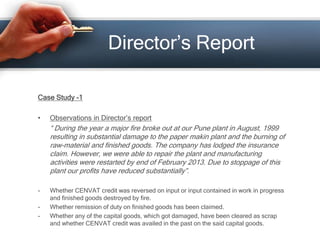

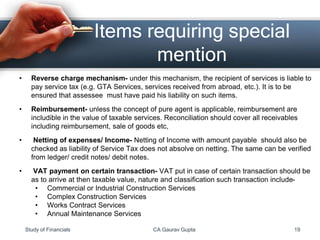

The document discusses analyzing financial statements to understand a company's performance and compliance with tax laws. It provides examples of notes and observations from director's reports that could indicate potential tax issues, such as input tax credits claimed on destroyed goods, related party transactions, or new business lines affecting tax obligations. The summary also mentions reviewing trial balances, understanding accounting policies and concepts, and examining additional documents like tax audit reports that could be relevant to analyzing a company's financial statements for tax purposes.