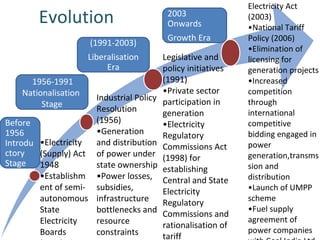

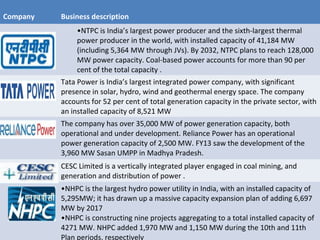

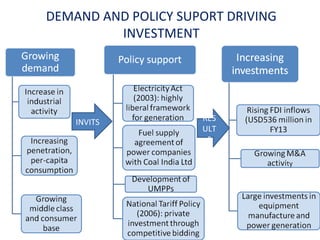

1) The document discusses the evolution of India's power sector from nationalization in 1956 to the current growth era since 2003 with private sector participation.

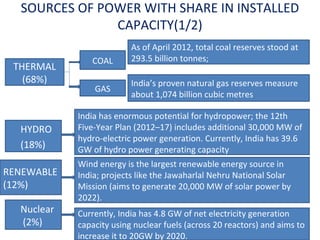

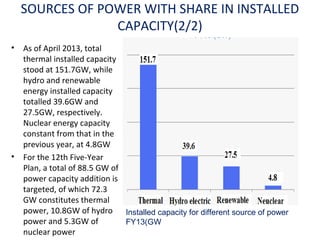

2) Key sources of power in India are thermal (68%), hydro (18%), and renewable (12%) such as wind and solar.

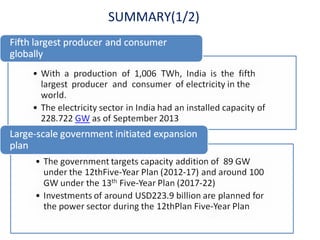

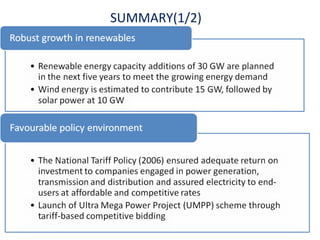

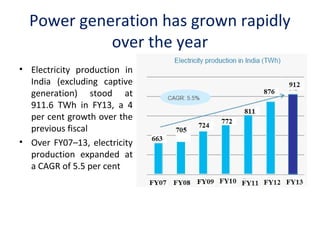

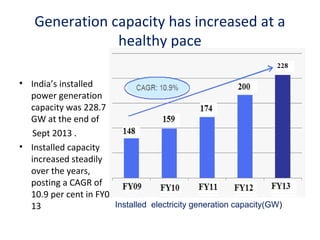

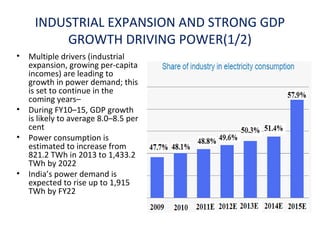

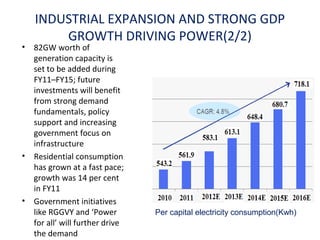

3) Power generation and installed capacity in India have grown significantly in recent years and further increases are expected to meet rising demand from economic and population growth.