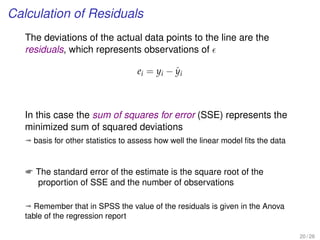

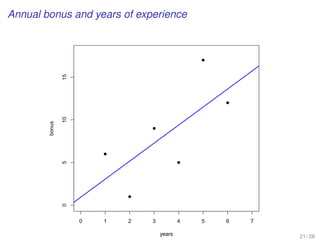

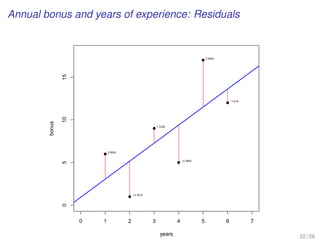

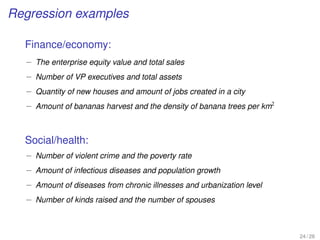

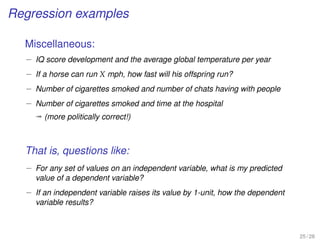

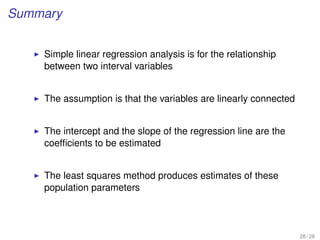

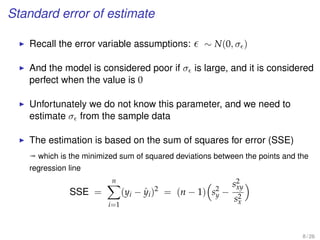

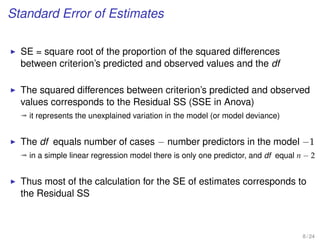

This document provides an overview of lectures for a Business Statistics II course between weeks 11-19. It covers topics like simple regression analysis, estimation in regression models, and assessing regression models. Key points include using least squares to estimate regression coefficients, calculating residuals, and evaluating fit using measures like the coefficient of determination and standard error of the estimate. Examples are provided to illustrate simple linear regression analysis.

![EXAMPLE-DO-IT-YOUR-SELF

[A predicted variable and a predictor variable]

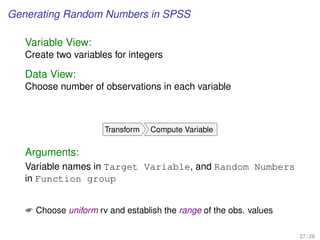

We do examples with random numbers...

26 / 28](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-26-320.jpg)

![EXAMPLE-DO-IT-YOUR-SELF

[A predicted variable and a predictor variable]

Data generation in SPSS

• Choose your DV and IV, and number of observations. Then generate

uniform random numbers:

Transform Compute Variable...

• Variable names in Target Variable , and Random Numbers in Function group

• Select Rv.Uniform in Functions and Special Variables , and then establish the

range of the observation values in Numeric Expression

9 / 31](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-63-320.jpg)

![EXAMPLE-DO-IT-YOUR-SELF

[A predicted variable and a predictor variable]

Confidence intervals of the regression model in SPSS

• We perform the linear regression analysis

Analyze Regression Linear

• Individual confidential intervals are given in this command, where in the

bottom Save we select in Prediction Intervals

– the Individual option for Prediction Interval

– the Mean option for the Confidential Interval Estimator

Both at the usual 95% value

10 / 31](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-64-320.jpg)

![EXAMPLE-DO-IT-YOUR-SELF

[A predicted variable and a predictor variable]

Confidence intervals of the regression model in SPSS (2)

• Since we have chosen Save , the confidential interval values are saved in

the Data Editor

ª here LMCI [UMCI] and LICI [UICI] stand respectively for Lower

[Upper] Mean and Individual Confidence Interval

The Variable View in the Data Editor gives the labels of the new variables

11 / 31](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-65-320.jpg)

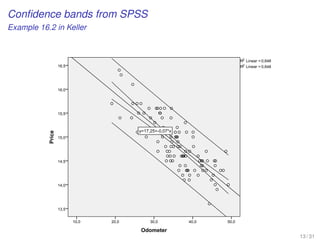

![EXAMPLE-DO-IT-YOUR-SELF

[A predicted variable and a predictor variable]

Visualizing confidence intervals in SPSS

• The visualization of both types of confidence intervals are possible after we

plotted the variables

Graphs Legacy Dialogs Scatter/Dot... Simple Scatter

• From Elements Fit Line at Total of the graph Chart Editor, we look in the

tab Fit Line (Properties) the options Mean and Individual in the

Confidential Intervals section for the two CI estimators

12 / 31](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-66-320.jpg)

![EXAMPLE-DO-IT-YOUR-SELF

[A predicted variable and a predictor variable]

Predict new observations in SPSS

• To forecast new observations, first we need to put the value in the

dependent variable of the Data Editor

• Then we choose a linear regression analysis

Analyze Regression Linear

• And, after we press the Save bottom, we select the Unstandardized

option in Predicted Values

14 / 31](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-68-320.jpg)

![Step-by-step simple linear regression analysis

EXAMPLE

[Population and avg. Household Size in Global Cities]

Be aware that in this case the model is chosen in advance, and

we adopt a linear relationship between two variables

18 / 24](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-103-320.jpg)

![Step-by-step simple linear regression analysis

EXAMPLE

[Population and avg. Household Size in Global Cities]

1. Determine the response and the explanatory variables

2. Visualize the data through a scatter plot

3. Perform basic descriptive statistics

19 / 24](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-104-320.jpg)

![Step-by-step simple linear regression analysis

EXAMPLE

[Population and avg. Household Size in Global Cities]

4. Estimate the coefficients (intercept and slope)

5. Compute the fitted values and the residuals

6. Obtain the sum of squares for errors (Residual SS)

20 / 24](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-105-320.jpg)

![Step-by-step simple linear regression analysis

EXAMPLE

[Population and avg. Household Size in Global Cities]

7. Estimate the coefficients (intercept and slope)

a) standard error of estimate

b) test of the slope

c) coefficient of determination

21 / 24](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-106-320.jpg)

![Step-by-step simple linear regression analysis

EXAMPLE

[Population and avg. Household Size in Global Cities]

8. Perform the regression diagnostics

a) confidence regions for individual prediction intervals

b) confidence regions for the average prediction interval

9. Make a residual analysis

a) nonnormality, heteroskedasticity, nonindependence errors

22 / 24](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-107-320.jpg)

![Step-by-step simple linear regression analysis

EXAMPLE

[Population and avg. Household Size in Global Cities]

10. Detect outliers and influential observations

11. Interpret the results

12. Draw the conclusions

23 / 24](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-108-320.jpg)

![Multiple regression analysis

WORKING EXAMPLE

[Prediction of avg. Household Size in Global Cities]

Multiple regression analysis using globalcity-multiple.sav

17 / 17](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-125-320.jpg)

![WORKING EXAMPLE

[Average Household Size in Global Cities]

Model Building

(Data in globalcity-multiple.sav)

10 / 16](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-135-320.jpg)

![WORKING EXAMPLE

[Average Household Size in Global Cities]

Comparing nested models

12 / 16](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-137-320.jpg)

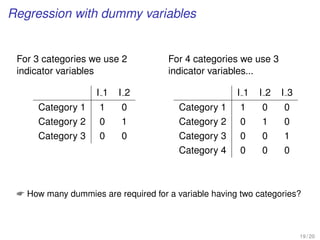

![Dummies with command-line

We need to create a number of dummy variables according to

the existing number of categories.

Syntax in SPSS:

RECODE varlist_1 (oldvalue=newvalue) ... (oldvalue=newvalue)

[INTO varlist_2].

[/varlist_n].

EXECUTE.

20 / 20](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-161-320.jpg)

![EXERCISE: MULTIPLE REGRESSION WITH A

POLYTOMOUS INDICATOR VARIABLE

[MBA data from Keller xm18-00.sav]

20 / 24](https://image.slidesharecdn.com/business-statistics-ii-aarhus-bss-170814111356/85/Business-statistics-ii-aarhus-bss-181-320.jpg)