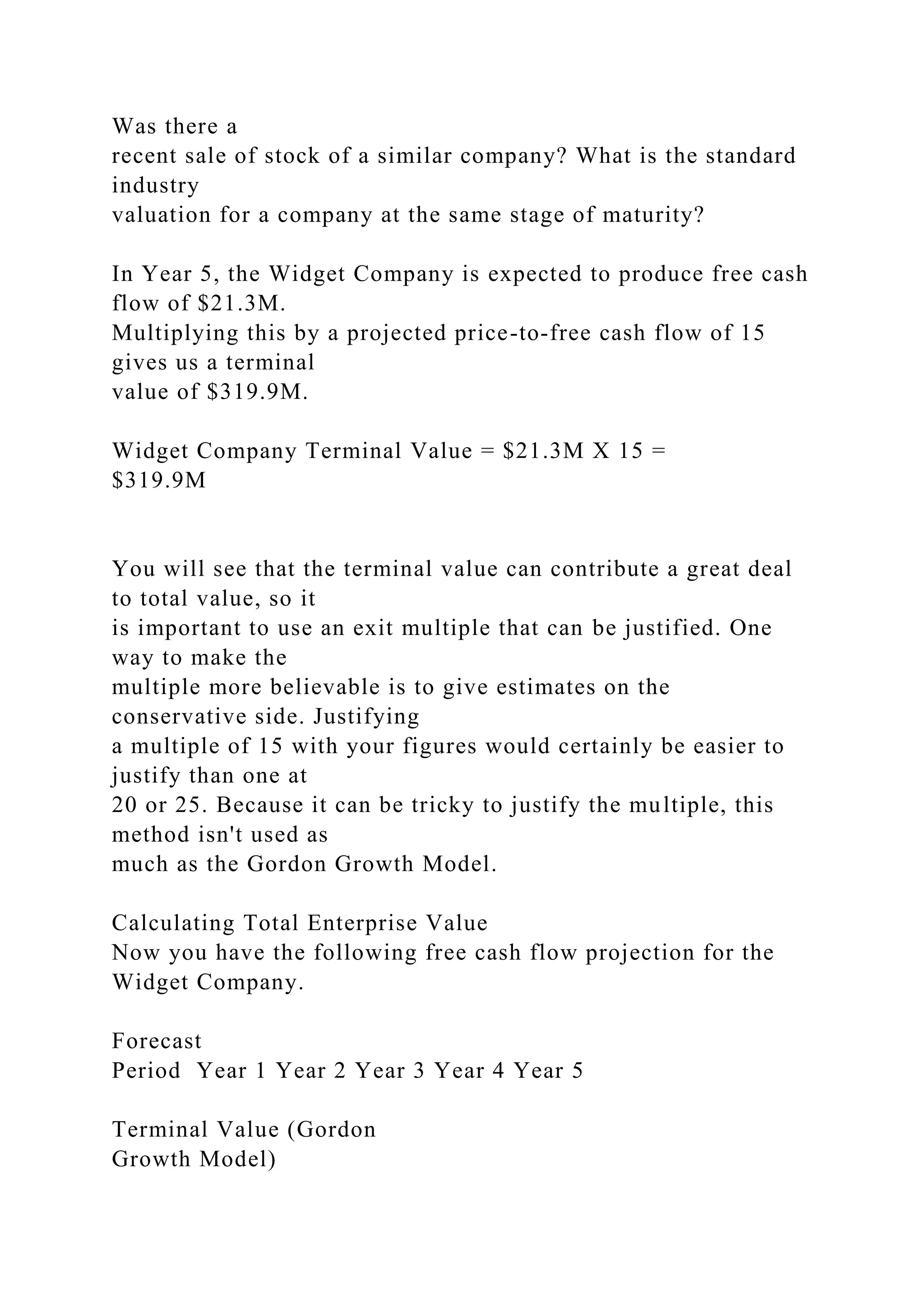

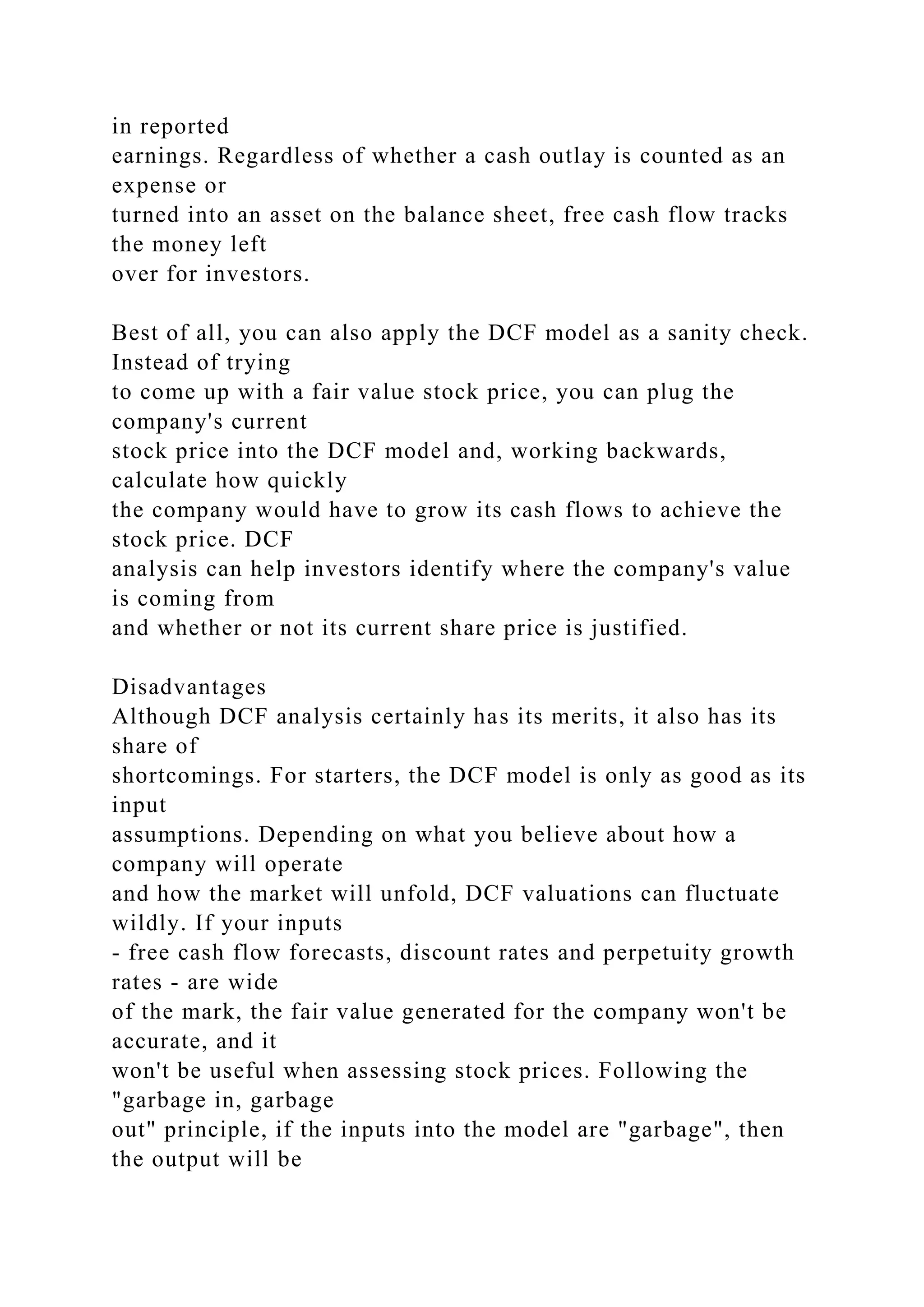

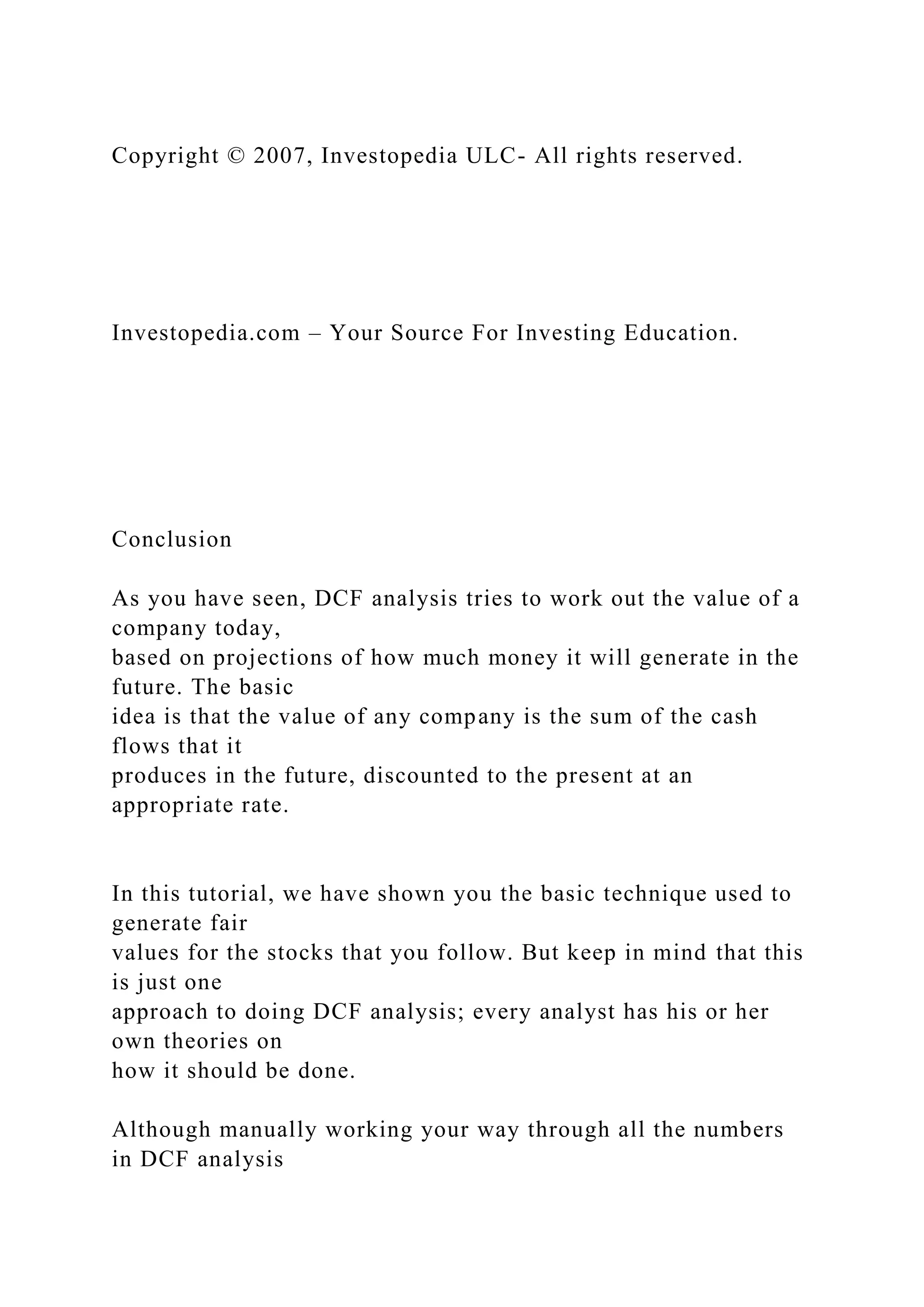

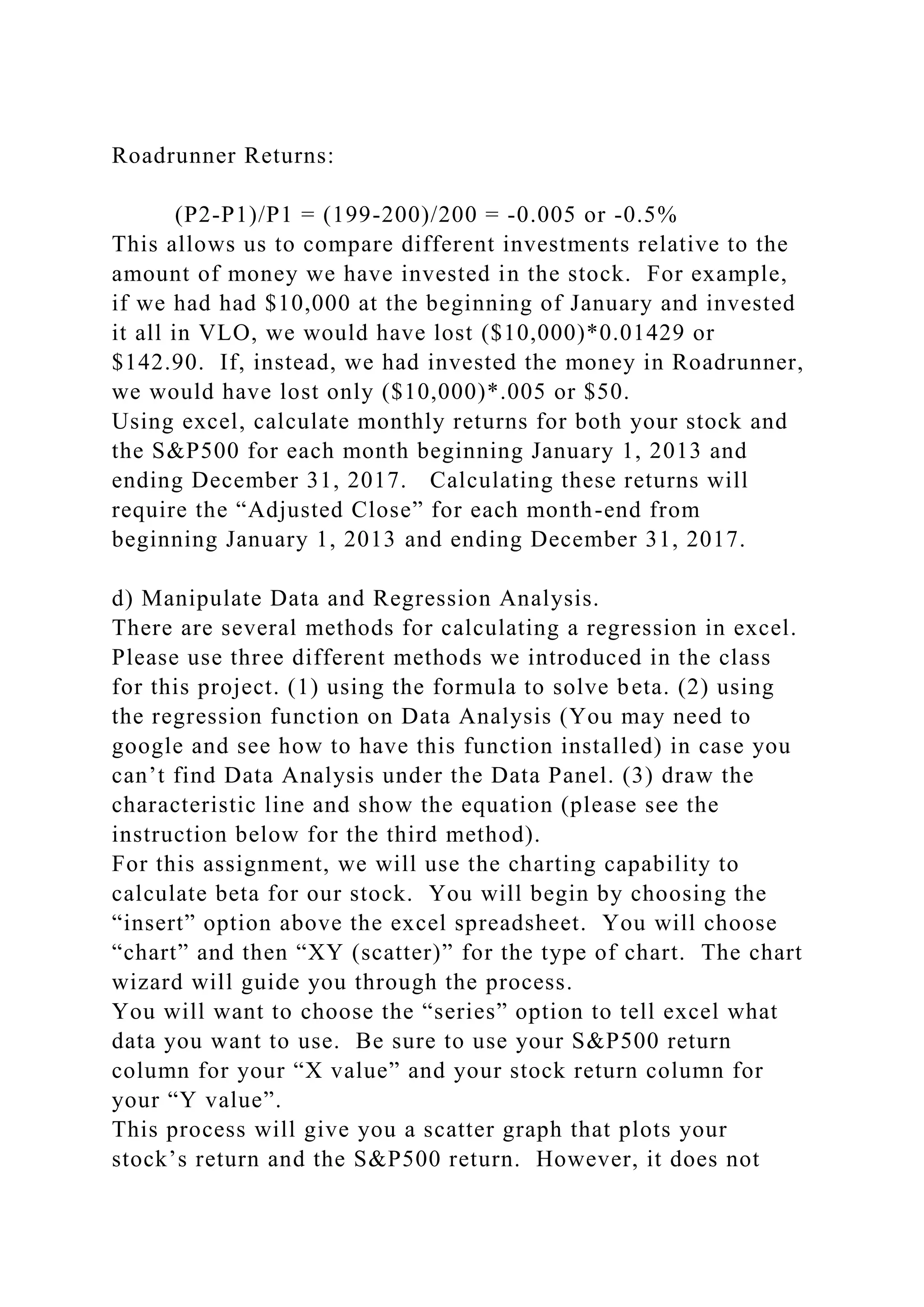

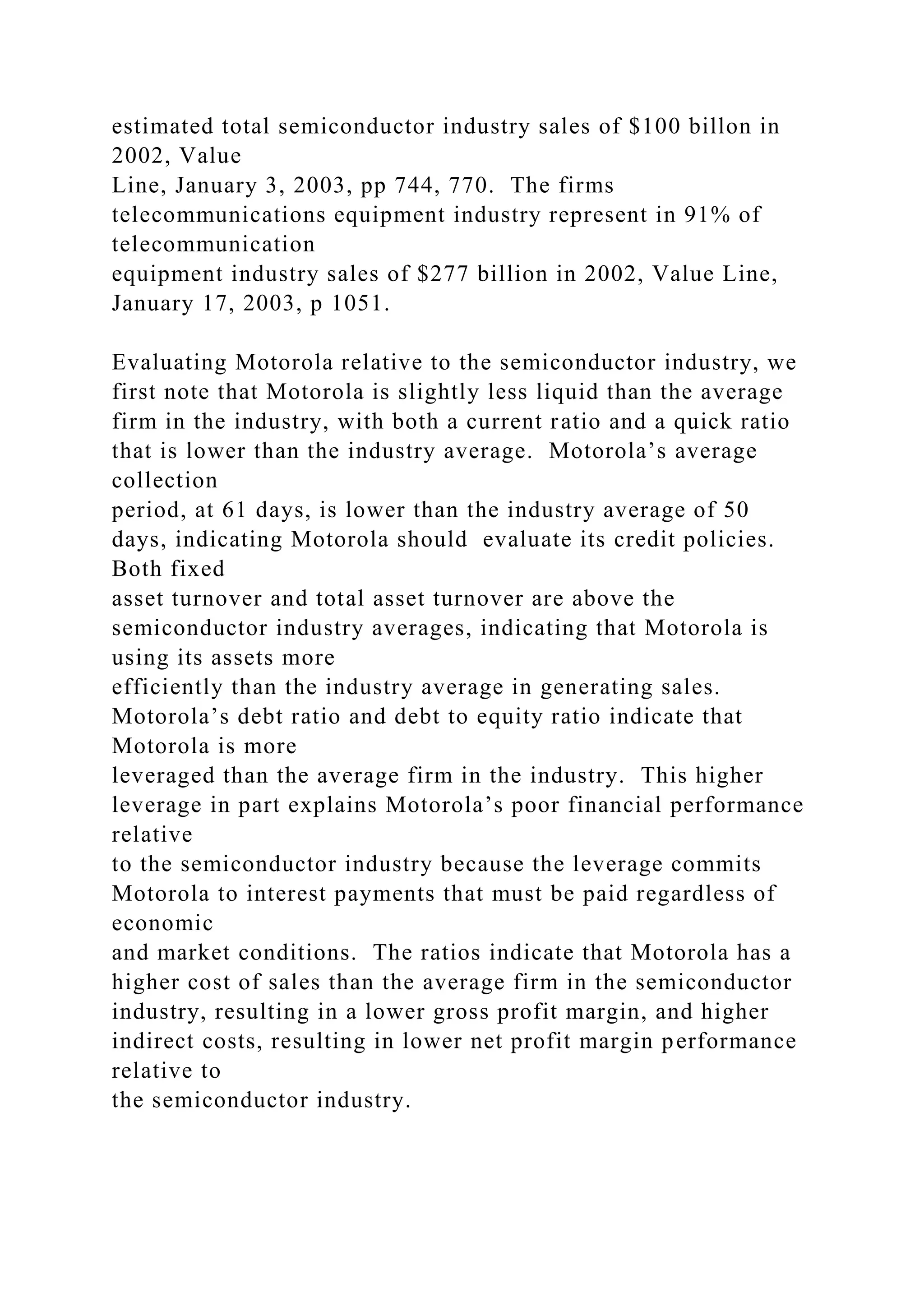

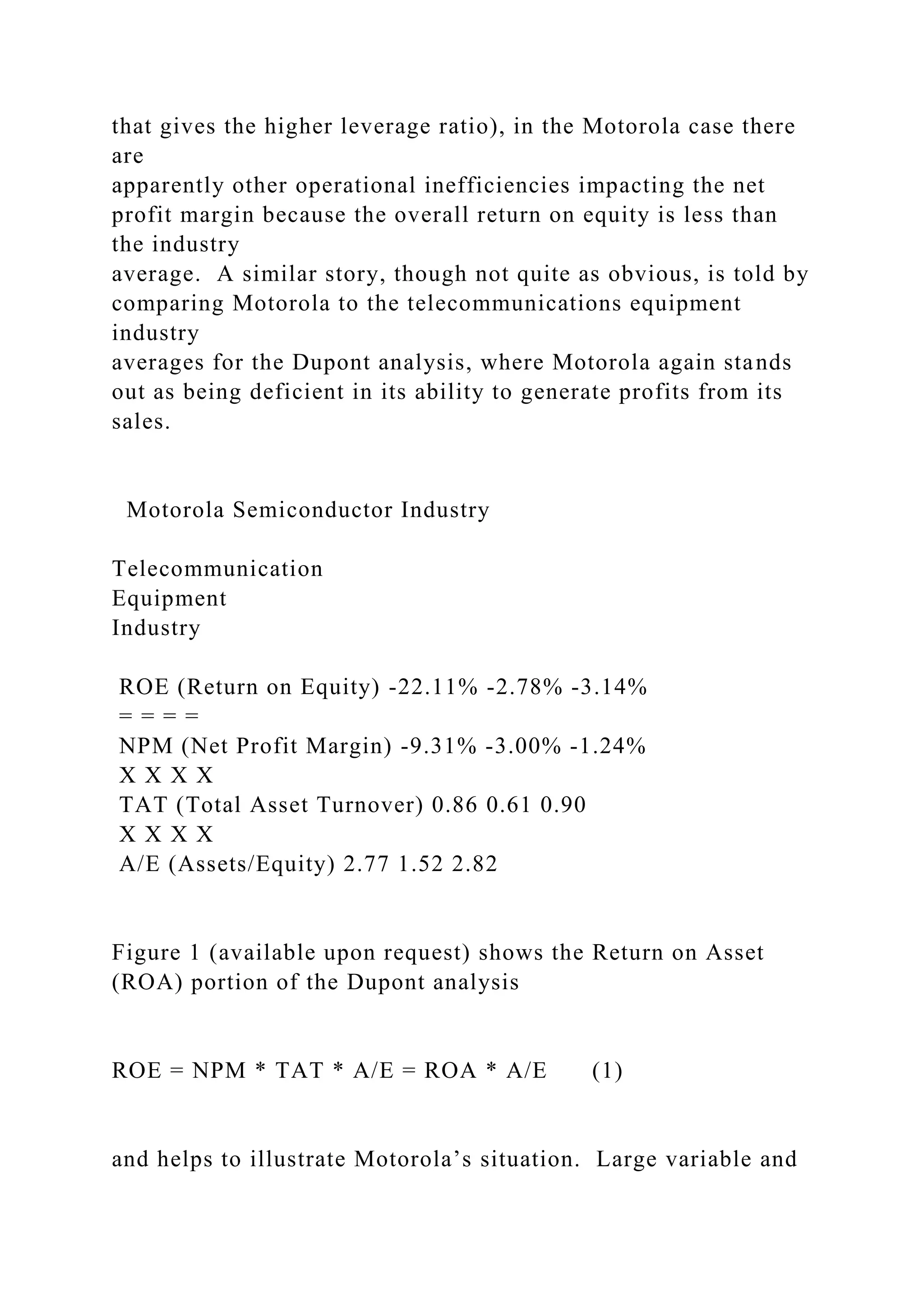

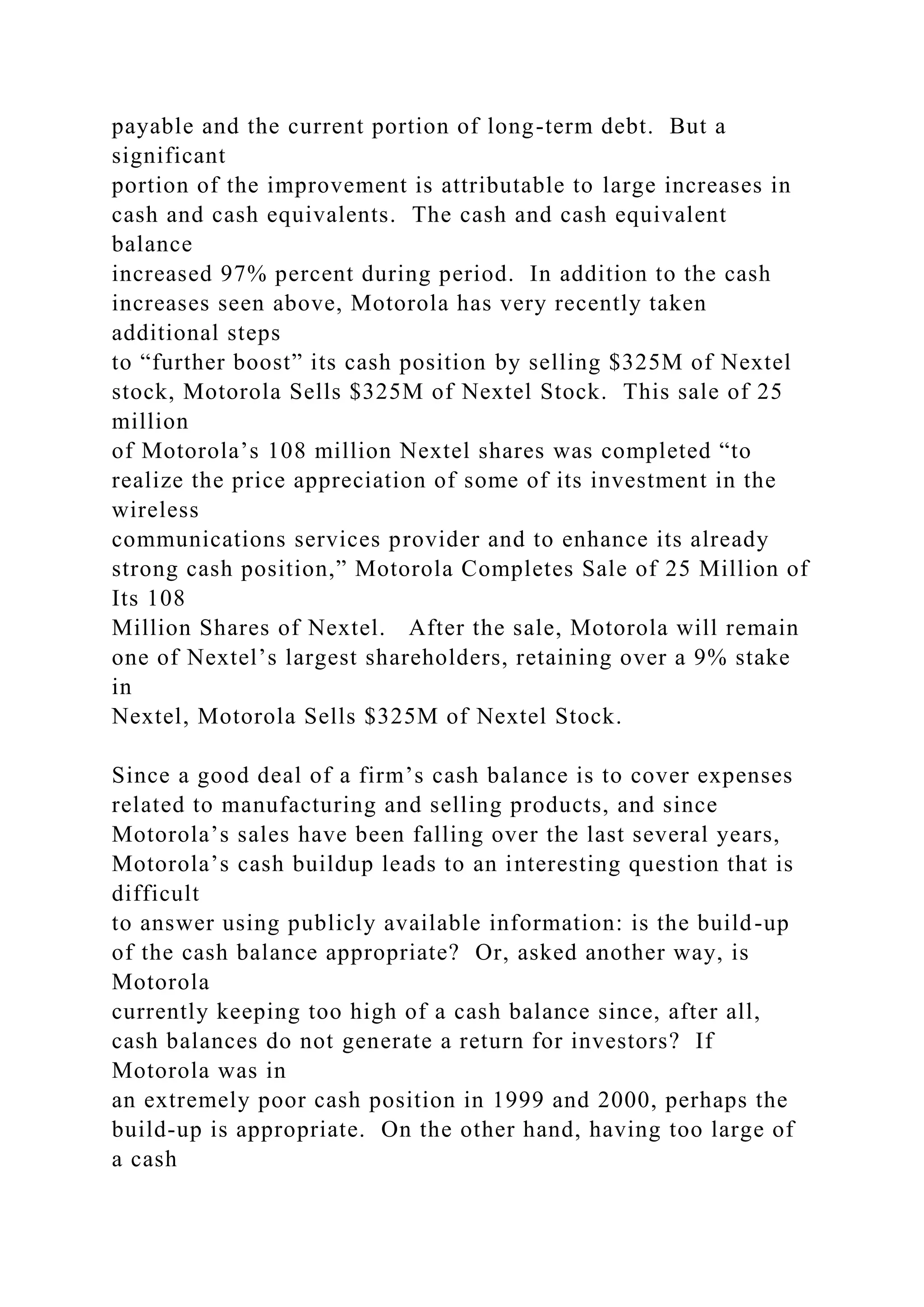

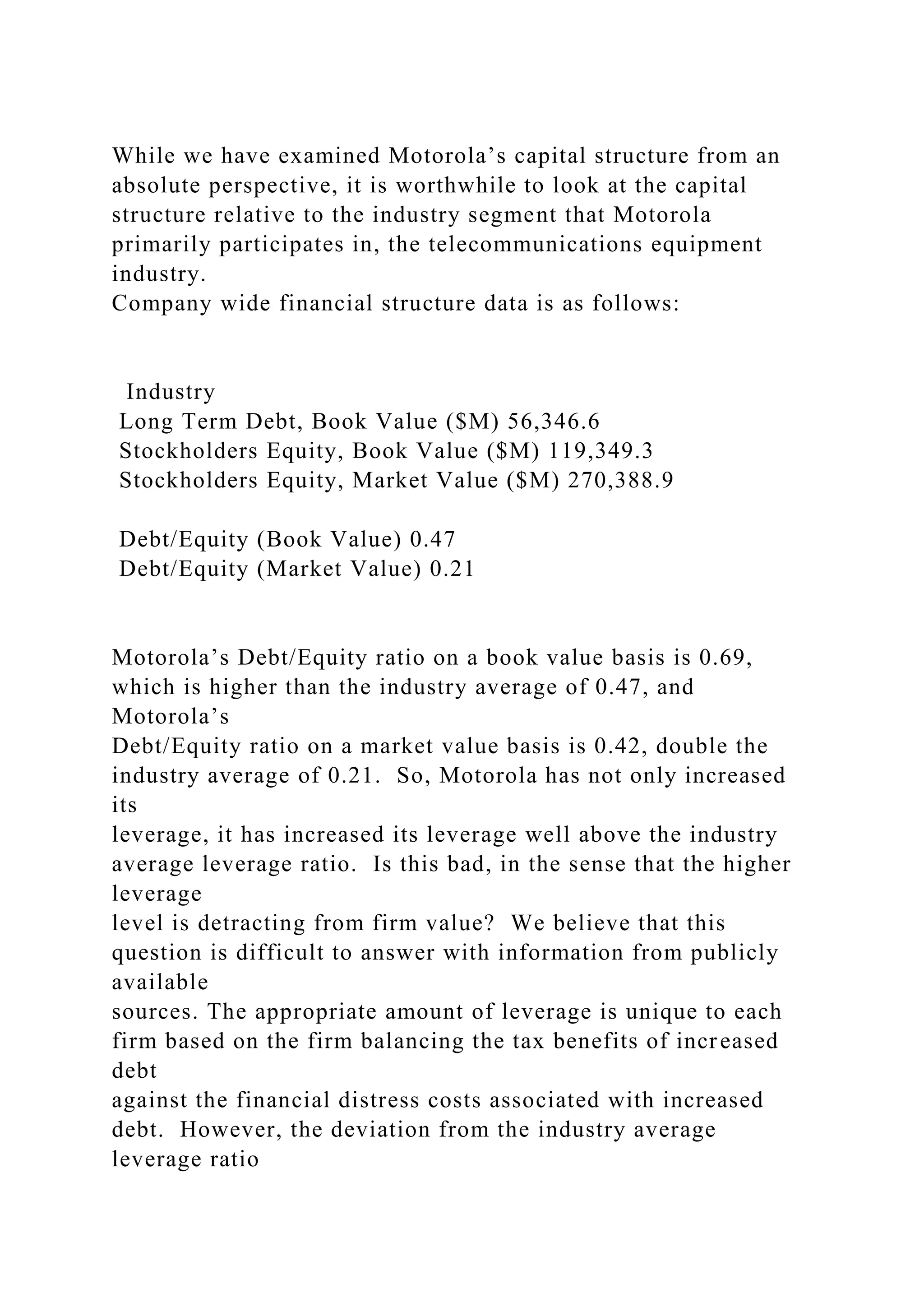

![structure of 40% debt and 60% equity, with a tax rate of 30%.

The risk-free rate

(RF) is 5%, the beta is 1.3 and the risk premium (RP) is 8%.

The WACC comes

to 10.64%. So, rounded up to the nearest percentage, the

discount rate for The

Widget Company would be 11% (see Figure 1).

WACC for The Widget Company

Cost of Debt Cost of Equity

0.40 [Rd x (1-.30)] +

0.40 [5.0 x 0.7)] +

0.40 [3.5] +

1.40 +

0.60 [RF + b(RP)]

0.60 [5.0 + 1.3(8)]

0.60 [15.4]

9.24

This tutorial can be found at:

http://www.investopedia.com/university/dcf/default.asp

(Page 10 of 16)

Copyright © 2007, Investopedia ULC- All rights reserved.](https://image.slidesharecdn.com/fin430financetheoryandpracticeprojectassignmentscalculat-221031130230-ab53fe6e/75/FIN-430-Finance-Theory-and-PracticeProject-AssignmentsCalculat-docx-111-2048.jpg)

![University of Wollongong, [email protected]

T. Grai

Oakland University, USA

S. Haslitt

Oakland University, USA

C. B. McGowan

Universiti Kebangsaan Malaysia, [email protected]

Research Online is the open access institutional repository for

the

University of Wollongong. For further information contact the

UOW

Library: [email protected]

Publication Details

This article was originally published as Collier, H, Grai, T,

Haslitt, S and McGowan, CB, An example of the use of

financial ratio

analysis: the case of Motorola, Decision Sciences Institute

Conference, Florida, 2-6 March 2004.

http://ro.uow.edu.au/

http://ro.uow.edu.au/

http://ro.uow.edu.au/

http://ro.uow.edu.au

http://ro.uow.edu.au/commpapers

http://ro.uow.edu.au/business

http://ro.uow.edu.au/

http://ro.uow.edu.au/

An example of the use of financial ratio analysis: the case of

Motorola

Abstract

In this paper, we demonstrate the use of actual financial data for](https://image.slidesharecdn.com/fin430financetheoryandpracticeprojectassignmentscalculat-221031130230-ab53fe6e/75/FIN-430-Finance-Theory-and-PracticeProject-AssignmentsCalculat-docx-131-2048.jpg)

![Henry W. Collier, University of Wollongong, [email protected]

Timothy Grai, Oakland University

Steve Haslitt, Oakland University

Carl B. McGowan, Jr., Universiti Kegangsaan Malaysia,

[email protected]

Abstract: In this paper, we demonstrate the use of actual

financial data for financial ratio analysis. We construct a

financial and

industry analysis for Motorola Corporation. The objective is to

show students exactly how to compute ratios for an actual

company. This paper demonstrates the difficulties in applying

the principles of financial ratio analysis when the data are not

homogeneous as is the case in textbook examples. We use

Motorola as an example because the firm has several segments,

two of

which account for the majority of sales and represent two

industries (semi-conductor and communications) that have

different

characteristics. The case illustrates the complexity of financial

analysis.

MOTOROLA SEGMENT ANALYSIS

Motorola is a global manufacturer of communication products,

semiconductors, and embedded electronic solutions. The

company is

divided into six operating segments that publicly report

financial results. The Personal Communication Segment (PCS)

designs,

manufactures, and markets wireless communication products for

service subscribers. Products include wireless handsets,

personal 2-

way radios, and messaging devices, along with the associated](https://image.slidesharecdn.com/fin430financetheoryandpracticeprojectassignmentscalculat-221031130230-ab53fe6e/75/FIN-430-Finance-Theory-and-PracticeProject-AssignmentsCalculat-docx-133-2048.jpg)

![Journal of

Financial Economics, 60, 2001, pp. 187-243.

Motorola Completes Sale of 25 Million of Its 108 Million

Shares of Nextel, retrieved from

http://biz.yahoo.com/prnews/030304/cgtu025_1.html

Motorola Sells $325M of Nextel Stock, retrieve from

http//biz.yahoo.com/ap/030305/Motorola_Nextel_1.html

Nokia Unveils New Phones to Crack CDMA Market, retrieved

from

http://biz.yahoo.com/rc/030317_tech_nokia_handsets_2.html

Nokia, Motorola Lose China Market Share to Domestic

Companies, retrieved from

http://biz.yahoo.com/djus/030314/0020000011_1.html

Reiter, Chris. Mobile Phone Sales Rose 6% to 423 Million

Units Last Year, Dow Jones Business New, retrieved from

http://biz.yahoo.com/djus/030309/2037000327_3.html

Yahoo.finance.com

Yahoo.marketguide.com

The data tables and sources of data used in this paper are

available upon request from Carl B. McGowan, Jr.,

[email protected] .

University of WollongongResearch Online2004An example of

the use of financial ratio analysis: the case of MotorolaH. W.

CollierT. GraiS. HaslittC. B. McGowanPublication DetailsAn

example of the use of financial ratio analysis: the case of

MotorolaAbstractDisciplinesPublication Details](https://image.slidesharecdn.com/fin430financetheoryandpracticeprojectassignmentscalculat-221031130230-ab53fe6e/75/FIN-430-Finance-Theory-and-PracticeProject-AssignmentsCalculat-docx-154-2048.jpg)