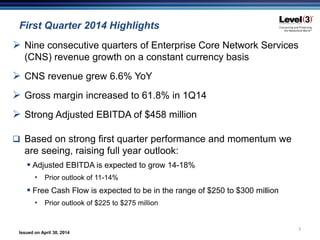

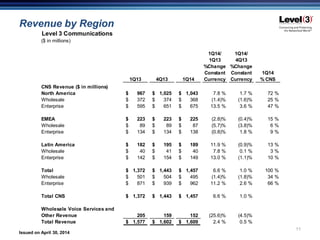

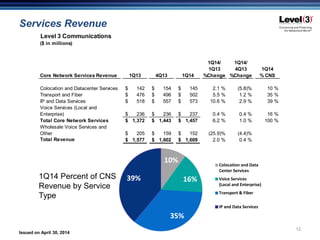

Level 3 Communications reported first quarter 2014 results with the following highlights:

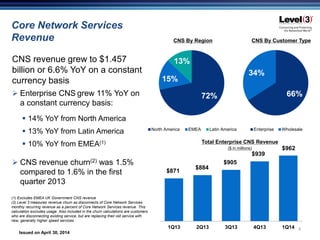

- Core Network Services revenue grew 6.6% year-over-year to $1.457 billion driven by 11% growth in Enterprise CNS.

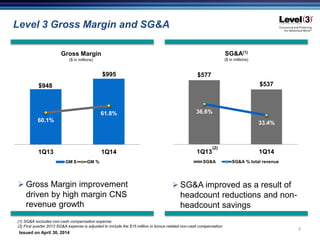

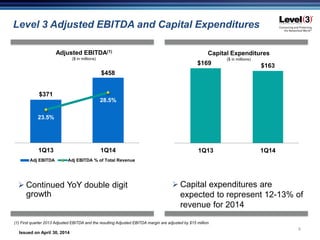

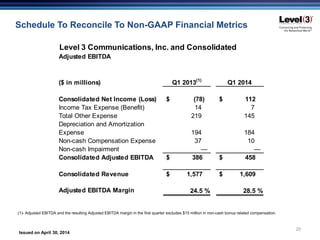

- Gross margin improved to 61.8% and Adjusted EBITDA grew 23% to $458 million.

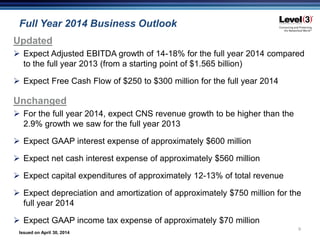

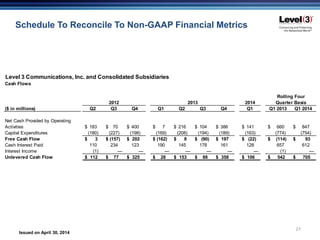

- Based on strong performance, Level 3 raised its full year 2014 outlook for Adjusted EBITDA growth to 14-18% and Free Cash Flow to $250-300 million.