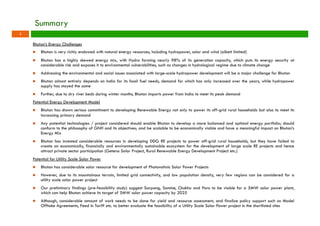

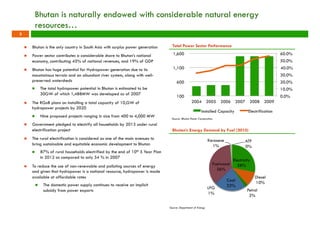

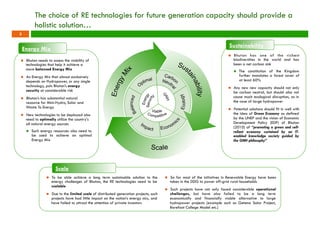

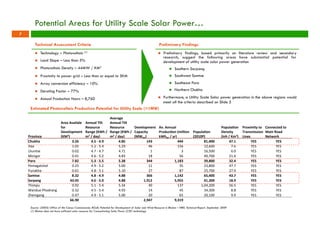

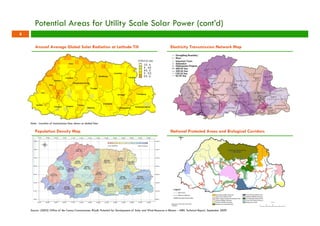

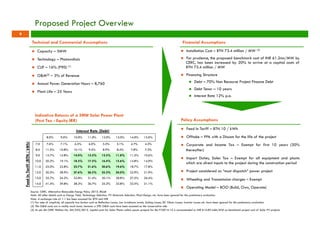

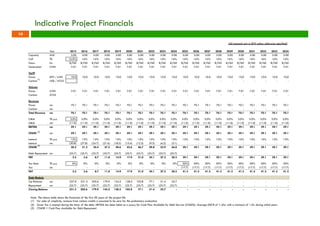

The document presents a pre-feasibility assessment for utility scale solar power in Bhutan, highlighting the country's reliance on hydropower which constitutes nearly 98% of its energy mix, creating vulnerabilities due to climate change and seasonal dry spells. It identifies viable areas for solar development, including Sarpang, Samtse, Chukha, and Paro, and outlines the need for supportive policies to enable a more diversified energy portfolio. The document concludes that while Bhutan has significant solar potential, achieving sustainable and economically viable renewable energy projects remains a challenge.