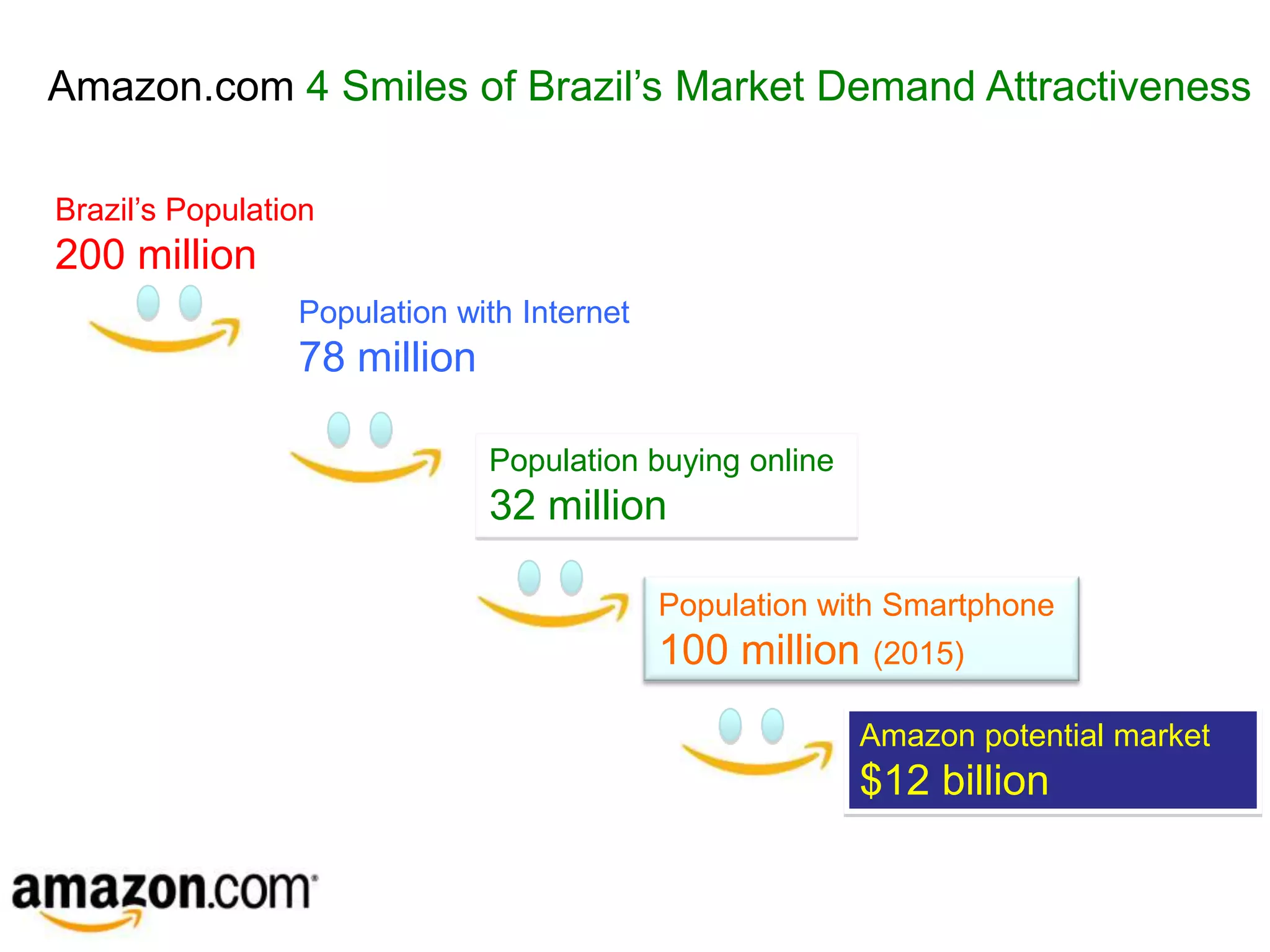

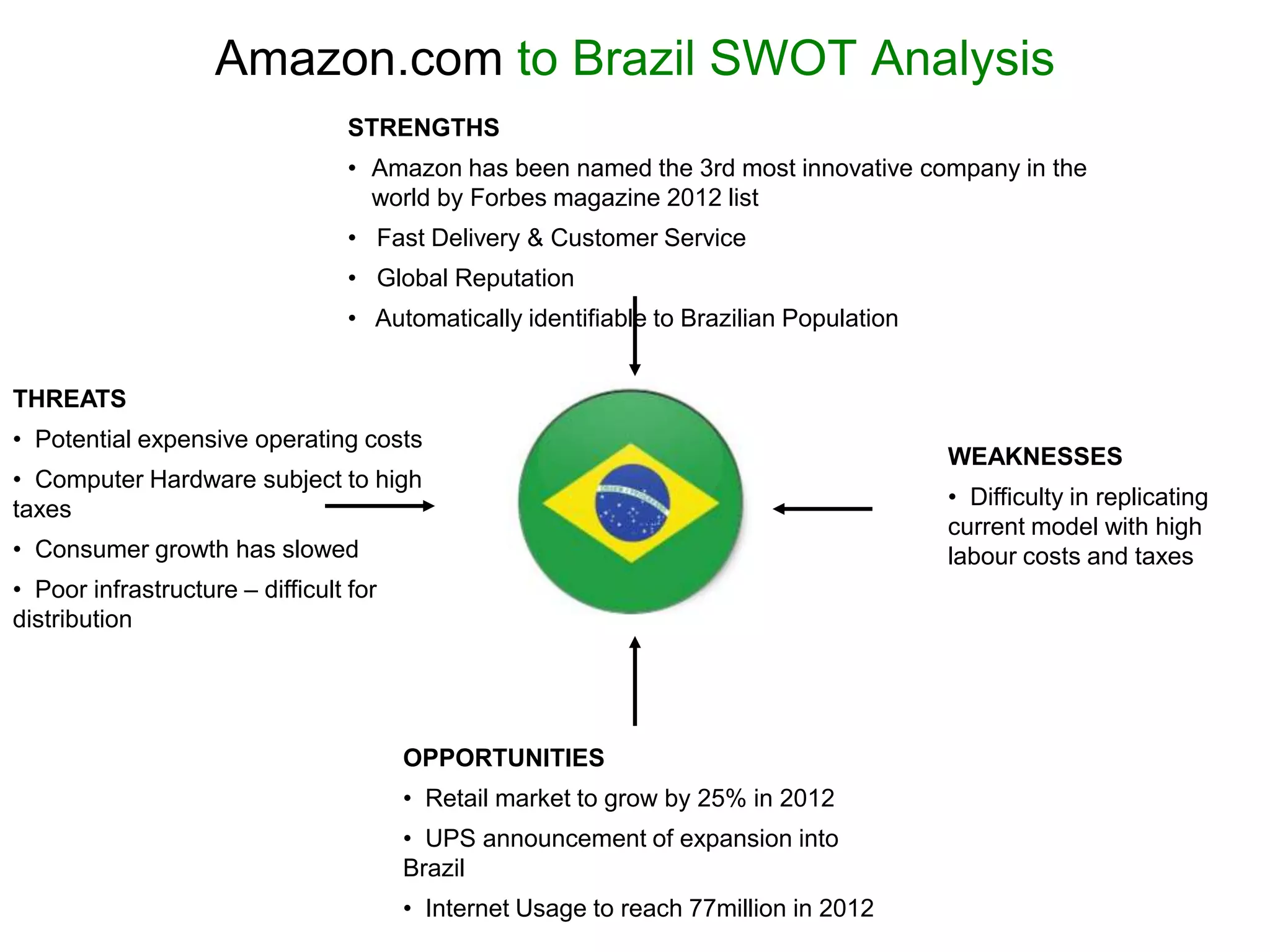

This document provides an analysis of entering the Brazilian market for Amazon.com. It begins with an assessment of Brazil's economy and market potential, noting growth in GDP, internet/mobile users, and the expanding middle class. A SWOT analysis identifies strengths like reputation but also threats such as high taxes. Market entry strategies are considered, along with the competitive e-commerce landscape and risks involved in operating in Brazil. Recommendations include addressing trust issues, further market research, and location feasibility studies to help Amazon.com successfully enter this emerging market.