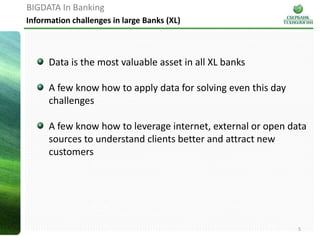

1) Large banks are challenged by the vast amounts of data they hold as their most valuable asset, but few know how to effectively analyze and leverage this data.

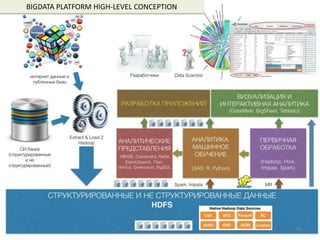

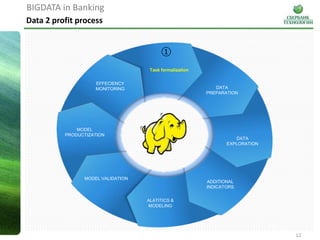

2) Setting up a "Big Data Factory" can help optimize data processing and analysis across the bank, reducing costs by up to 70% by standardizing data preparation.

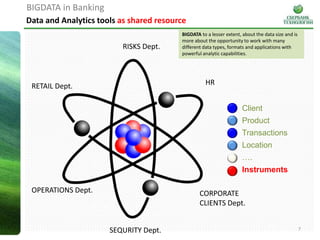

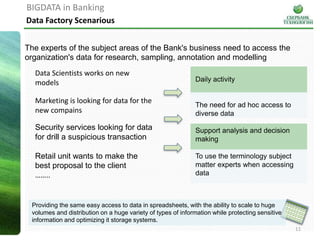

3) The factory would provide unified access and analysis of both traditional and non-traditional internal and external data sources to various departments to help with tasks like customer acquisition, risk management, and operations optimization.