The document discusses various budgeting concepts and terms:

- Budgets are quantitative expressions of plans that translate organizational goals into operational terms. They are used for both planning and control by comparing actual outcomes to planned outcomes.

- Master budgets are comprehensive financial plans that include operating budgets for income-generating activities and financial budgets for cash flows and financial position.

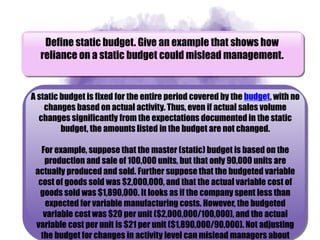

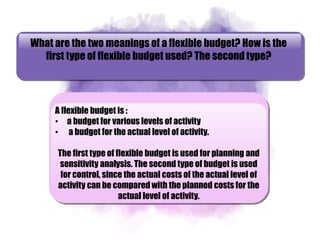

- Flexible budgets allow costs to vary with changes in activity levels, while static budgets do not change with varying activity. Activity-based budgets determine resource needs by first linking them to activities and outputs.