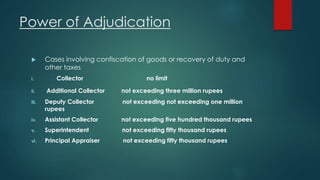

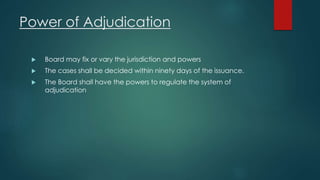

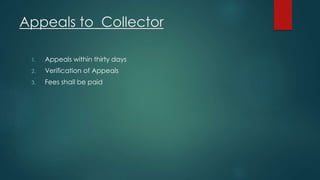

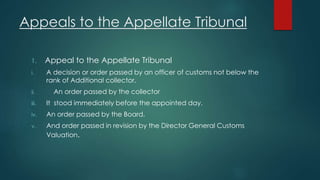

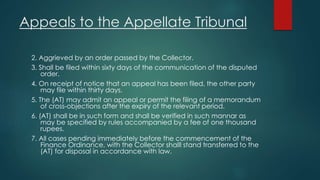

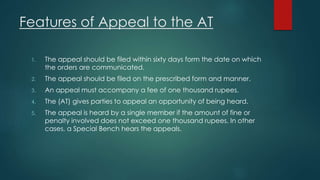

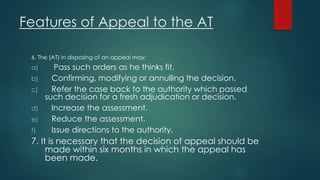

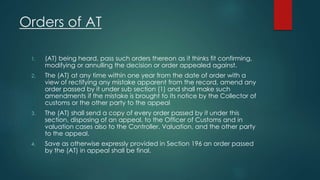

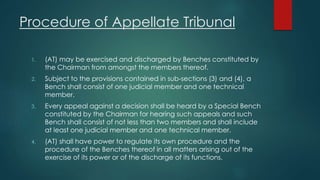

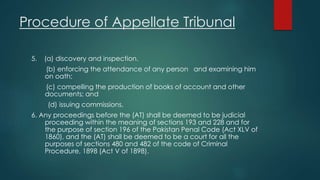

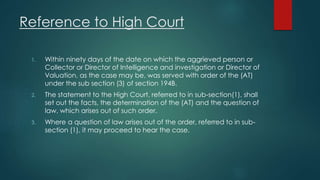

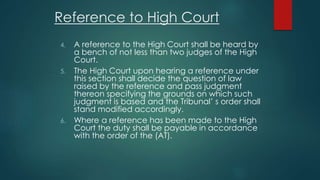

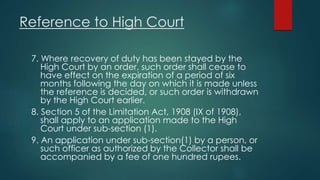

The document details the framework for the levy, exemption, and repayment of customs duties in Pakistan, outlining the types of goods subject to duty, exemptions, and the processes for appeals and adjudications. It specifies the powers and procedures related to customs appeals to the appellate tribunal, including timelines, fees, and roles of judicial and technical members. Additionally, it addresses the procedure for references to the high court concerning the decisions of the appellate tribunal.