The document discusses changes to service tax rates and exemptions in the Finance Act 2016. Key points include:

1. A new Krishi Kalyan Cess of 0.5% will be imposed on all taxable services, increasing the effective service tax rate to 15%.

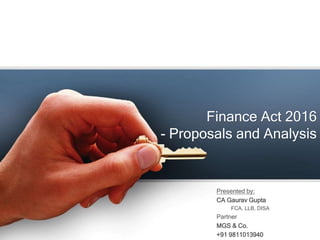

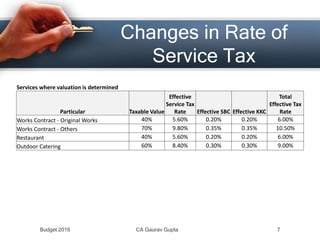

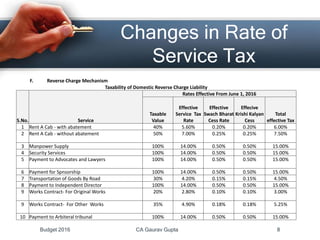

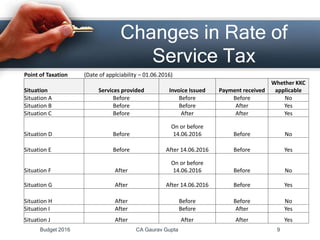

2. Service tax rates have been increased for various services such as transport, hotels, restaurants. Reverse charge rates have also been increased.

3. Education services have been removed from the negative list and will be taxed, with some exemptions.

4. All services provided by the government to business entities will be taxable.

5. Transportation of goods from outside India to India is now taxable.

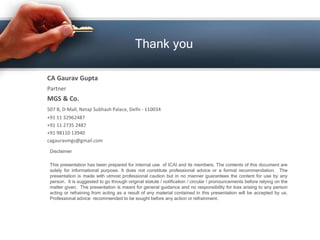

![Changes in Rate of

Service Tax

Levy of “Krishi Kalyan Cess” (KKC)

• An enabling provision is being incorporated in the Finance Bill, 2016

(Chapter VI/clause 158) to empower the Central Government to impose

KKC as service tax on all or any of the taxable services at the rate of 0.5

per cent on the value of such services.

• Now the effective rate of levy from 01.06.2016 shall be 15% viz., 14%

Service Tax plus 0.5% Swachh Bharat Cess plus 0.5% Krishi Kalyan

Cess. It is important to mention that all other rates shall correspondingly

be changed by way of amendment notification on 01.06.2016.

[effective from 01.06.2016]

Budget 2016 CA Gaurav Gupta 3](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-3-320.jpg)

![Changes in Rate of

Service Tax

Levy of Service Tax on distributors of Lottery

• Explanation 2 in section 65B(44) (definition of “Service”) is proposed to be

amended to clarify that activity carried out by a lottery distributor or selling

agents of the State Government under the provisions of the Lotteries

(Regulation) Act, 1998 (17 of 1998), is leviable to service tax.

• It is forsen that such levy shall be put to test in Court again by such

distributors / agents in light of the decision in case of Future Gaming

Solutions Pvt Ltd. v UOI[2015 (37) S.T.R. 65 (Sikkim)].

[effective from the date of enactment of Finance Bill, 2016]

Budget 2016 CA Gaurav Gupta 10](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-10-320.jpg)

![Changes in Negative List

Education Services omitted from Negative List

• Education services of preschool, higher secondary, recognized degree

courses and certain approved vocational courses found place in negative

list till now. Such services have been proposed to be introduced in

Exemption notification from the date of enactment of Finance Bill. The

move hints at certain more services in education space to be made taxable

soon.

effective from the date of enactment of Finance Bill, 2016]

Budget 2016 CA Gaurav Gupta 12](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-12-320.jpg)

![Changes in Negative List

All Services of Government to Business entity made taxable

• Earlier only support services (other than renting) when provided by

Government to a business Entity, were liable for payment of Service Tax.

• It has thus, been proposed by Finance Bill, 2015, that all services other

than services specified in Section 66D(i) to (ii) when provided by

Government, or a local authority to a business entity be charged to

Service Tax. Accordingly, all services provided by government to a

Business Entity shall hence forth be taxable.

[effective from date to be Notified]

Budget 2016 CA Gaurav Gupta 13](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-13-320.jpg)

![Changes in Negative List

Services of transportation of passenger by stage carriage made taxable

• Earlier, transportation of passenger by stage carriage was in negative list.

The entry is being deleted. Thus, the various mode of passenger

transportation and their taxability after 01.06.2016 shall be as follows:

[effective from 01.06.2016]

Negative List CA Gaurav Gupta 14

Mode of transportation of passenger by Road Taxability post

01.06.2016

Change in position prior

to 01.06.2016

Transportation of passenger by Non air-conditioned

Contract carriage other than for tourism, conducted tour,

hire or charter

Includes Maxi cab and motor cab

Non - Taxable No Change

Transportation of passenger by air conditioned Contract

carriage

Taxable No Change

Radio Taxi Taxable No Change

Air-conditioned Stage Carriage Taxable Changed from non

taxable

Non Air conditioned Stage carriage Exempt Non taxable

Rent- a-cab Taxable Taxable](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-14-320.jpg)

![Changes in Negative List

Transportation of goods from outside India to India made taxable

• Services by way of transportation of goods by an aircraft or a

vessel from a place outside India upto the customs station of

clearance in India was in negative list and was thus, non taxable.

Though such services were taxable as per the provisions of Rule

10 of Place of Provision Rules, 2012, however because of

negative list, such transportation was not taxable. Finance Bill

2016 has proposed to delete the entry from negative list.

• Accordingly, Service Tax would be payable all Indian ship liners

on such transportation of goods. Also, in case of foreign

shipliners, such tax would be payable by persons importing such

goods. The entry would impact taxability of shipliners, multimodal

Transport operators, CHAs, GSAs etc.

[effective from 01.06.2016]

Budget 2016 CA Gaurav Gupta 15](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-15-320.jpg)

![Changes in Exemptions

• Exemption in case of services provided by a Senior Advocate

Exemption has been provided in case of service provided by a senior

advocate by way of legal services to a person other than a person

ordinarily carrying out any activity relating to industry, commerce or any

other business or profession vide clause (c) of entry no. 6 of Notification

No. 25/2012 dated 20.06.2012.

[effective from April 1, 2016]

Budget 2016 CA Gaurav Gupta 17](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-17-320.jpg)

![• Exemption in case of services provided to an Arbitral Tribunal withdrawn

Services provided by a person represented on an arbitral tribunal to an

arbitral tribunal has now been made taxable by deleting clause (c) of entry

no. 6 of Notification No. 25/2012 dated 20.06.2012.

[effective from April 1, 2016]

Changes in Exemptions

Budget 2016 CA Gaurav Gupta 18](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-18-320.jpg)

![Exemption to services provided by the Indian Institute of Management

• Services provided by the Indian Institutes of Management (IIM) by way of

2 year full time Post Graduate Programme in Management(PGPM) (other

than executive development programme), admissions to which are made

through Common Admission Test conducted by IIMs, 5 year Integrated

Programme in Management and Fellowship Programme in Management

are being exempted from service tax.

[effective from April 1, 2016]

Exemption to folk artists enhanced

• The threshold exemption limit of consideration charged for services

provided by a performing artist in folk or classical art forms of music, dance

or theatre, is being increased from Rs 1 lakh to Rs 1.5 lakh per

performance.

[effective from April 1, 2016]

Changes in Exemptions

Budget 2016 CA Gaurav Gupta 19](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-19-320.jpg)

![Exemption to ongoing Government Construction contracts

Services provided to the Government, a local authority or a governmental

authority by way of construction, erection, commissioning, installation, completion,

fitting out, repair, maintenance, renovation, or alteration of –

(a) a civil structure or any other original works meant predominantly for use other

than for commerce, industry, or any other business or profession;

(b) a structure meant predominantly for use as (i) an educational, (ii) a clinical,

or(iii) an art or cultural establishment; or

(c) a residential complex predominantly meant for self-use or the use of their

employees or other persons specified in the

However, exemption will be provided to the contract which had been entered into

prior to 1st March, 2015 and on which appropriate stamp duty, where applicable,

had been paid prior to such date. Further, exemption vide this entry will not be

applicable on or after 1st April, 2020.

[effective from March 1, 2016]

Changes in Exemptions

Budget 2016 CA Gaurav Gupta 20](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-20-320.jpg)

![Exemption to services of construction and allied works in low cost housing

projects of Government

Exemption has been provided against services provided by way of

construction, erection, commissioning, installation, completion, fitting out,

repair, maintenance, renovation, or alteration of,

• a civil structure or any other original works pertaining to the “In-situ

rehabilitation of existing slum dwellers using land as a resource through

private participation” under the Housing for All (Urban) Mission/Pradhan

Mantri Awas Yojana, only for existing slum dwellers

• a civil structure or any other original works pertaining to the “Beneficiary-led

individual house construction / enhancement under the Housing for All

(Urban) Mission/Pradhan Mantri Awas Yojana”

[effective from March 1, 2016]

Changes in Exemptions

Budget 2016 CA Gaurav Gupta 21](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-21-320.jpg)

![Exemption in case of construction activities of monorail or metro withdrawn

• Exemption against services by way of construction, erection,

commissioning, or installation of original works pertaining to monorail or

metro has been withdrawn in respect of contracts entered into on or after

1st March 2016. Exemption to Railway contract shall continue.

[effective from March 1, 2016]

Exemption against construction activities of low cost houses:

• Exemption has been provided by inserting clause (ca) in entry 14 of

Notification No. 25/2012-Service Tax dated 20.06.2012 to Low cost houses

up to a carpet area of 60 square metres per house in a housing project

approved by the competent authority under:

(i) the “Affordable Housing in Partnership” component of the Housing for

All (Urban) Mission/Pradhan Mantri Awas Yojana;

(ii) any housing scheme of a State Government

[effective from March 1, 2016]

Changes in Exemptions

Budget 2016 CA Gaurav Gupta 22](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-22-320.jpg)

![Exemption to ongoing construction activities of airport or port:

• Exemption is introduced for services by way of construction, erection,

commissioning, installation of original works pertaining to an airport or port

where a contract which had been entered into prior to 01.03.2015 and on

which appropriate stamp duty, where applicable, had been paid prior to that

date subject to production of certificate from the Ministry of Civil Aviation or

Ministry of Shipping, as the case may be, that the contract had been

entered into prior to 01.03.2015.

• The services provided during the period from 01.04.2015 to 29.02.2016

under such contracts are also proposed to be exempted from service tax

and till 2020.

[effective from March 1, 2016]

Changes in Exemptions

Budget 2016 CA Gaurav Gupta 23](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-23-320.jpg)

![Exemption in case of transport of passengers reduced

• Exemption has been provided in case of transport of passengers by stage

carriage other than air-conditioned stage carriage by inserting clause (bb)

in entry 23 of Notification No. 25/2012-Service Tax dated 20.06.2012. Thus,

now transportation by air-conditioned Stage carriage has become taxable.

• Further, exemption in case of transport of passengers by ropeway, cable

car or aerial tramway has been withdrawn.

[effective from June 1,2016]

Exemption to inward transportation of goods by air

• Exemption in case of services by way of transportation of goods by an

aircraft from a place outside India upto the customs station of clearance in

India by inserting new entry no. 53 in Notification No. 25/2012-Service Tax

dated 20.06.2012.

[effective April 1,2016]

Changes in Exemptions

Budget 2016 CA Gaurav Gupta 24](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-24-320.jpg)

![Changes in Abatements

Changes in abatement in rail transport:

• Rate of abatement allowed to transport of goods by rail has been amended

as under:

• Further, Cenvat Credit of input services has been allowed in both cases.

Thus, the condition of non-availment of Cenvat Credit on inputs and capital

goods will remain same in both the cases i.e in case of rail transport for

goods as well as for passengers.

[effective April 1,2016]

Particular of services Present rate

of abatement

Amended rate

of abatement

Transport of goods and passengers by Indian

Railways

70% 70%

Transport of goods in containers by a person other

than Indian Railways

70% 60%

Budget 2016 CA Gaurav Gupta 27](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-27-320.jpg)

![Changes in Abatements

Reduction of abatement for transport of household goods:

• Rate of abatement allowed to GTA for household goods has been amended

as under:

• Abatement on transport of used household goods by a Goods Transport

Agency (GTA) is being reduced to 60% without availment of cenvat credit

on inputs, input services and capital goods by the service provider.

[effective April 1,2016]

Particular of services Present rate

of abatement

Amended rate

of abatement

Services of Goods Transport Agency 70% 70%

Services of Goods Transport Agency in relation to

used households goods

70% 60%

Budget 2016 CA Gaurav Gupta 28](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-28-320.jpg)

![Changes in Abatements

Introduction of abatement in Chit funds:

• Abatement was withdrawn from this services last year. Abatement of 30%

is being reintroduced on the services of foreman to a chit fund under the

Chit Funds Act, 1982 with a condition of non-availment of Cenvat Credit

on inputs, capital goods and input services.

[effective April 1,2016]

Clarification in rent a cab services:

• At present, there is abatement of 60% on the gross value of renting of

motor-cab services, provided no cenvat credit has been taken. It is being

made clear by way of inserting an explanation in the notification No.

26/2012-ST that cost of fuel should be included in the consideration

charged for providing renting of motor-cab services for availing the

abatement.

[effective April 1,2016]

Budget 2016 CA Gaurav Gupta 29](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-29-320.jpg)

![Changes in Abatements

Abatement in transportation of passenger by stage carriage:

• On being made taxable, suitable abatement has also been provided to

transportation of passenger by stage carriage:

• At present, abatement of 60% is being provided in case of transport of

passengers by a contract carriage (other than motorcab) and a radio taxi.

Now, the scope of abatement has been extended to a stage carriage with

a uniform condition of non-availment of Cenvat Credit on inputs, capital

goods and input services.

[effective from June 1,2016]

Cenvat of input services allowed in transportation by vessel:

• At present, abatement of 70% is being provided in case of transport of

goods in a vessel with a condition of non-availment of Cenvat Credit on

inputs, capital goods and input services. Now, Cenvat credit of input

services is allowed in cases where abatement is availed.

[effective April 1,2016]

Budget 2016 CA Gaurav Gupta 30](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-30-320.jpg)

![Changes in Abatements

Reduction of abatement in Tour operator:

• Abatement of 90% is being provided to a tour operator if he is merely

arranging or booking accommodation for any person in relation to tour.

Now, abatement has been reduced to 70% for all cases other than those

merely engaged in arranging or booking accommodation and no separate

abatement rate has been specified for a package tour. Now the amended

abatement stands as under:

[effective April 1,2016]

Particular of services Present rate of

abatement

Amended rate

of abatement

services solely of arranging or booking

accommodation for any person in relation to a tour

90% 90%

Services in relation to Package Tours 75% 70%

Other Tours 60% 70%

Budget 2016 CA Gaurav Gupta 31](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-31-320.jpg)

![Changes in Abatements

Reduction of abatement in Construction Sector:

• A uniform abatement of 70% is now being prescribed for services of

construction of complex, building, civil structure, or a part thereof, subject to

fulfillment of the existing conditions. Thus, the beneficial rate of 75% is no

longer applicable. The new rates are as under:

[effective April 1,2016]

Particular of services Present rate

of abatement

Amended rate

of abatement

Construction of a complex, building, civil structure

or a part thereof, intended for a sale to a buyer,

wholly or partly except where entire consideration

is received after issuance of completion certificate

by the competent authority

75% / 70% 70%

Budget 2016 CA Gaurav Gupta 32](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-32-320.jpg)

![Changes in Reverse

Charge Mechanism

Reverse Charge removed from Services of Mutual Fund Agent or Distributor:

• Services provided by mutual fund agents/distributor to a mutual fund or

asset management company was earlier put under reverse charge liability,

i.e., the Asset Management Company was made liable to pay service tax

for the services received from such agents/distributors. Now, these services

are being put under forward charge and therefore, mutual fund

agents/distributors will discharge their service tax liabilities and asset

management companies shall no longer be liable to discharge such tax

under reverse charge.

[effective from April 1, 2016]

Budget 2016 CA Gaurav Gupta 34](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-34-320.jpg)

![Changes in Reverse

Charge Mechanism

Services of Lottery agents:

• At present, services provided by a selling or marketing agent of lottery

tickets to lottery distributor or selling agent are under reverse charge

mechanism. Now, reverse charge will be applicable only when these

services are provided to a lottery distributor or selling agent of the State

Government under the provisions of the Lottery (Regulations) Act, 1998 (17

of 1998). In other cases, the charge shall be forward charge and on the

provider of services.

[effective from April 1, 2016]

Budget 2016 CA Gaurav Gupta 35](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-35-320.jpg)

![Changes in Reverse

Charge Mechanism

Services of Senior Advocate:

• Legal services provided by an advocate are under reverse charge

mechanism. However, legal services provided by a senior advocate are

removed from reverse charge and are being put under forward charge.

Therefore, service tax liability on legal services will now be discharged by

senior Advocates itself.

[effective from April 1, 2016]

Budget 2016 CA Gaurav Gupta 36](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-36-320.jpg)

![Changes in Reverse

Charge Mechanism

Services of Government:

• At present, support services provided by Government or local authorities to

business entities are taxable under reverse charge mechanism that is the

liability to pay service tax on such services is on the service recipient. With

effect from 1st April, 2016, any service (and not only support services)

provided by Government or local authorities to business entities shall be on

the service recipient on reverse charge basis.

[effective from April 1, 2016]

Budget 2016 CA Gaurav Gupta 37](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-37-320.jpg)

![Frequency rights by

government

Provision of frequency rights by government added to declared services

[effective from the date of enactment of Finance Bill, 2016]

• Declared services list is amended to include assignment by the

Government of the right to use the radio-frequency spectrum and

subsequent transfers thereof so as to make it clear that assignment by

Government of the right to use the spectrum as well as subsequent

transfers of assignment of such right to use is a service leviable to service

tax and not sale of intangible goods. It is important to note that though

deemed sale covered under Article 366(29A) is excluded from the definition

of service, can such a deeming fiction bring a deemed sale intro the ambit

of service.

• A temporary transfer of license is outside the ambit of ‘sale’ and falls within

the ambit of service. Similar decision was held in the case of GS

Entertainment Private Ltd., v. Union of India (Madras High Court). The

question which would arise not is whether such levy is covered under Entry

54 of List II and whether it amounts to transgression by Parliament into the

exclusive domain of the State?

Budget 2016 CA Gaurav Gupta 44](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-44-320.jpg)

![Changes to sustain levy of rate

change as per Point of Taxation

Changes to sustain levy of rate change as per Point of Taxation

• Sub section (2) has been inserted in Section 67A of Finance Act, 1994 to

sustain levy of Service Tax in case of rate change and new levy. It is

pertinent to note that a new levy like Swachh Bharat Cess is not covered

vide provisions of POTR. They are still guided by Section 66B read with

Section 67A. Thus, in order to bring such rate change within the ambit of

POTR. Accordingly, amendment has been brought in Act to sustain

imposition of tax on such levies. Also, an Explanation is being inserted in

Rule 5 stating that the same is applicable in case of new levy on services.

The new levy – KKC (0.5%) shall now be guided by Rule 5 of POTR.

[effective from date of enactment of Finance Bill, 2016]

Budget 2016 CA Gaurav Gupta 45](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-45-320.jpg)

![Period Limitation

increased to 30 months

Period Limitation increased to 30 months

• The limitation period for recovery of service tax not levied or paid or

shortlevied or short paid or erroneously refunded, for cases not involving

fraud, collusion, suppression etc. is proposed to be enhanced by one year,

that is, from eighteen months to thirty months by making suitable changes

to section 73 of the Finance Act, 1994. The period of limitation in case of

fraud, collusion, suppression etc remains five years. However, this

increase has reduced the gap between the two cases and thus, this

disincentives an honest tax payers as he shall remain under scrutiny for

longer.

[effective from date of enactment of Finance Bill, 2016]

Budget 2016 CA Gaurav Gupta 46](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-46-320.jpg)

![Higher rate of Interest on Person who

has collected Service Tax but not

deposited

Higher rate of Interest on person who has collected Service Tax but not

deposited

• Section 75 of the Finance Act is proposed to be amended so that a higher

rate of interest would apply to a person who has collected the amount of

service tax from the service recipient but not deposited the same with the

Central Government. The rate is proposed to be kept at 24% which shall be

higher than normal rate of interest to penalize genuine tax payer.

[effective from date of enactment of Finance Bill, 2016]

Budget 2016 CA Gaurav Gupta 47](https://image.slidesharecdn.com/budgetpresentationlcagauravgupta-160617123919/85/Budget-2016-Proposals-and-Analysis-47-320.jpg)