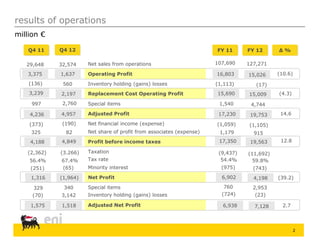

eni reported its 2012 fourth quarter and preliminary full year results. Some key points:

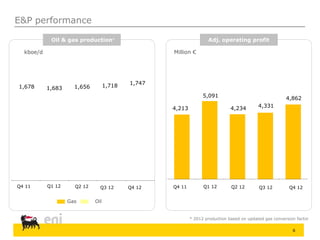

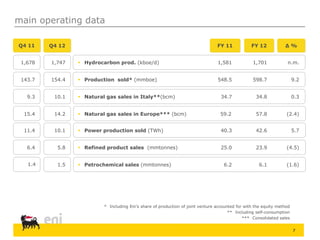

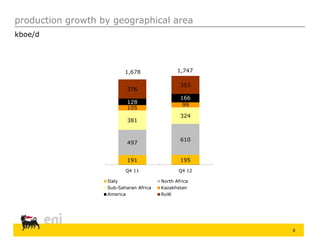

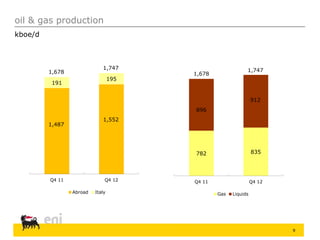

- Production increased to 1.747 million boe/day in Q4 2012, up from 1.678 million boe/day in Q4 2011.

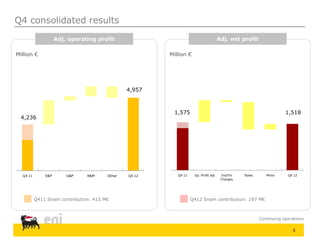

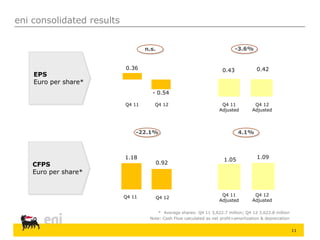

- Adjusted net profit was €1.518 billion in Q4 2012, down slightly from €1.575 billion in Q4 2011.

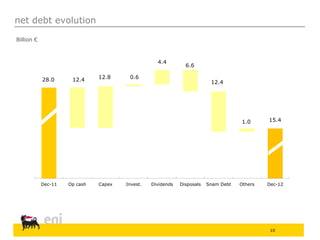

- Net debt was reduced by over €12 billion from end 2011 to end 2012 through asset sales and cash flow.

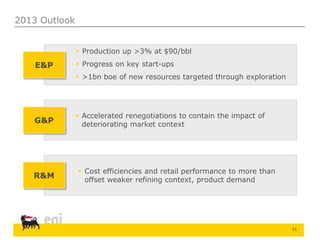

- Production is forecast to increase over 3% in 2013 at $90 per barrel, with progress on key project start-ups.