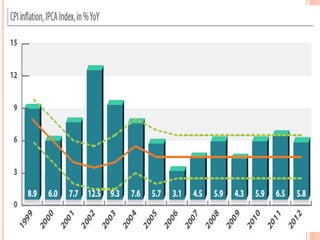

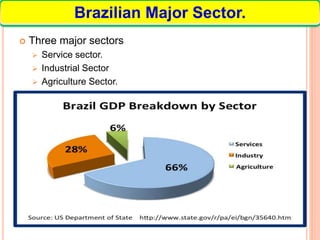

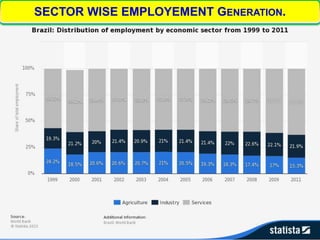

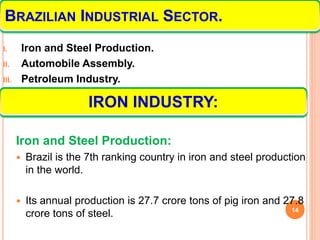

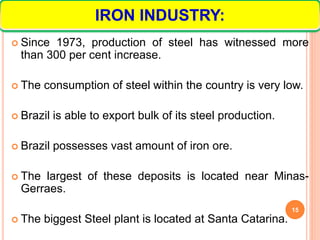

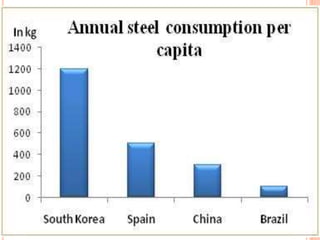

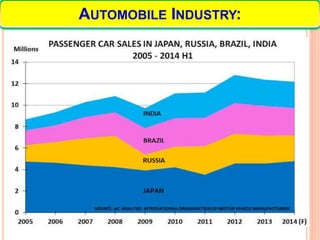

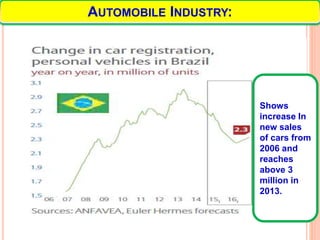

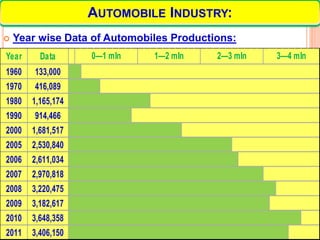

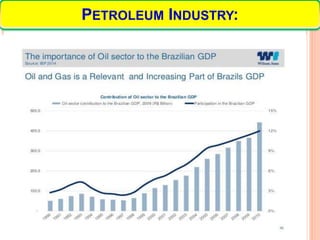

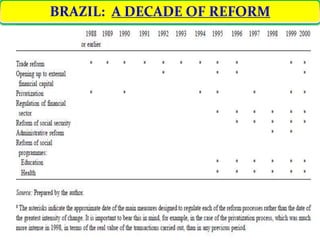

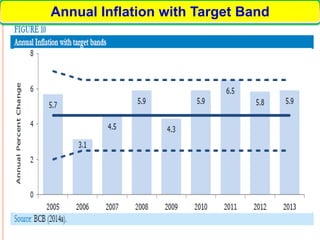

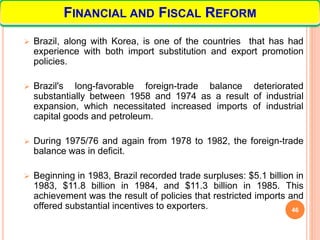

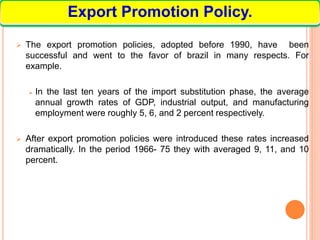

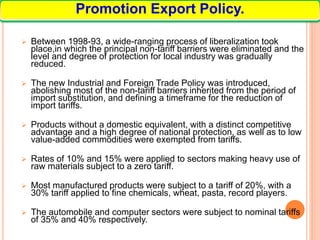

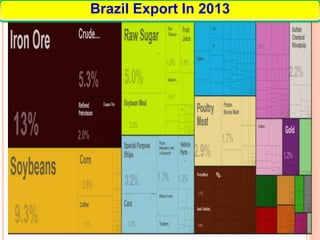

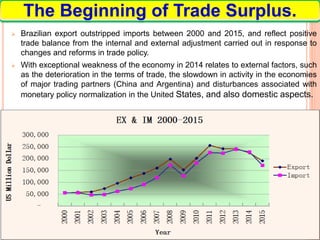

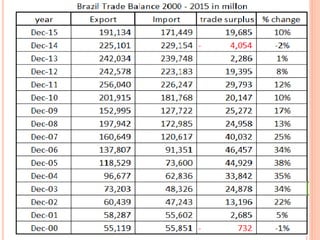

Brazil has a population of 202 million and an area of 8.5 million square kilometers. Its GDP in 2015 was $3.259 trillion, making it the 7th largest economy in the world. Brazil has a diversified economy with strong sectors in industry, agriculture, and services. Some of Brazil's largest industries include iron and steel production, automobiles, and petroleum. In recent decades, Brazil implemented economic reforms including exchange rate flexibility, inflation targeting, fiscal responsibility laws, and shifting from import substitution to export promotion policies, which contributed to macroeconomic stability and growth.