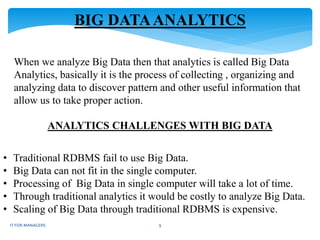

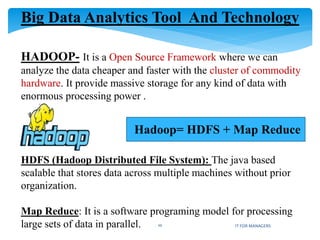

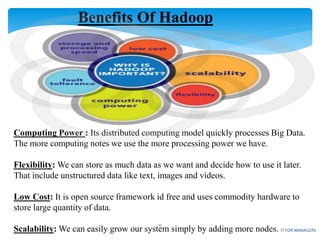

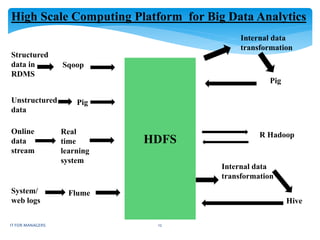

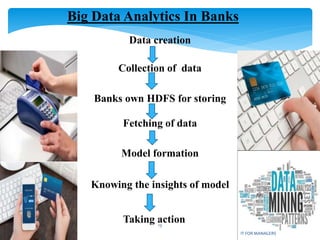

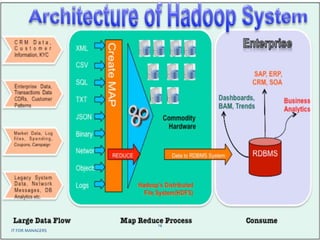

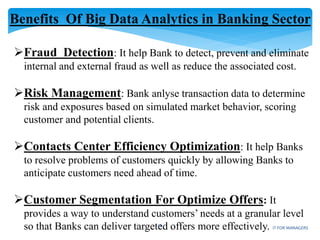

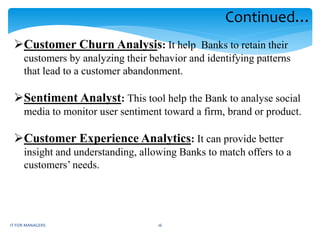

The document discusses big data and big data analytics in banking. It defines big data as large, complex datasets that are difficult to process and store using traditional databases. Sources of big data include social media, sensors, transportation services, online shopping, and mobile apps. Characteristics of big data include volume, velocity, and variety. Hadoop is presented as an open source framework for analyzing big data using HDFS for storage and MapReduce for processing. The benefits of big data analytics in banking include fraud detection, risk management, customer segmentation, churn analysis, and sentiment analysis to improve customer experience.